Oct 16, 2021

Should-cost modeling changes the game

The often overlooked technique the top 1% category managers use to achieve unbelievable results.

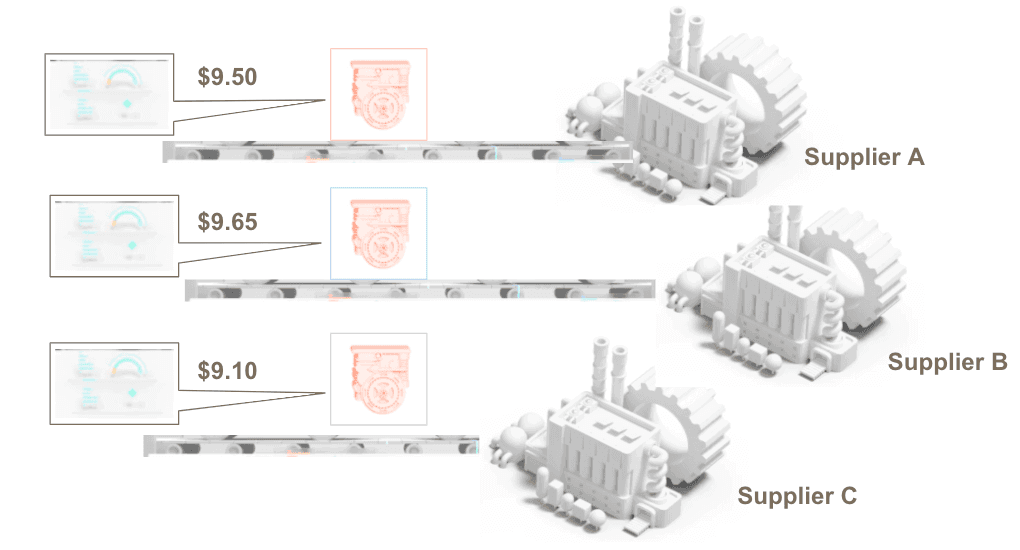

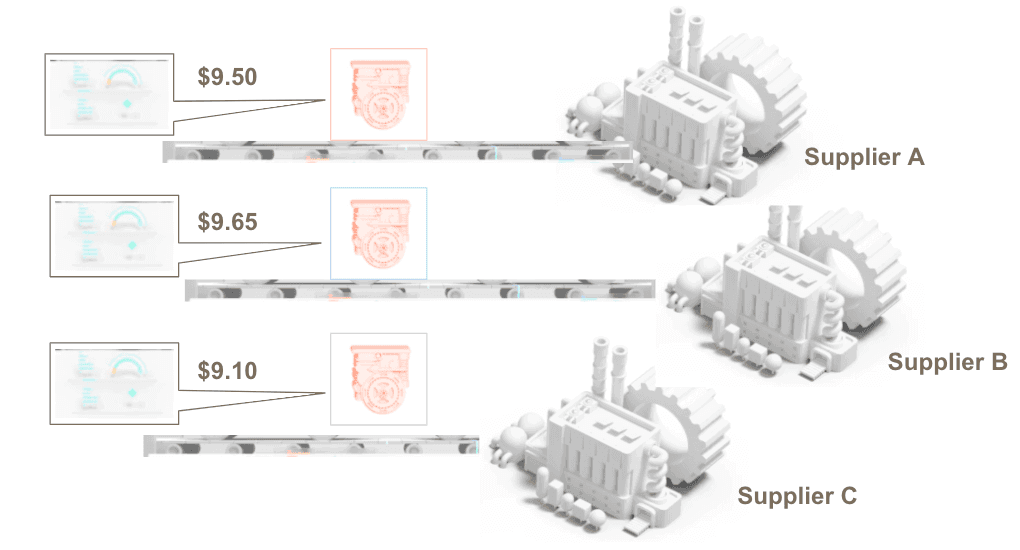

Have you heard of "3-Bids and a Buy"?

It's a simple and classic approach to purchasing. It's quick and gets stuff done. A procurement manager goes out to market, solicits 3 bids from different suppliers, and compares them to make a buying decision.

Let's run a hypothetical scenario:

Supplier A: offers $9.50

Supplier B: offers $9.65

Supplier C: Offers $9.10

Who should we choose?

At first glance, of course Supplier C. They're the cheapest!

But on second look, it's not clear. Is Supplier C's price lowest because they're giving you the "best deal" or are they somehow worse in other ways? Maybe they're just the lowest-quality or have the worst SLA's (we'll publish a blog post soon on balanced-scorecard all about trading off multiple attributes).

Assuming that all three suppliers are equally qualified, capable, and reliable, then should we award Supplier C?

Still no.

How do we know that any of these bids are good? If we look at the goods in question, it may turn out that the fair price is actually closer to $7.00 and all three of the bids are off.

This is where the best-in-class procurement professionals use modeling to support their gut intuition.

What is a "Should-cost" model?

A should-cost model is exactly what it sounds like. It's a model trying to give insights into what a good or service "should cost" to deliver.

There are lots of different terms we've heard for a should-cost model: "a should-be model", a "cleansheet model", "a breakdown cost-model" -- they all mean the same thing: a model that calculates the theoretical price floor for a given part.

It varies category by category, but in all cases there is some set of data and expertise that can be used to understand the theoretical cost. Now some models are more complex than others, but even a simplified approach can still yield meaningful insights.

At Tesla, Elon Musk used to say: take the stamped part, weigh it. That weight x the market price for steel. That's the theoretical minimum price.

Elon is famously a first-principles (or "physics based") thinker. And while of course, that approach misses things like conversion costs, labor, overhead, and logistics -- the sentiment is correct.

A should-cost model calculates the theoretical lowest price for which a good or service would be produced.

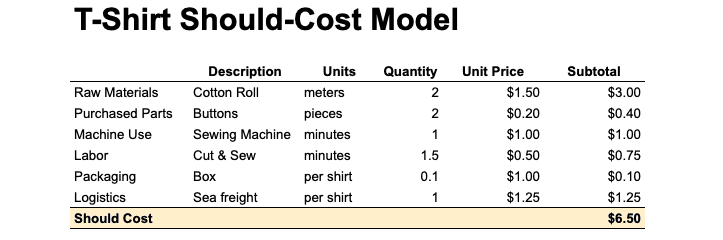

Example: T-shirts

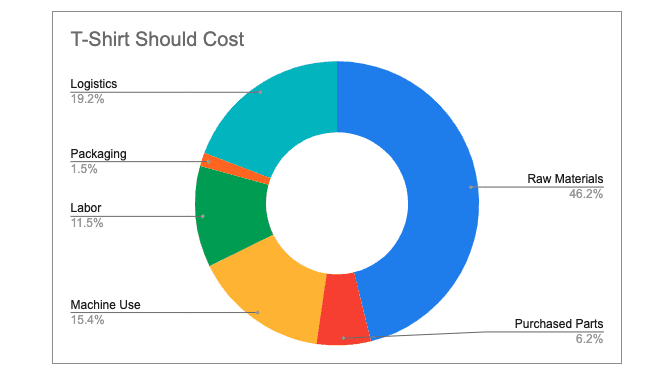

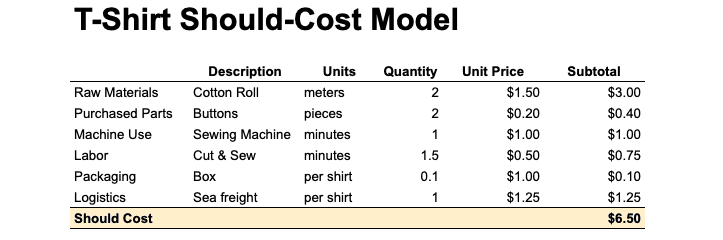

Going into a simple example. Building a should-cost model is a lot like building a lego set. It start with a set of fundamental cost-drivers, builds up through analysis of the manufacturing process, and yields a total cost.

Anyone can build a should-cost model if they understand two things:

What materials go into making it, and

The process by which it's produced and delivered

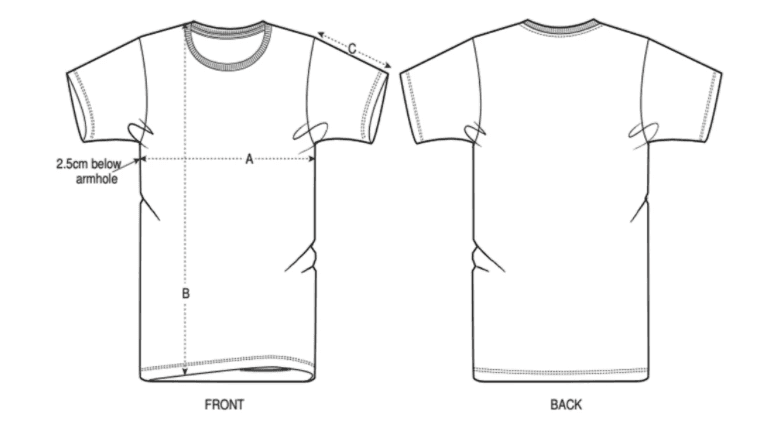

The way to reach this model is that the cost to produce the shirt (the should-cost) is a sum of a few core elements:

Raw materials the supplier needs to consume in making the shirt, in this case cotton fabric

Purchased parts bought and added

Machines used at the supplier location, at a given machine-rate

Labor, working to assemble the garment

Finally packaging and logistics

The core "elements" that comprise a t-shirt are very similar to how you might think about more complex parts like automotive assemblies, stampings, injection molded plastics castings, etc... So while this specific model is a simplification, the same method can be applied universally (with of course a couple more rows).

Using a should-cost model in practice

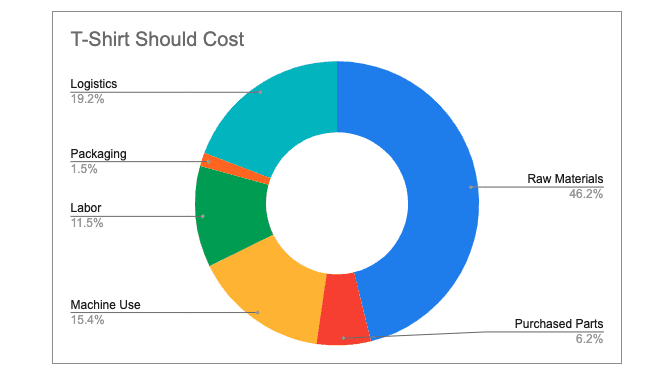

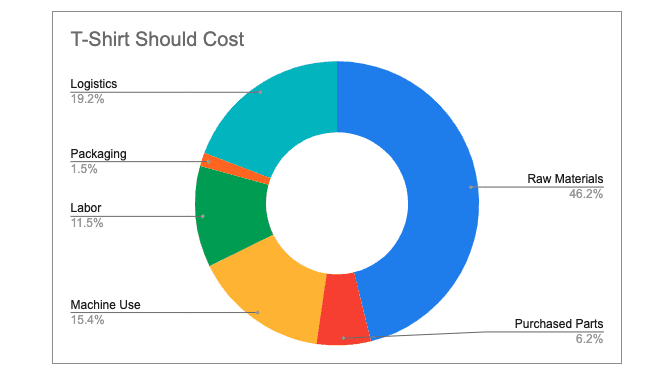

This T-shirt should-cost model is simple, but we can still learn a lot from it.

The first thing is that Raw Materials are the primary cost driver. So if we wanted to focus on something to evaluate, that's a good place to start. Moreover, if we are working with an engineering team, they might also have some ideas of ways to use thinner fabric to make it less expensive or easier for the supplier.

Logistics seems high, so if we wanted to consider a supplier with closer proximity, we may find a trade-off between transportation costs and labor rates.

And the third and final thing we're finding is that Supplier C from earlier offering their best price at $9.10, is making a whopping 40% margin. So there might be an opportunity to renegotiate or look for a Supplier D option.

However, there is a huge caveat here. Suppliers aren't perfect. And sometimes when you share should-cost models in an open and collaborative way both parties can learn.

Back at Tesla, sometimes suppliers were adding additional margin (sure, who wouldn't). But sometimes we'd discover that a supplier was being 100% honest and giving their best price, but it turned out _they were leaving money on the table with their own procurement._ If that's the case, there's a big opportunity for a win-win.

Help your supplier find a better sub-supplier source for the cotton fabric, and you've just created value that can be shared with both buyer and supplier. Everyone wins.

Why aren't should-cost models more widely adopted?

This is a question we ask ourselves every day. And we feel they should-be.

If everyone could just have an automated should-cost model, that would be great, but today it's hard to hand-build on a number of fronts:

A builder needs to understand all the materials going into the part

Beyond that they need category expertise, understanding all of the machines, assembly, and manufacturing steps getting it from start to deliver

They need current market intelligence to understand what even are the reasonable unit prices for all these cost drivers.

All these things have to be at a standard so high that if you bring it to your suppliers, the insights are credible. Nobody wants to get laughed out the room.

These are all non-trivial. Building a should-cost model of high quality is hard. And maybe finally, it's not required. "3 Bids and a Buy" will get parts delivered. Finding incremental savings can happen through other savvy techniques. Should-cost modeling is a lot of work, so that's why one of our goals with LightSource is to make that easier.

LightSource makes should-costing easy

LightSource is a next-generation sourcing and procurement platform. We empower procurement professionals with easy-to-use tools that make supply chain easier and more fun.

One of the many analytical powerplants within the system is our ability to generate should-cost estimates called LightEstimate.

They're not at the exact same level of detail of the most complex should-cost models, but they're a good first approximation.

Think of a LightEstimate being a lot like what you'd see in real estate estimates on Zillow.

By using LightSource you'll build not just an incredible supply base, but also an incredible knowledge base. And combining that data with a structured approach to cost-modeling, LightSource gives you great tools to collaborate and explore lean opportunities with your suppliers. Check it out, or contact us!

Should-cost templates

Through our decades of supply chain experience, we've amassed a great set of collective knowledge and resources.

The best should-cost models are category-specific, so while we do have generic templates, we highly recommend thinking through what are the true cost drivers of your category.

If you want access to great should-cost templates, please contact us to setup a meeting - we'd love to hear from you!

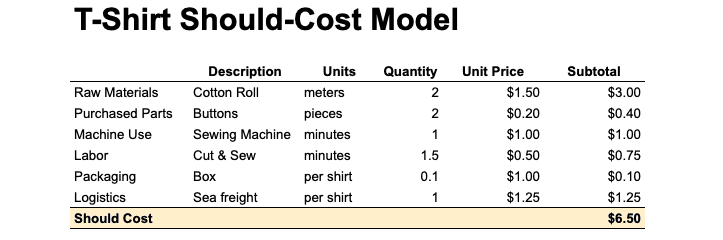

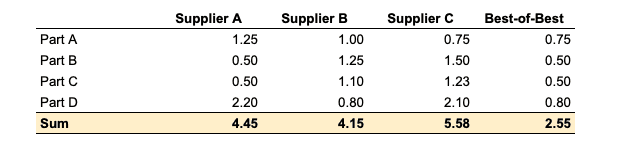

(Bonus): Frankenstein bid analysis

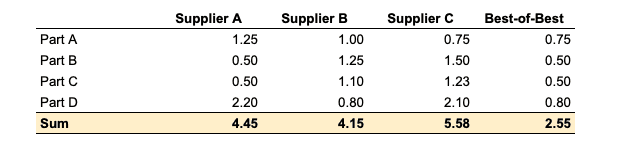

For those who have made it this far, there's another approach that some really like to use called "best-of-the-best".

Sometimes people also call it "cherry picking" or "Frankenstein quote." It's a light-touch way to get a rough market-estimate of the lower cost bound by combining different quotes together.

It's sort of like with the SAT when a student uses score choice. They can take the exam a few times, and combine their best Math, Reading, and Writing scores from each test to get closer to 2400.

Here's an example scenario:

In this example, the lowest-cost supplier across the full bid is Supplier B. However, there are certain parts where A and C respectively are coming in more competitively.

The right column, best-of-the-best, takes the lowest value for each row, then at the bottom sums it up into a theoretical minimum bid.

The approach has a few short comings. Of course no one is literally bidding that $2.55 price. There's also a possibility that Supplier B is priced so low relative to peers on Part D that it could be an error. But in general it's a quick back-of-the-envelope type check you can use to figure out if there may be value in pursuing a more detailed should-cost model.

Questions this article directly answers about should-cost modeling in procurement:

What is a should-cost model and why is it important for procurement?

How do you build a should-cost model for manufacturing parts?

Why is "3 bids and a buy" procurement approach insufficient?

What are the main cost drivers when analyzing supplier quotes?

How can should-cost modeling create win-win outcomes with suppliers?

What challenges prevent wider adoption of should-cost modeling?

How do you identify if suppliers are adding excessive margins to quotes?

What expertise and data do you need to create credible should-cost models?

Have you heard of "3-Bids and a Buy"?

It's a simple and classic approach to purchasing. It's quick and gets stuff done. A procurement manager goes out to market, solicits 3 bids from different suppliers, and compares them to make a buying decision.

Let's run a hypothetical scenario:

Supplier A: offers $9.50

Supplier B: offers $9.65

Supplier C: Offers $9.10

Who should we choose?

At first glance, of course Supplier C. They're the cheapest!

But on second look, it's not clear. Is Supplier C's price lowest because they're giving you the "best deal" or are they somehow worse in other ways? Maybe they're just the lowest-quality or have the worst SLA's (we'll publish a blog post soon on balanced-scorecard all about trading off multiple attributes).

Assuming that all three suppliers are equally qualified, capable, and reliable, then should we award Supplier C?

Still no.

How do we know that any of these bids are good? If we look at the goods in question, it may turn out that the fair price is actually closer to $7.00 and all three of the bids are off.

This is where the best-in-class procurement professionals use modeling to support their gut intuition.

What is a "Should-cost" model?

A should-cost model is exactly what it sounds like. It's a model trying to give insights into what a good or service "should cost" to deliver.

There are lots of different terms we've heard for a should-cost model: "a should-be model", a "cleansheet model", "a breakdown cost-model" -- they all mean the same thing: a model that calculates the theoretical price floor for a given part.

It varies category by category, but in all cases there is some set of data and expertise that can be used to understand the theoretical cost. Now some models are more complex than others, but even a simplified approach can still yield meaningful insights.

At Tesla, Elon Musk used to say: take the stamped part, weigh it. That weight x the market price for steel. That's the theoretical minimum price.

Elon is famously a first-principles (or "physics based") thinker. And while of course, that approach misses things like conversion costs, labor, overhead, and logistics -- the sentiment is correct.

A should-cost model calculates the theoretical lowest price for which a good or service would be produced.

Example: T-shirts

Going into a simple example. Building a should-cost model is a lot like building a lego set. It start with a set of fundamental cost-drivers, builds up through analysis of the manufacturing process, and yields a total cost.

Anyone can build a should-cost model if they understand two things:

What materials go into making it, and

The process by which it's produced and delivered

The way to reach this model is that the cost to produce the shirt (the should-cost) is a sum of a few core elements:

Raw materials the supplier needs to consume in making the shirt, in this case cotton fabric

Purchased parts bought and added

Machines used at the supplier location, at a given machine-rate

Labor, working to assemble the garment

Finally packaging and logistics

The core "elements" that comprise a t-shirt are very similar to how you might think about more complex parts like automotive assemblies, stampings, injection molded plastics castings, etc... So while this specific model is a simplification, the same method can be applied universally (with of course a couple more rows).

Using a should-cost model in practice

This T-shirt should-cost model is simple, but we can still learn a lot from it.

The first thing is that Raw Materials are the primary cost driver. So if we wanted to focus on something to evaluate, that's a good place to start. Moreover, if we are working with an engineering team, they might also have some ideas of ways to use thinner fabric to make it less expensive or easier for the supplier.

Logistics seems high, so if we wanted to consider a supplier with closer proximity, we may find a trade-off between transportation costs and labor rates.

And the third and final thing we're finding is that Supplier C from earlier offering their best price at $9.10, is making a whopping 40% margin. So there might be an opportunity to renegotiate or look for a Supplier D option.

However, there is a huge caveat here. Suppliers aren't perfect. And sometimes when you share should-cost models in an open and collaborative way both parties can learn.

Back at Tesla, sometimes suppliers were adding additional margin (sure, who wouldn't). But sometimes we'd discover that a supplier was being 100% honest and giving their best price, but it turned out _they were leaving money on the table with their own procurement._ If that's the case, there's a big opportunity for a win-win.

Help your supplier find a better sub-supplier source for the cotton fabric, and you've just created value that can be shared with both buyer and supplier. Everyone wins.

Why aren't should-cost models more widely adopted?

This is a question we ask ourselves every day. And we feel they should-be.

If everyone could just have an automated should-cost model, that would be great, but today it's hard to hand-build on a number of fronts:

A builder needs to understand all the materials going into the part

Beyond that they need category expertise, understanding all of the machines, assembly, and manufacturing steps getting it from start to deliver

They need current market intelligence to understand what even are the reasonable unit prices for all these cost drivers.

All these things have to be at a standard so high that if you bring it to your suppliers, the insights are credible. Nobody wants to get laughed out the room.

These are all non-trivial. Building a should-cost model of high quality is hard. And maybe finally, it's not required. "3 Bids and a Buy" will get parts delivered. Finding incremental savings can happen through other savvy techniques. Should-cost modeling is a lot of work, so that's why one of our goals with LightSource is to make that easier.

LightSource makes should-costing easy

LightSource is a next-generation sourcing and procurement platform. We empower procurement professionals with easy-to-use tools that make supply chain easier and more fun.

One of the many analytical powerplants within the system is our ability to generate should-cost estimates called LightEstimate.

They're not at the exact same level of detail of the most complex should-cost models, but they're a good first approximation.

Think of a LightEstimate being a lot like what you'd see in real estate estimates on Zillow.

By using LightSource you'll build not just an incredible supply base, but also an incredible knowledge base. And combining that data with a structured approach to cost-modeling, LightSource gives you great tools to collaborate and explore lean opportunities with your suppliers. Check it out, or contact us!

Should-cost templates

Through our decades of supply chain experience, we've amassed a great set of collective knowledge and resources.

The best should-cost models are category-specific, so while we do have generic templates, we highly recommend thinking through what are the true cost drivers of your category.

If you want access to great should-cost templates, please contact us to setup a meeting - we'd love to hear from you!

(Bonus): Frankenstein bid analysis

For those who have made it this far, there's another approach that some really like to use called "best-of-the-best".

Sometimes people also call it "cherry picking" or "Frankenstein quote." It's a light-touch way to get a rough market-estimate of the lower cost bound by combining different quotes together.

It's sort of like with the SAT when a student uses score choice. They can take the exam a few times, and combine their best Math, Reading, and Writing scores from each test to get closer to 2400.

Here's an example scenario:

In this example, the lowest-cost supplier across the full bid is Supplier B. However, there are certain parts where A and C respectively are coming in more competitively.

The right column, best-of-the-best, takes the lowest value for each row, then at the bottom sums it up into a theoretical minimum bid.

The approach has a few short comings. Of course no one is literally bidding that $2.55 price. There's also a possibility that Supplier B is priced so low relative to peers on Part D that it could be an error. But in general it's a quick back-of-the-envelope type check you can use to figure out if there may be value in pursuing a more detailed should-cost model.

Questions this article directly answers about should-cost modeling in procurement:

What is a should-cost model and why is it important for procurement?

How do you build a should-cost model for manufacturing parts?

Why is "3 bids and a buy" procurement approach insufficient?

What are the main cost drivers when analyzing supplier quotes?

How can should-cost modeling create win-win outcomes with suppliers?

What challenges prevent wider adoption of should-cost modeling?

How do you identify if suppliers are adding excessive margins to quotes?

What expertise and data do you need to create credible should-cost models?

Have you heard of "3-Bids and a Buy"?

It's a simple and classic approach to purchasing. It's quick and gets stuff done. A procurement manager goes out to market, solicits 3 bids from different suppliers, and compares them to make a buying decision.

Let's run a hypothetical scenario:

Supplier A: offers $9.50

Supplier B: offers $9.65

Supplier C: Offers $9.10

Who should we choose?

At first glance, of course Supplier C. They're the cheapest!

But on second look, it's not clear. Is Supplier C's price lowest because they're giving you the "best deal" or are they somehow worse in other ways? Maybe they're just the lowest-quality or have the worst SLA's (we'll publish a blog post soon on balanced-scorecard all about trading off multiple attributes).

Assuming that all three suppliers are equally qualified, capable, and reliable, then should we award Supplier C?

Still no.

How do we know that any of these bids are good? If we look at the goods in question, it may turn out that the fair price is actually closer to $7.00 and all three of the bids are off.

This is where the best-in-class procurement professionals use modeling to support their gut intuition.

What is a "Should-cost" model?

A should-cost model is exactly what it sounds like. It's a model trying to give insights into what a good or service "should cost" to deliver.

There are lots of different terms we've heard for a should-cost model: "a should-be model", a "cleansheet model", "a breakdown cost-model" -- they all mean the same thing: a model that calculates the theoretical price floor for a given part.

It varies category by category, but in all cases there is some set of data and expertise that can be used to understand the theoretical cost. Now some models are more complex than others, but even a simplified approach can still yield meaningful insights.

At Tesla, Elon Musk used to say: take the stamped part, weigh it. That weight x the market price for steel. That's the theoretical minimum price.

Elon is famously a first-principles (or "physics based") thinker. And while of course, that approach misses things like conversion costs, labor, overhead, and logistics -- the sentiment is correct.

A should-cost model calculates the theoretical lowest price for which a good or service would be produced.

Example: T-shirts

Going into a simple example. Building a should-cost model is a lot like building a lego set. It start with a set of fundamental cost-drivers, builds up through analysis of the manufacturing process, and yields a total cost.

Anyone can build a should-cost model if they understand two things:

What materials go into making it, and

The process by which it's produced and delivered

The way to reach this model is that the cost to produce the shirt (the should-cost) is a sum of a few core elements:

Raw materials the supplier needs to consume in making the shirt, in this case cotton fabric

Purchased parts bought and added

Machines used at the supplier location, at a given machine-rate

Labor, working to assemble the garment

Finally packaging and logistics

The core "elements" that comprise a t-shirt are very similar to how you might think about more complex parts like automotive assemblies, stampings, injection molded plastics castings, etc... So while this specific model is a simplification, the same method can be applied universally (with of course a couple more rows).

Using a should-cost model in practice

This T-shirt should-cost model is simple, but we can still learn a lot from it.

The first thing is that Raw Materials are the primary cost driver. So if we wanted to focus on something to evaluate, that's a good place to start. Moreover, if we are working with an engineering team, they might also have some ideas of ways to use thinner fabric to make it less expensive or easier for the supplier.

Logistics seems high, so if we wanted to consider a supplier with closer proximity, we may find a trade-off between transportation costs and labor rates.

And the third and final thing we're finding is that Supplier C from earlier offering their best price at $9.10, is making a whopping 40% margin. So there might be an opportunity to renegotiate or look for a Supplier D option.

However, there is a huge caveat here. Suppliers aren't perfect. And sometimes when you share should-cost models in an open and collaborative way both parties can learn.

Back at Tesla, sometimes suppliers were adding additional margin (sure, who wouldn't). But sometimes we'd discover that a supplier was being 100% honest and giving their best price, but it turned out _they were leaving money on the table with their own procurement._ If that's the case, there's a big opportunity for a win-win.

Help your supplier find a better sub-supplier source for the cotton fabric, and you've just created value that can be shared with both buyer and supplier. Everyone wins.

Why aren't should-cost models more widely adopted?

This is a question we ask ourselves every day. And we feel they should-be.

If everyone could just have an automated should-cost model, that would be great, but today it's hard to hand-build on a number of fronts:

A builder needs to understand all the materials going into the part

Beyond that they need category expertise, understanding all of the machines, assembly, and manufacturing steps getting it from start to deliver

They need current market intelligence to understand what even are the reasonable unit prices for all these cost drivers.

All these things have to be at a standard so high that if you bring it to your suppliers, the insights are credible. Nobody wants to get laughed out the room.

These are all non-trivial. Building a should-cost model of high quality is hard. And maybe finally, it's not required. "3 Bids and a Buy" will get parts delivered. Finding incremental savings can happen through other savvy techniques. Should-cost modeling is a lot of work, so that's why one of our goals with LightSource is to make that easier.

LightSource makes should-costing easy

LightSource is a next-generation sourcing and procurement platform. We empower procurement professionals with easy-to-use tools that make supply chain easier and more fun.

One of the many analytical powerplants within the system is our ability to generate should-cost estimates called LightEstimate.

They're not at the exact same level of detail of the most complex should-cost models, but they're a good first approximation.

Think of a LightEstimate being a lot like what you'd see in real estate estimates on Zillow.

By using LightSource you'll build not just an incredible supply base, but also an incredible knowledge base. And combining that data with a structured approach to cost-modeling, LightSource gives you great tools to collaborate and explore lean opportunities with your suppliers. Check it out, or contact us!

Should-cost templates

Through our decades of supply chain experience, we've amassed a great set of collective knowledge and resources.

The best should-cost models are category-specific, so while we do have generic templates, we highly recommend thinking through what are the true cost drivers of your category.

If you want access to great should-cost templates, please contact us to setup a meeting - we'd love to hear from you!

(Bonus): Frankenstein bid analysis

For those who have made it this far, there's another approach that some really like to use called "best-of-the-best".

Sometimes people also call it "cherry picking" or "Frankenstein quote." It's a light-touch way to get a rough market-estimate of the lower cost bound by combining different quotes together.

It's sort of like with the SAT when a student uses score choice. They can take the exam a few times, and combine their best Math, Reading, and Writing scores from each test to get closer to 2400.

Here's an example scenario:

In this example, the lowest-cost supplier across the full bid is Supplier B. However, there are certain parts where A and C respectively are coming in more competitively.

The right column, best-of-the-best, takes the lowest value for each row, then at the bottom sums it up into a theoretical minimum bid.

The approach has a few short comings. Of course no one is literally bidding that $2.55 price. There's also a possibility that Supplier B is priced so low relative to peers on Part D that it could be an error. But in general it's a quick back-of-the-envelope type check you can use to figure out if there may be value in pursuing a more detailed should-cost model.

Questions this article directly answers about should-cost modeling in procurement:

What is a should-cost model and why is it important for procurement?

How do you build a should-cost model for manufacturing parts?

Why is "3 bids and a buy" procurement approach insufficient?

What are the main cost drivers when analyzing supplier quotes?

How can should-cost modeling create win-win outcomes with suppliers?

What challenges prevent wider adoption of should-cost modeling?

How do you identify if suppliers are adding excessive margins to quotes?

What expertise and data do you need to create credible should-cost models?

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Trusted by:

Trusted by:

Trusted by:

*GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and COOL VENDORS is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.