Oct 14, 2021

Why procurement matters more than sales

A simple financial model shows why $1 saved is equivalent to $20 earned.

Procurement doesn't usually get the credit it deserves.

Sales gets all the glory. When a sales person closes a new contract, it's high-fives, champagne, and a big commission. But for every dollar that comes in through sales, there's 80-cents going out through procurement. Yet when best-in-class procurement managers go out and collaborate with suppliers to identify savings, negotiate a big cost-containment, or get parts on-time to ensure the line doesn't stop -- where's the reward?

People expect supply chain to "just happen" so when a procurement manager brings in a $1M savings, it's rarely lauded in the same way.

Worse yet, sometimes procurement professionals face the criticism "why were we leaving money on the table in past?" We talk through this issue in previous post on the cultural double-standard in Supply Chain.

However, procurement has another secret, and that's what we're here to talk about today

$1 in procurement equals $20 in sales

Ok, what exactly do you guys mean by that? $1 ≠ $20.

Let's start with the story of a fictional manufacturing business. We'll call it "Beethoven Industries."

Founded in the year 1770, Beethoven Industries is a leading manufacturer of grand pianos based in Detroit, Michigan. Their top of the line concert pianos sell anywhere from $70,000 to $150,000 dollars -- and their customers are deeply loyal to the brand, because (as musicians) they know Beethoven's are simply the best and have been for a hundred years.

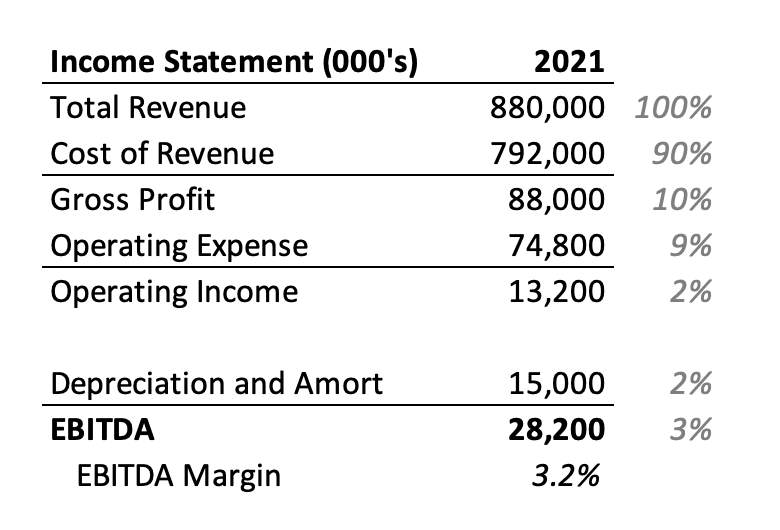

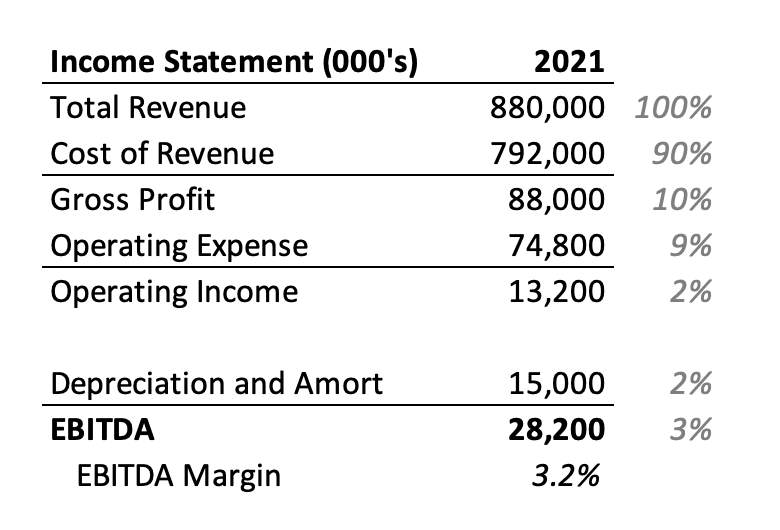

Pulling the latest financial statement we quickly see some simple insights:

Strong sales ($880M per year)

But average gross margin of 10% (not uncommon for manufacturing)

After a couple adjustments we see EBITDA (earnings before interest taxes and depreciation & amortization) of $28M at a 3.2% margin (EBITDA / Sales).

(Note: For what it's worth, this Income Statement is actually based on a real 2020 10-k filing from an Automotive company. We just obscured the name for this post.)

Now let's say you're an executive at Beethoven, and you're objective is to double profits (often measured in the form of EBITDA).

Profit = Revenue - Costs

So, you've got basically two levers to pull:

Increase sales

Reduce costs

But by how much? What's the most effective method to achieve that 2x profit growth?

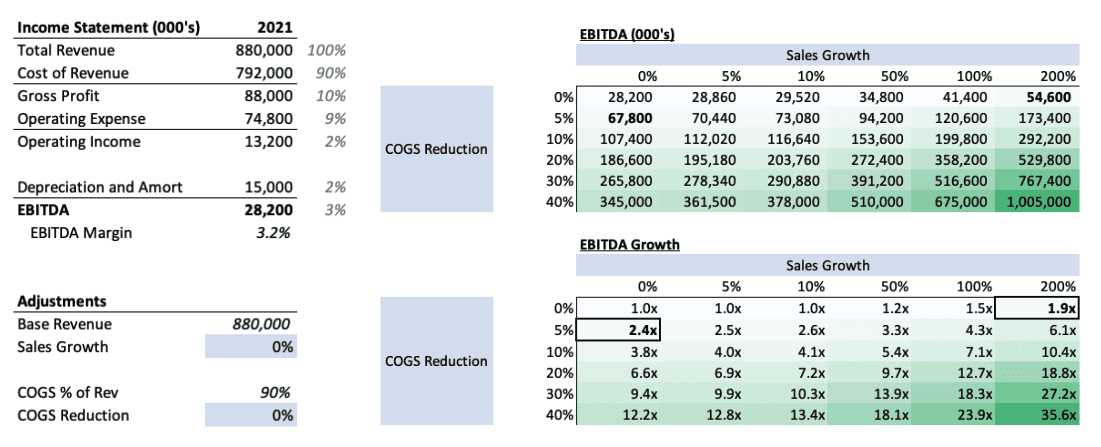

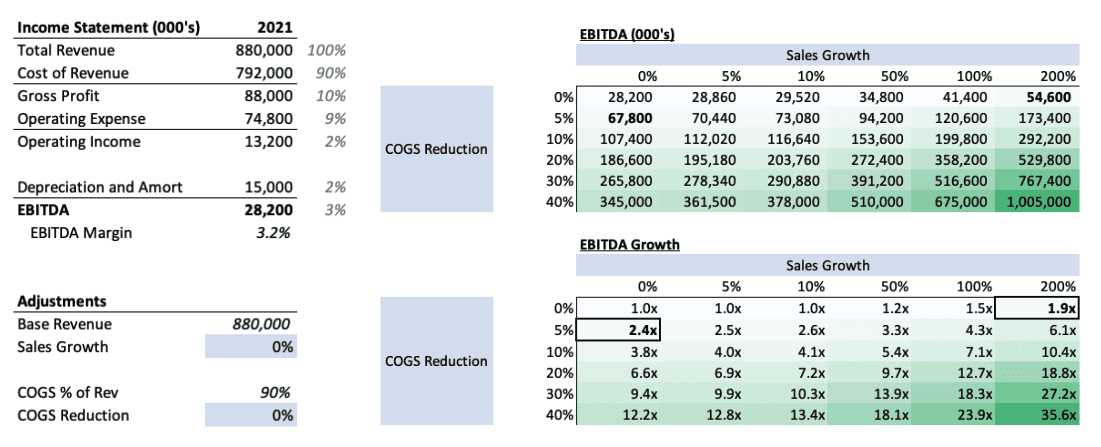

To answer this question, we run a what-if analysis:

Looking through this chart, we notice some shocking revelations.

Doubling sales, doubles profit - holding margins equal - of course that makes sense.

However, if reduce costs by even 5%, while holding sales constant, the EBITDA profits more than double by 2.4x.

That's right! A 100% increase in sales yields the same profit impact as a 5% decrease in costs.

By walking through a simplified income statement we find that $1 of Procurement Savings = $20 of incremental sales.

Now of course, it depends somewhat on the industry. In ultra-high margin businesses (like software) incremental sales matter more because cost-to-serve an additional customer is low. However, for virtually all businesses involved in the production of physical goods - cost is king.

Procurement and the private equity industry

The impact of procurement is one of the great secrets of the private equity industry.

PE Firms work on a simple business model: buy a company, improve its profits, and sell it for a higher price. The reason this works is that "valuation" in its most abstracted form is just a multiple of EBITDA. Again depending on the industry, you might see EV/EBITDA multiples ranging anywhere from 5x to 30x.

The calculus is simple: if you have a $100M EBITDA per year business and it's in a 10x multiple sector, the business is worth $1B. If an acquiring firm doubles the EBITDA, it doubles the valuation.

For this reason the most savvy PE funds work very hard to empower the procurement teams of their portfolio companies, sometimes even stepping in to help directly with the support of operating partners or management consulting firms like McKinsey, Bain, or AT Kearney.

For those interested, NYU Stern publishes a fascinating dataset of Enterprise Value Multiples by Sector and Margins by Sector.

LightSource helps top procurement teams achieve exceptional outcomes

Our dream is that this hard yet hugely impactful work of procurement can be made easier. At the same time, we feel that procurement needs to get more credit as a function.

When we engage businesses and discover that the supply chain teams are still sourcing using excel and email, we know the software industry could do better. If this year has taught us anything, it's that supply chain is one of the most difficult functions in the business.

We wouldn't equip our most valuable soldiers with tools from 40 years ago. So why can't we do better for procurement professionals?

So that's LightSource.

A next-generation procurement platform designed to give category managers super powers. We take the tedious transactional stuff and make it simple, then use the data coming through the system to elevate insights and empower the procurement manager to focus on strategy and relationships.

This is the future procurement professionals have been talking about for 20 years. We're just trying now to really make it happen.

Questions about procurement & sales answered in this article:

Why does procurement not receive the same level of credit as sales for its contributions to a company's financial success?

What is the financial relationship between a dollar of procurement savings and a dollar of sales?

What is the most effective way for a company to double its profits: by increasing sales or by reducing costs?

How can a 5% reduction in costs have a greater impact on profit than a 100% increase in sales?

How does the private equity industry leverage procurement to increase a company's valuation?

Procurement doesn't usually get the credit it deserves.

Sales gets all the glory. When a sales person closes a new contract, it's high-fives, champagne, and a big commission. But for every dollar that comes in through sales, there's 80-cents going out through procurement. Yet when best-in-class procurement managers go out and collaborate with suppliers to identify savings, negotiate a big cost-containment, or get parts on-time to ensure the line doesn't stop -- where's the reward?

People expect supply chain to "just happen" so when a procurement manager brings in a $1M savings, it's rarely lauded in the same way.

Worse yet, sometimes procurement professionals face the criticism "why were we leaving money on the table in past?" We talk through this issue in previous post on the cultural double-standard in Supply Chain.

However, procurement has another secret, and that's what we're here to talk about today

$1 in procurement equals $20 in sales

Ok, what exactly do you guys mean by that? $1 ≠ $20.

Let's start with the story of a fictional manufacturing business. We'll call it "Beethoven Industries."

Founded in the year 1770, Beethoven Industries is a leading manufacturer of grand pianos based in Detroit, Michigan. Their top of the line concert pianos sell anywhere from $70,000 to $150,000 dollars -- and their customers are deeply loyal to the brand, because (as musicians) they know Beethoven's are simply the best and have been for a hundred years.

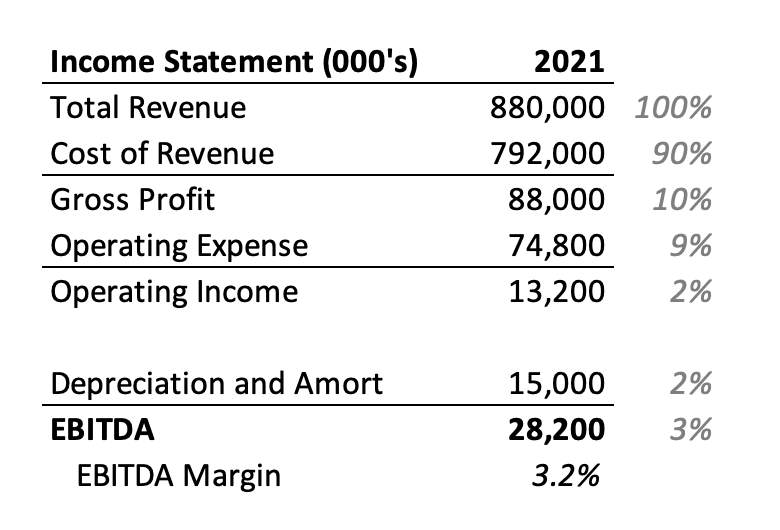

Pulling the latest financial statement we quickly see some simple insights:

Strong sales ($880M per year)

But average gross margin of 10% (not uncommon for manufacturing)

After a couple adjustments we see EBITDA (earnings before interest taxes and depreciation & amortization) of $28M at a 3.2% margin (EBITDA / Sales).

(Note: For what it's worth, this Income Statement is actually based on a real 2020 10-k filing from an Automotive company. We just obscured the name for this post.)

Now let's say you're an executive at Beethoven, and you're objective is to double profits (often measured in the form of EBITDA).

Profit = Revenue - Costs

So, you've got basically two levers to pull:

Increase sales

Reduce costs

But by how much? What's the most effective method to achieve that 2x profit growth?

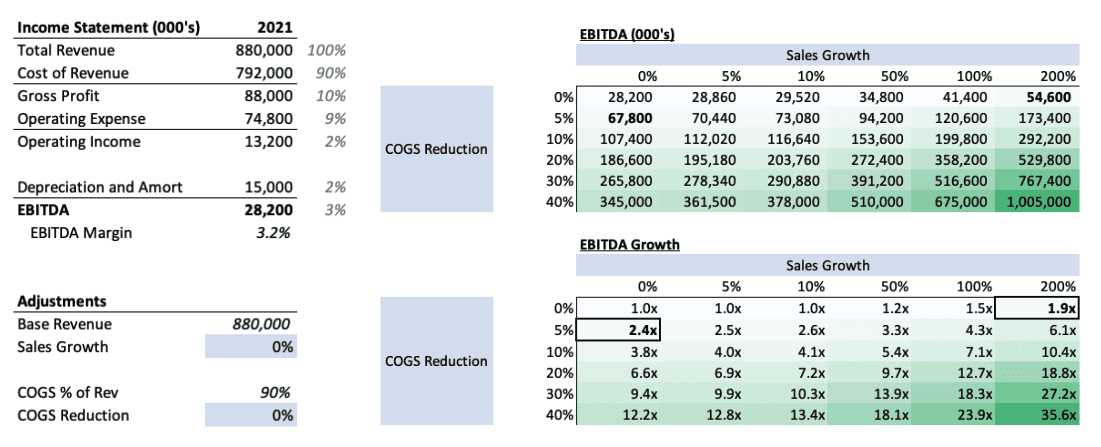

To answer this question, we run a what-if analysis:

Looking through this chart, we notice some shocking revelations.

Doubling sales, doubles profit - holding margins equal - of course that makes sense.

However, if reduce costs by even 5%, while holding sales constant, the EBITDA profits more than double by 2.4x.

That's right! A 100% increase in sales yields the same profit impact as a 5% decrease in costs.

By walking through a simplified income statement we find that $1 of Procurement Savings = $20 of incremental sales.

Now of course, it depends somewhat on the industry. In ultra-high margin businesses (like software) incremental sales matter more because cost-to-serve an additional customer is low. However, for virtually all businesses involved in the production of physical goods - cost is king.

Procurement and the private equity industry

The impact of procurement is one of the great secrets of the private equity industry.

PE Firms work on a simple business model: buy a company, improve its profits, and sell it for a higher price. The reason this works is that "valuation" in its most abstracted form is just a multiple of EBITDA. Again depending on the industry, you might see EV/EBITDA multiples ranging anywhere from 5x to 30x.

The calculus is simple: if you have a $100M EBITDA per year business and it's in a 10x multiple sector, the business is worth $1B. If an acquiring firm doubles the EBITDA, it doubles the valuation.

For this reason the most savvy PE funds work very hard to empower the procurement teams of their portfolio companies, sometimes even stepping in to help directly with the support of operating partners or management consulting firms like McKinsey, Bain, or AT Kearney.

For those interested, NYU Stern publishes a fascinating dataset of Enterprise Value Multiples by Sector and Margins by Sector.

LightSource helps top procurement teams achieve exceptional outcomes

Our dream is that this hard yet hugely impactful work of procurement can be made easier. At the same time, we feel that procurement needs to get more credit as a function.

When we engage businesses and discover that the supply chain teams are still sourcing using excel and email, we know the software industry could do better. If this year has taught us anything, it's that supply chain is one of the most difficult functions in the business.

We wouldn't equip our most valuable soldiers with tools from 40 years ago. So why can't we do better for procurement professionals?

So that's LightSource.

A next-generation procurement platform designed to give category managers super powers. We take the tedious transactional stuff and make it simple, then use the data coming through the system to elevate insights and empower the procurement manager to focus on strategy and relationships.

This is the future procurement professionals have been talking about for 20 years. We're just trying now to really make it happen.

Questions about procurement & sales answered in this article:

Why does procurement not receive the same level of credit as sales for its contributions to a company's financial success?

What is the financial relationship between a dollar of procurement savings and a dollar of sales?

What is the most effective way for a company to double its profits: by increasing sales or by reducing costs?

How can a 5% reduction in costs have a greater impact on profit than a 100% increase in sales?

How does the private equity industry leverage procurement to increase a company's valuation?

Procurement doesn't usually get the credit it deserves.

Sales gets all the glory. When a sales person closes a new contract, it's high-fives, champagne, and a big commission. But for every dollar that comes in through sales, there's 80-cents going out through procurement. Yet when best-in-class procurement managers go out and collaborate with suppliers to identify savings, negotiate a big cost-containment, or get parts on-time to ensure the line doesn't stop -- where's the reward?

People expect supply chain to "just happen" so when a procurement manager brings in a $1M savings, it's rarely lauded in the same way.

Worse yet, sometimes procurement professionals face the criticism "why were we leaving money on the table in past?" We talk through this issue in previous post on the cultural double-standard in Supply Chain.

However, procurement has another secret, and that's what we're here to talk about today

$1 in procurement equals $20 in sales

Ok, what exactly do you guys mean by that? $1 ≠ $20.

Let's start with the story of a fictional manufacturing business. We'll call it "Beethoven Industries."

Founded in the year 1770, Beethoven Industries is a leading manufacturer of grand pianos based in Detroit, Michigan. Their top of the line concert pianos sell anywhere from $70,000 to $150,000 dollars -- and their customers are deeply loyal to the brand, because (as musicians) they know Beethoven's are simply the best and have been for a hundred years.

Pulling the latest financial statement we quickly see some simple insights:

Strong sales ($880M per year)

But average gross margin of 10% (not uncommon for manufacturing)

After a couple adjustments we see EBITDA (earnings before interest taxes and depreciation & amortization) of $28M at a 3.2% margin (EBITDA / Sales).

(Note: For what it's worth, this Income Statement is actually based on a real 2020 10-k filing from an Automotive company. We just obscured the name for this post.)

Now let's say you're an executive at Beethoven, and you're objective is to double profits (often measured in the form of EBITDA).

Profit = Revenue - Costs

So, you've got basically two levers to pull:

Increase sales

Reduce costs

But by how much? What's the most effective method to achieve that 2x profit growth?

To answer this question, we run a what-if analysis:

Looking through this chart, we notice some shocking revelations.

Doubling sales, doubles profit - holding margins equal - of course that makes sense.

However, if reduce costs by even 5%, while holding sales constant, the EBITDA profits more than double by 2.4x.

That's right! A 100% increase in sales yields the same profit impact as a 5% decrease in costs.

By walking through a simplified income statement we find that $1 of Procurement Savings = $20 of incremental sales.

Now of course, it depends somewhat on the industry. In ultra-high margin businesses (like software) incremental sales matter more because cost-to-serve an additional customer is low. However, for virtually all businesses involved in the production of physical goods - cost is king.

Procurement and the private equity industry

The impact of procurement is one of the great secrets of the private equity industry.

PE Firms work on a simple business model: buy a company, improve its profits, and sell it for a higher price. The reason this works is that "valuation" in its most abstracted form is just a multiple of EBITDA. Again depending on the industry, you might see EV/EBITDA multiples ranging anywhere from 5x to 30x.

The calculus is simple: if you have a $100M EBITDA per year business and it's in a 10x multiple sector, the business is worth $1B. If an acquiring firm doubles the EBITDA, it doubles the valuation.

For this reason the most savvy PE funds work very hard to empower the procurement teams of their portfolio companies, sometimes even stepping in to help directly with the support of operating partners or management consulting firms like McKinsey, Bain, or AT Kearney.

For those interested, NYU Stern publishes a fascinating dataset of Enterprise Value Multiples by Sector and Margins by Sector.

LightSource helps top procurement teams achieve exceptional outcomes

Our dream is that this hard yet hugely impactful work of procurement can be made easier. At the same time, we feel that procurement needs to get more credit as a function.

When we engage businesses and discover that the supply chain teams are still sourcing using excel and email, we know the software industry could do better. If this year has taught us anything, it's that supply chain is one of the most difficult functions in the business.

We wouldn't equip our most valuable soldiers with tools from 40 years ago. So why can't we do better for procurement professionals?

So that's LightSource.

A next-generation procurement platform designed to give category managers super powers. We take the tedious transactional stuff and make it simple, then use the data coming through the system to elevate insights and empower the procurement manager to focus on strategy and relationships.

This is the future procurement professionals have been talking about for 20 years. We're just trying now to really make it happen.

Questions about procurement & sales answered in this article:

Why does procurement not receive the same level of credit as sales for its contributions to a company's financial success?

What is the financial relationship between a dollar of procurement savings and a dollar of sales?

What is the most effective way for a company to double its profits: by increasing sales or by reducing costs?

How can a 5% reduction in costs have a greater impact on profit than a 100% increase in sales?

How does the private equity industry leverage procurement to increase a company's valuation?

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Trusted by:

Trusted by:

Trusted by:

*GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and COOL VENDORS is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.