Jan 22, 2026

What is Supplier Performance Management?

Master SPM with real-time monitoring, automated scorecards, and data-driven supplier improvement strategies that reduce costs and eliminate supply risks.

TL;DR: Supplier performance management (SPM) = tracking supplier cost, quality, and delivery metrics to drive continuous improvement.

SPM forces procurement teams to track quality, compliance, and cost-effectiveness in real-time. That way, they discover problems way before the quarterly review.

That way, they can catch problems while they're fixable and identify strategic partners who drive competitive advantage.

Supplier performance management (SPM) tracks supplier performance across four areas: cost, quality, delivery, and compliance. You share the data with suppliers and collaborate with them, ideally, before problems escalate.

Procurement teams run SPM programs, but three groups use the data daily:

Supply chain managers track delivery performance to prevent stockouts

Quality engineers monitor defect rates to catch problems before products ship

Finance teams verify that invoiced prices match contracted rates

When all three work from the same supplier scorecards, you catch issues early.

SPM matters because it turns supplier problems from expensive surprises into fixable issues. Companies using SPM eliminate late-delivery crises that shut down production lines, catch quality issues before they reach customers, and build backup supplier relationships.

Why supplier performance management matters

SPM catches problems before they cost you money. Here's how:

Cost reduction through performance visibility. You can't optimize what you don't measure. SPM shows you which suppliers charge more for the same parts. You see the data, consolidate orders with your lowest-cost suppliers, and cut procurement spend.

Quality control before products reach customers. Customer complaints about defective products damage your reputation and cost money to fix. SPM tracks defect rates from each supplier and helps you catch quality problems in real time.

Supply chain resilience against disruption. SPM monitors your suppliers continuously for warning signs such as late deliveries, financial stress, and capacity issues. When problems emerge, you have time to line up backup suppliers.

Data-driven negotiation leverage. SPM gives you documented proof of supplier performance. When a supplier consistently delivers late or over budget, you have the numbers to negotiate better prices or switch to more reliable alternatives.

Compliance and risk management. SPM automatically tracks supplier certifications, audit results, financial health, and regulatory requirements. You get alerts before certifications expire or compliance issues arise, preventing violations that could shut down your operations.

3 types of supplier performance metrics

SPM metrics fall into three categories:

1. Operational metrics

Operational metrics measure day-to-day supplier execution. Five important operational metrics include:

On-time delivery (OTD): This tracks the percentage of orders delivered by the promised date. Target 95%+. Calculate it as (on-time deliveries / total deliveries) × 100. If you receive 100 shipments and 92 arrive on time, your OTD is 92%.

On-time in-full (OTIF): This measures orders delivered on time AND with the complete quantity. You might have 95% OTD but only 85% OTIF if suppliers consistently short-ship. OTIF shows you the real picture of supplier reliability. Use the same formula as OTD, but only count deliveries that arrive on time with full quantities.

Lead time accuracy: This measures how consistently suppliers meet quoted lead times. A supplier promises a four-week lead time but consistently delivers in 6 weeks? That's a planning problem. You can't schedule production when suppliers miss their commitments by 50%.

Defect rate: This calculates defective units per thousand delivered (DPMO). World-class suppliers target <500 DPMO. Calculate it as (defective units / total units) × 1,000. A supplier delivering 1,000 parts with 5 defects has a 5 DPMO rate.

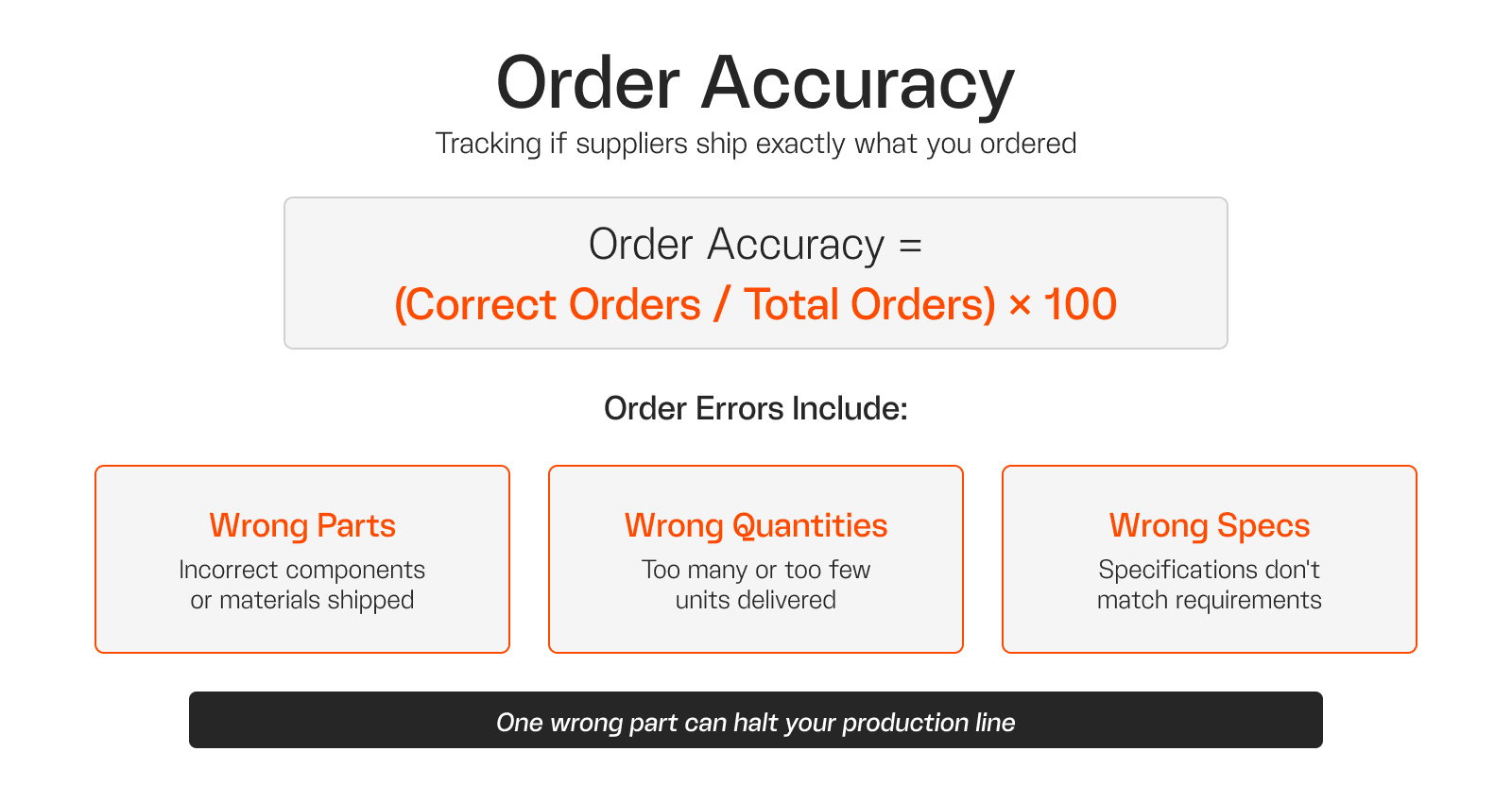

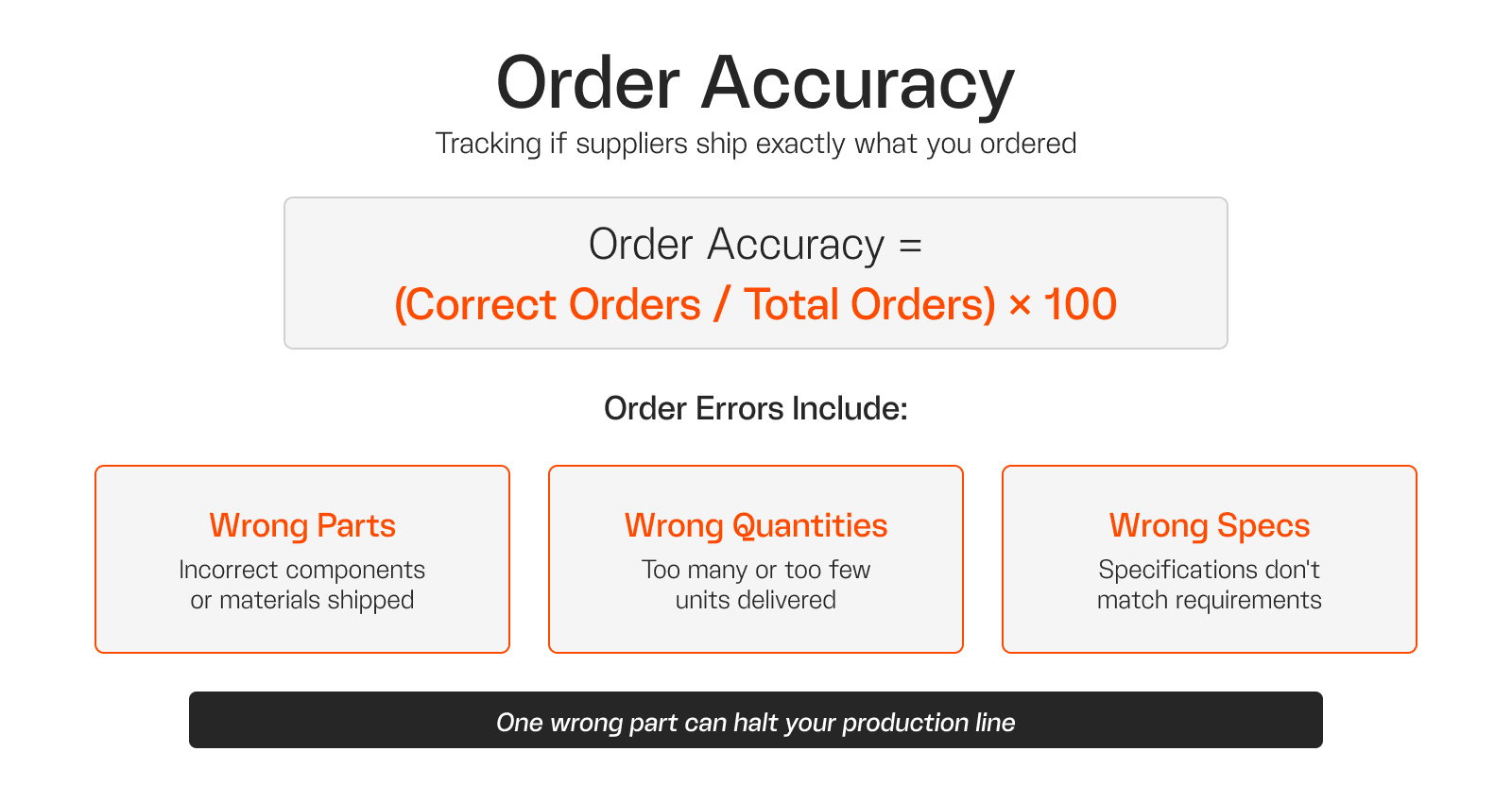

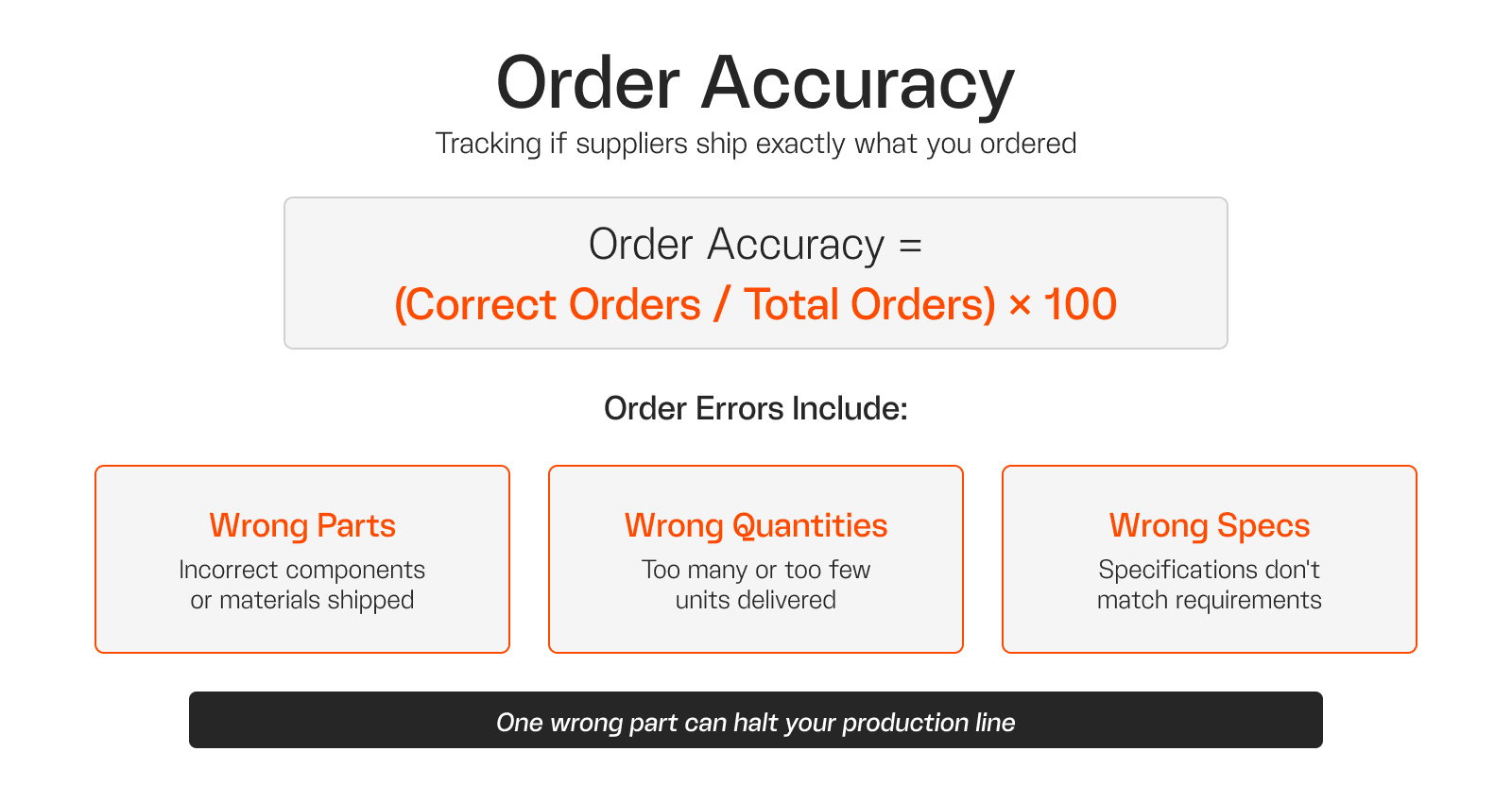

Order Accuracy: This tracks how often suppliers ship exactly what you ordered. Wrong parts, wrong quantities, and wrong specifications all count as order errors. One wrong part can halt your production line while you wait for the correct component.

Track these five operational metrics together to spot patterns early—when OTD drops but OTIF stays stable, suppliers are shipping partial orders on time while missing volumes.

2. Financial and compliance metrics

Financial metrics quantify supplier cost impact and regulatory adherence. Here are five relevant ones for any business:

Price variance measures supplier pricing against contracted rates or market benchmarks. Calculate the difference between what you agreed to pay and what you're actually invoiced. A 5% variance seems small until you multiply it across $10M in annual spend. That's $500K leaking from your budget.

Total cost of ownership (TCO) goes beyond unit price. Add shipping costs, quality inspection time, returns processing, and administrative overhead for handling supplier issues. A supplier with the lowest unit price might cost you the most if they deliver defective products that require rework, replacement parts, and production downtime.

Invoice accuracy measures how often invoices match purchase orders and delivery receipts without discrepancies. Every invoice error means someone on your team wastes time chasing down the supplier, reconciling numbers, and fixing the payment. Target 95%+ accuracy. Below that, you're paying staff to fix supplier mistakes instead of doing strategic work.

Compliance rate tracks adherence to contractual terms, certifications, and regulatory requirements. This includes ISO certifications, conflict minerals declarations, sustainability standards, and safety requirements. A single compliance failure can shut down your production line if regulators step in or customers audit your supply chain.

Financial stability monitors suppliers' credit ratings, payment terms, and financial health. Check quarterly reports, payment history, and debt levels. A supplier declaring bankruptcy mid-contract creates immediate supply chain chaos. You'll scramble to find replacements, potentially halt production, and likely pay premium prices for emergency sourcing.

These five metrics catch the financial and regulatory issues that operational metrics miss. For example, a supplier with perfect OTD can still drain your budget through invoice errors or create compliance risk through expired certifications.

3. Composite metrics (SPI)

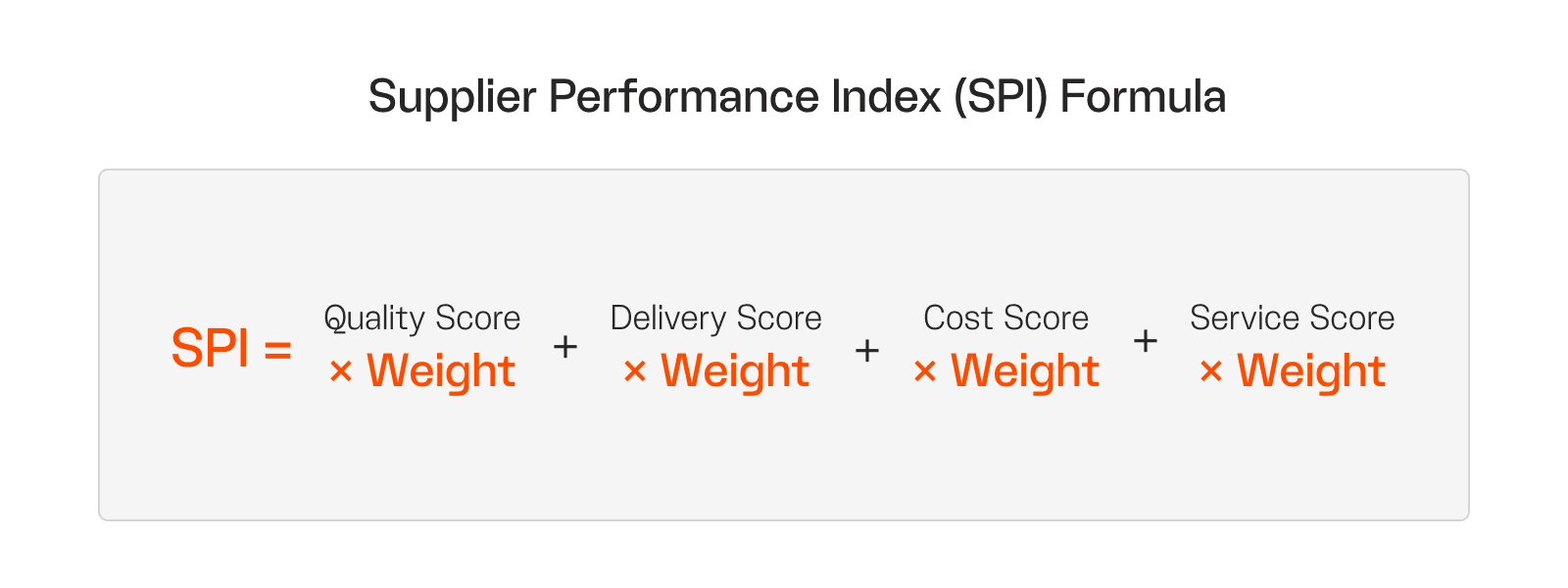

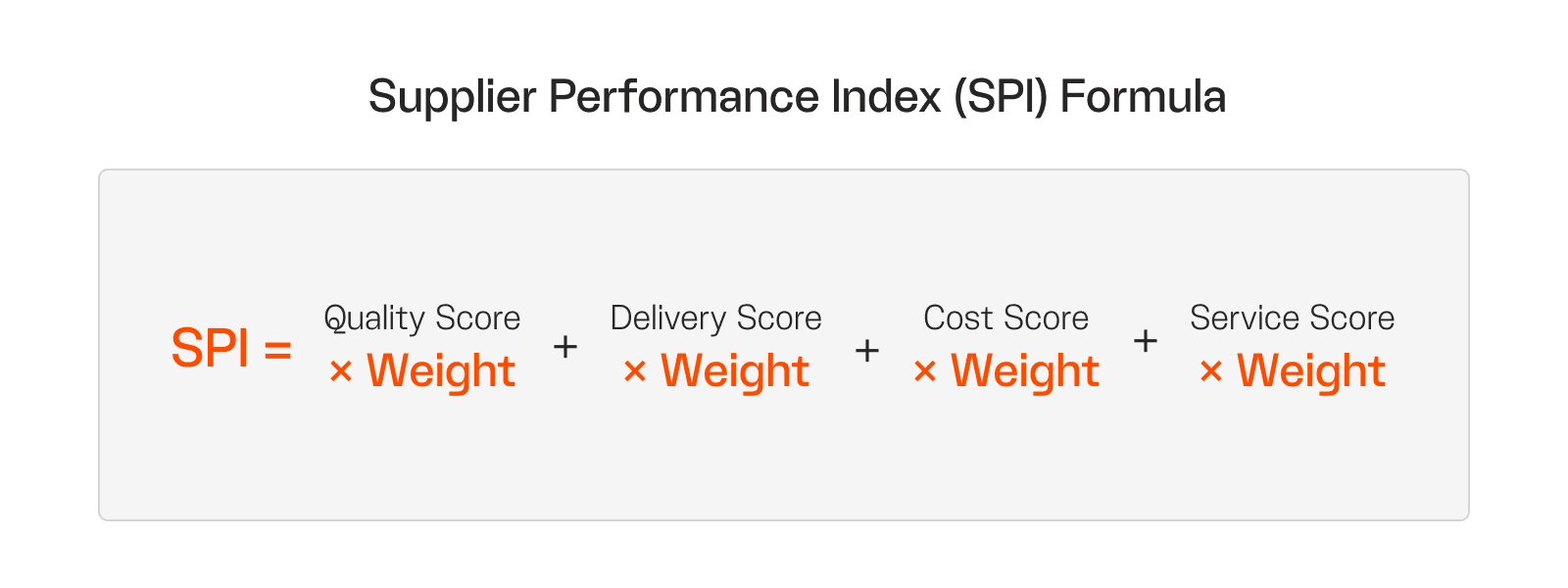

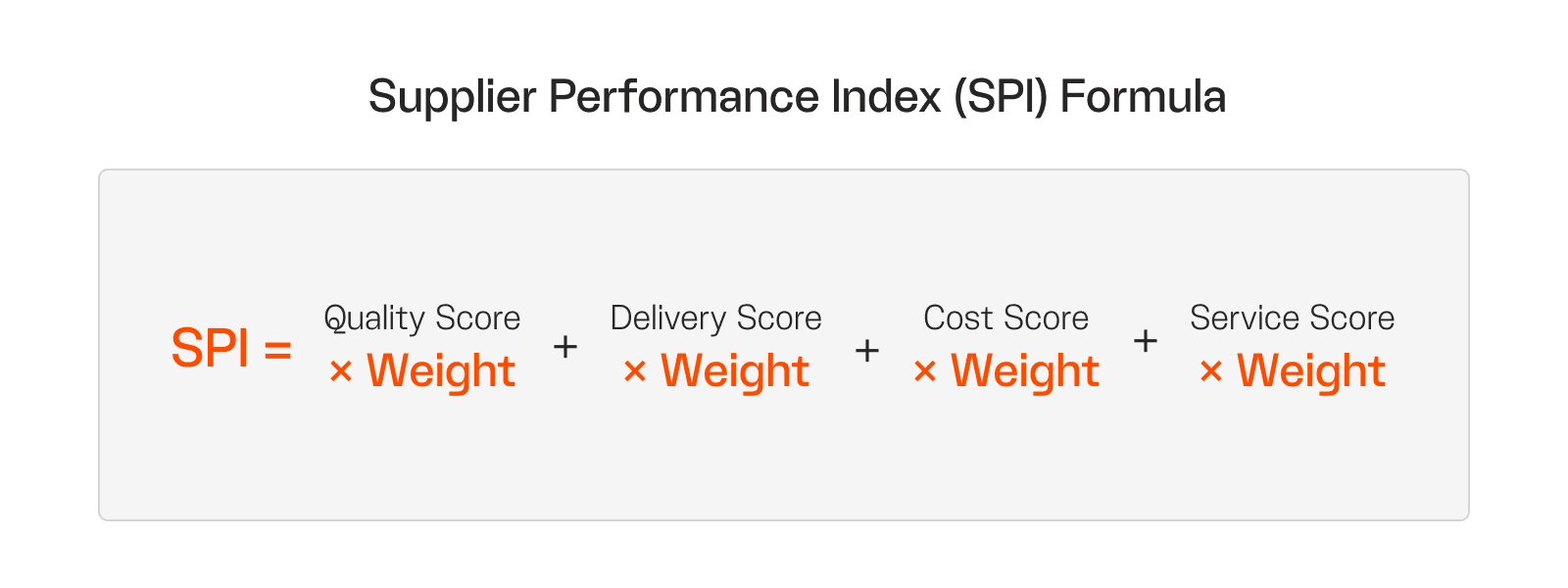

The Supplier Performance Index (SPI) combines multiple composite metrics into a single score for easy benchmarking.

Here’s a simple SPI formula:

SPI = (Quality Score × Weight) + (Delivery Score × Weight) + (Cost Score × Weight) + (Service Score × Weight)

Set your weights based on what matters most to your business. For example, manufacturing companies typically use:

Quality: 30%

Delivery: 30%

Cost: 25%

Service/Responsiveness: 15%

Adjust these weights for your industry. If you're shipping fresh food with a two-day shelf life, increase delivery weight to 40% and reduce cost to 20%.

Calculate SPI in three steps:

Convert each metric to a 0-100 scale

Multiply by its weight

Add the results

For instance, a supplier delivers 95% quality, 92% on-time delivery, 85% cost competitiveness, and 88% service responsiveness. Here’s how to calculate SPI:

Quality: 95 × 0.30 = 28.5

Delivery: 92 × 0.30 = 27.6

Cost: 85 × 0.25 = 21.25

Service: 88 × 0.15 = 13.2

Based on that, the supplier’s SPI is 90.55.

Use SPI scores to make decisions:

90+: Strategic partners. Increase their business, extend contract terms, involve them in new product development.

70-89: Solid performers. Maintain current relationship, monitor for improvement or decline.

Below 70: Underperformers. Put them on performance improvement plans or start qualifying replacements.

Update SPI scores monthly or quarterly to review how scores increase or decrease over time. A supplier scoring 92 in Q1 who drops to 78 in Q2 needs immediate attention before they damage your operations.

Measuring and tracking supplier performance

Effective supplier performance measurement runs on automated data feeds and real-time dashboards. Manual tracking can't keep up.

Automate data collection from your systems

Delivery confirmations flow from your ERP, defect counts from quality management systems, and pricing terms from contract platforms. Connect these systems so performance data feeds automatically into supplier scorecards instead of requiring manual updates. This eliminates the reconciliation work that consumes procurement analysts' time and ensures you're working with current data.

Add external risk signals to internal data

Internal systems track operational performance but miss external risks that disrupt supply chains. A supplier can deliver on time for months while their credit rating deteriorates or lawsuits pile up. Add third-party data feeds that monitor supplier financial health, news alerts, and geopolitical conditions to receive warning signs on time.

Build real-time scorecards for instant visibility

Centralized dashboards show supplier performance across all metrics with daily updates instead of monthly reports. Category managers see on-time delivery rates, defect percentages, and cost variance in real time. Automatic alerts flag performance changes the moment they happen. You'll know immediately when a supplier's on-time rate drops 10%, when defects exceed your threshold, or when invoices don't match POs. This gives you time to intervene on time.

Tailor reports to each stakeholder's needs

Executives need high-level SPI scores and risk heat maps showing which suppliers require attention. Engineers need detailed defect breakdowns by part number to diagnose quality issues. Finance needs cost variance reports to track budget adherence. Create monthly one-page scorecards for each group with only the metrics they use to make decisions to prevent data overload.

Turn measurement into action

Performance data only matters if you act on it. Run quarterly business reviews with suppliers using performance data as the agenda. When metrics decline, schedule root-cause analysis sessions to identify fixes together. When suppliers consistently exceed targets, reward them with increased volume or contract extensions. Transparent scorecards shift conversations from blame to problem-solving because both sides work from the same numbers.

How to improve supplier performance

Supplier performance improves when you identify problems early and give suppliers clear reasons to fix them.

Run regular performance reviews with top suppliers

Schedule monthly or quarterly reviews with your tier-one suppliers. Walk through on-time delivery, defect rates, and cost variance together. You'll spot issues while they're still fixable, and both sides see the same trends instead of arguing over one-off incidents.

Fix root causes, not symptoms

When problems appear, dig deeper. Document the issue, pilot a solution, measure the results, then either lock in what works or try something else. This approach prevents you from patching the same problem repeatedly while the underlying cause continues creating issues.

Invest in supplier capability building

Sometimes suppliers want to improve but lack the tools or expertise. When a supplier can't hit your quality targets, help them get there. Share your SOPs or co-fund training programs. You'll see fewer disruptions and faster lead times when suppliers feel supported instead of just audited.

Reward high performance publicly

Give your best suppliers more business, longer contracts, or bonus payments when they exceed targets. Public recognition reinforces what you value. Add penalty clauses for persistent underperformance, but start with incentives before moving to enforcement.

Build consistent communication channels

Set up weekly check-ins and shared dashboards so suppliers can flag problems early. When a supplier alerts you to capacity constraints or material shortages weeks in advance, you adjust forecasts proactively instead of scrambling for emergency alternatives.

Use centralized platforms to aggregate risk signals

Track supplier financial health, geographic exposure, and compliance status in one system. This lets you rank suppliers by risk level and focus oversight where it matters most. Automatic alerts notify you when delivery performance drops or certifications near expiration, giving you time to intervene before problems shut down production.

Transform SPM with AI

Effective supplier performance management requires more than quarterly scorecards and annual reviews. Integrating performance tracking into RFx processes, building automated scorecards with real-time data, and establishing collaborative improvement programs turn SPM from administrative overhead into strategic supplier intelligence that drives cost savings and supply chain resilience.

These strategies help procurement teams spot performance degradation, focus improvement efforts on suppliers who matter most, and build supply chains where accountability drives continuous improvement. The result is procurement operations that reward top performers, fix underperformers quickly, and eliminate suppliers who can't meet standards.

AI-native platforms accelerate this transformation by automating data capture, predicting performance issues before they impact operations, and embedding supplier intelligence directly into sourcing decisions. LightSource captures supplier performance automatically during every RFQ interaction, builds performance profiles at the Bill of Materials line-item level, and flags deteriorating metrics before they cascade into delivery failures.

Our platform shortens sourcing cycles while building comprehensive supplier performance histories without manual data entry. It helps strategic sourcing managers make award decisions backed by historical delivery data, identify chronic underperformers before contract renewals, and spot performance trends that signal emerging supply chain risks.

Ready to see how it works? Book a personalized demo.

Frequently asked questions about supplier performance management

What is supplier performance management?

Supplier performance management is the systematic process of measuring, analyzing, and improving how suppliers deliver on quality, cost, delivery, and responsiveness commitments. SPM turns supplier relationships from reactive firefighting into data-driven partnerships where both sides work from the same performance scorecards.

What metrics matter most for tracking supplier performance?

Track five essential metrics: On-Time Delivery (reliability), defect rates (quality), cost variance (financial accuracy), lead time (responsiveness), and order accuracy (operational precision). Combine these into a weighted Supplier Performance Index score that lets you benchmark suppliers at a glance and make fast award decisions.

How do I calculate a supplier performance score?

Weight each metric by business impact, measure actual performance against targets, and multiply: On-Time Delivery (30%) plus Quality (30%) plus Cost (20%) plus Responsiveness (10%) plus Innovation (10%) equals your composite SPI score. Suppliers scoring 90+ are strategic partners, 70-89 need monitoring, below 70 need performance improvement plans or replacement.

How does SPM improve supplier relationships?

Performance data shifts conversations from blame to problem-solving when both sides review the same scorecards quarterly. Underperformers get clear improvement targets while top performers earn public recognition, longer contracts, and increased volume.

What technology accelerates SPM effectiveness?

AI-native platforms automate data collection, predict performance issues before they impact production, and embed supplier intelligence directly into sourcing decisions. Demand systems that pull delivery data from your ERP, quality metrics from inspection systems, and external risk signals into unified real-time dashboards with automated alerts.

How should an SPM program evolve over time?

Start with manual scorecards and quarterly reviews, move to standardized digital scorecards with monthly updates, then graduate to predictive analytics that segment suppliers by risk. The final stage implements AI-powered systems that connect historical performance data to contract negotiations and award decisions.

Can SPM prevent supply chain disruptions?

SPM doesn't prevent disruptions but buys critical reaction time by flagging early warning signs like climbing lead times or financial stress weeks before suppliers fail. Manual quarterly reviews give you 90 days of blind spots; real-time monitoring cuts that to days or hours.

Why choose LightSource for supplier performance management?

LightSource embeds performance tracking directly into sourcing workflows, automatically capturing responsiveness, quote accuracy, and delivery commitments at the Bill of Materials line-item level during every RFQ interaction. Performance data lives where award decisions happen, not buried in separate SPM modules that require manual updates.

TL;DR: Supplier performance management (SPM) = tracking supplier cost, quality, and delivery metrics to drive continuous improvement.

SPM forces procurement teams to track quality, compliance, and cost-effectiveness in real-time. That way, they discover problems way before the quarterly review.

That way, they can catch problems while they're fixable and identify strategic partners who drive competitive advantage.

Supplier performance management (SPM) tracks supplier performance across four areas: cost, quality, delivery, and compliance. You share the data with suppliers and collaborate with them, ideally, before problems escalate.

Procurement teams run SPM programs, but three groups use the data daily:

Supply chain managers track delivery performance to prevent stockouts

Quality engineers monitor defect rates to catch problems before products ship

Finance teams verify that invoiced prices match contracted rates

When all three work from the same supplier scorecards, you catch issues early.

SPM matters because it turns supplier problems from expensive surprises into fixable issues. Companies using SPM eliminate late-delivery crises that shut down production lines, catch quality issues before they reach customers, and build backup supplier relationships.

Why supplier performance management matters

SPM catches problems before they cost you money. Here's how:

Cost reduction through performance visibility. You can't optimize what you don't measure. SPM shows you which suppliers charge more for the same parts. You see the data, consolidate orders with your lowest-cost suppliers, and cut procurement spend.

Quality control before products reach customers. Customer complaints about defective products damage your reputation and cost money to fix. SPM tracks defect rates from each supplier and helps you catch quality problems in real time.

Supply chain resilience against disruption. SPM monitors your suppliers continuously for warning signs such as late deliveries, financial stress, and capacity issues. When problems emerge, you have time to line up backup suppliers.

Data-driven negotiation leverage. SPM gives you documented proof of supplier performance. When a supplier consistently delivers late or over budget, you have the numbers to negotiate better prices or switch to more reliable alternatives.

Compliance and risk management. SPM automatically tracks supplier certifications, audit results, financial health, and regulatory requirements. You get alerts before certifications expire or compliance issues arise, preventing violations that could shut down your operations.

3 types of supplier performance metrics

SPM metrics fall into three categories:

1. Operational metrics

Operational metrics measure day-to-day supplier execution. Five important operational metrics include:

On-time delivery (OTD): This tracks the percentage of orders delivered by the promised date. Target 95%+. Calculate it as (on-time deliveries / total deliveries) × 100. If you receive 100 shipments and 92 arrive on time, your OTD is 92%.

On-time in-full (OTIF): This measures orders delivered on time AND with the complete quantity. You might have 95% OTD but only 85% OTIF if suppliers consistently short-ship. OTIF shows you the real picture of supplier reliability. Use the same formula as OTD, but only count deliveries that arrive on time with full quantities.

Lead time accuracy: This measures how consistently suppliers meet quoted lead times. A supplier promises a four-week lead time but consistently delivers in 6 weeks? That's a planning problem. You can't schedule production when suppliers miss their commitments by 50%.

Defect rate: This calculates defective units per thousand delivered (DPMO). World-class suppliers target <500 DPMO. Calculate it as (defective units / total units) × 1,000. A supplier delivering 1,000 parts with 5 defects has a 5 DPMO rate.

Order Accuracy: This tracks how often suppliers ship exactly what you ordered. Wrong parts, wrong quantities, and wrong specifications all count as order errors. One wrong part can halt your production line while you wait for the correct component.

Track these five operational metrics together to spot patterns early—when OTD drops but OTIF stays stable, suppliers are shipping partial orders on time while missing volumes.

2. Financial and compliance metrics

Financial metrics quantify supplier cost impact and regulatory adherence. Here are five relevant ones for any business:

Price variance measures supplier pricing against contracted rates or market benchmarks. Calculate the difference between what you agreed to pay and what you're actually invoiced. A 5% variance seems small until you multiply it across $10M in annual spend. That's $500K leaking from your budget.

Total cost of ownership (TCO) goes beyond unit price. Add shipping costs, quality inspection time, returns processing, and administrative overhead for handling supplier issues. A supplier with the lowest unit price might cost you the most if they deliver defective products that require rework, replacement parts, and production downtime.

Invoice accuracy measures how often invoices match purchase orders and delivery receipts without discrepancies. Every invoice error means someone on your team wastes time chasing down the supplier, reconciling numbers, and fixing the payment. Target 95%+ accuracy. Below that, you're paying staff to fix supplier mistakes instead of doing strategic work.

Compliance rate tracks adherence to contractual terms, certifications, and regulatory requirements. This includes ISO certifications, conflict minerals declarations, sustainability standards, and safety requirements. A single compliance failure can shut down your production line if regulators step in or customers audit your supply chain.

Financial stability monitors suppliers' credit ratings, payment terms, and financial health. Check quarterly reports, payment history, and debt levels. A supplier declaring bankruptcy mid-contract creates immediate supply chain chaos. You'll scramble to find replacements, potentially halt production, and likely pay premium prices for emergency sourcing.

These five metrics catch the financial and regulatory issues that operational metrics miss. For example, a supplier with perfect OTD can still drain your budget through invoice errors or create compliance risk through expired certifications.

3. Composite metrics (SPI)

The Supplier Performance Index (SPI) combines multiple composite metrics into a single score for easy benchmarking.

Here’s a simple SPI formula:

SPI = (Quality Score × Weight) + (Delivery Score × Weight) + (Cost Score × Weight) + (Service Score × Weight)

Set your weights based on what matters most to your business. For example, manufacturing companies typically use:

Quality: 30%

Delivery: 30%

Cost: 25%

Service/Responsiveness: 15%

Adjust these weights for your industry. If you're shipping fresh food with a two-day shelf life, increase delivery weight to 40% and reduce cost to 20%.

Calculate SPI in three steps:

Convert each metric to a 0-100 scale

Multiply by its weight

Add the results

For instance, a supplier delivers 95% quality, 92% on-time delivery, 85% cost competitiveness, and 88% service responsiveness. Here’s how to calculate SPI:

Quality: 95 × 0.30 = 28.5

Delivery: 92 × 0.30 = 27.6

Cost: 85 × 0.25 = 21.25

Service: 88 × 0.15 = 13.2

Based on that, the supplier’s SPI is 90.55.

Use SPI scores to make decisions:

90+: Strategic partners. Increase their business, extend contract terms, involve them in new product development.

70-89: Solid performers. Maintain current relationship, monitor for improvement or decline.

Below 70: Underperformers. Put them on performance improvement plans or start qualifying replacements.

Update SPI scores monthly or quarterly to review how scores increase or decrease over time. A supplier scoring 92 in Q1 who drops to 78 in Q2 needs immediate attention before they damage your operations.

Measuring and tracking supplier performance

Effective supplier performance measurement runs on automated data feeds and real-time dashboards. Manual tracking can't keep up.

Automate data collection from your systems

Delivery confirmations flow from your ERP, defect counts from quality management systems, and pricing terms from contract platforms. Connect these systems so performance data feeds automatically into supplier scorecards instead of requiring manual updates. This eliminates the reconciliation work that consumes procurement analysts' time and ensures you're working with current data.

Add external risk signals to internal data

Internal systems track operational performance but miss external risks that disrupt supply chains. A supplier can deliver on time for months while their credit rating deteriorates or lawsuits pile up. Add third-party data feeds that monitor supplier financial health, news alerts, and geopolitical conditions to receive warning signs on time.

Build real-time scorecards for instant visibility

Centralized dashboards show supplier performance across all metrics with daily updates instead of monthly reports. Category managers see on-time delivery rates, defect percentages, and cost variance in real time. Automatic alerts flag performance changes the moment they happen. You'll know immediately when a supplier's on-time rate drops 10%, when defects exceed your threshold, or when invoices don't match POs. This gives you time to intervene on time.

Tailor reports to each stakeholder's needs

Executives need high-level SPI scores and risk heat maps showing which suppliers require attention. Engineers need detailed defect breakdowns by part number to diagnose quality issues. Finance needs cost variance reports to track budget adherence. Create monthly one-page scorecards for each group with only the metrics they use to make decisions to prevent data overload.

Turn measurement into action

Performance data only matters if you act on it. Run quarterly business reviews with suppliers using performance data as the agenda. When metrics decline, schedule root-cause analysis sessions to identify fixes together. When suppliers consistently exceed targets, reward them with increased volume or contract extensions. Transparent scorecards shift conversations from blame to problem-solving because both sides work from the same numbers.

How to improve supplier performance

Supplier performance improves when you identify problems early and give suppliers clear reasons to fix them.

Run regular performance reviews with top suppliers

Schedule monthly or quarterly reviews with your tier-one suppliers. Walk through on-time delivery, defect rates, and cost variance together. You'll spot issues while they're still fixable, and both sides see the same trends instead of arguing over one-off incidents.

Fix root causes, not symptoms

When problems appear, dig deeper. Document the issue, pilot a solution, measure the results, then either lock in what works or try something else. This approach prevents you from patching the same problem repeatedly while the underlying cause continues creating issues.

Invest in supplier capability building

Sometimes suppliers want to improve but lack the tools or expertise. When a supplier can't hit your quality targets, help them get there. Share your SOPs or co-fund training programs. You'll see fewer disruptions and faster lead times when suppliers feel supported instead of just audited.

Reward high performance publicly

Give your best suppliers more business, longer contracts, or bonus payments when they exceed targets. Public recognition reinforces what you value. Add penalty clauses for persistent underperformance, but start with incentives before moving to enforcement.

Build consistent communication channels

Set up weekly check-ins and shared dashboards so suppliers can flag problems early. When a supplier alerts you to capacity constraints or material shortages weeks in advance, you adjust forecasts proactively instead of scrambling for emergency alternatives.

Use centralized platforms to aggregate risk signals

Track supplier financial health, geographic exposure, and compliance status in one system. This lets you rank suppliers by risk level and focus oversight where it matters most. Automatic alerts notify you when delivery performance drops or certifications near expiration, giving you time to intervene before problems shut down production.

Transform SPM with AI

Effective supplier performance management requires more than quarterly scorecards and annual reviews. Integrating performance tracking into RFx processes, building automated scorecards with real-time data, and establishing collaborative improvement programs turn SPM from administrative overhead into strategic supplier intelligence that drives cost savings and supply chain resilience.

These strategies help procurement teams spot performance degradation, focus improvement efforts on suppliers who matter most, and build supply chains where accountability drives continuous improvement. The result is procurement operations that reward top performers, fix underperformers quickly, and eliminate suppliers who can't meet standards.

AI-native platforms accelerate this transformation by automating data capture, predicting performance issues before they impact operations, and embedding supplier intelligence directly into sourcing decisions. LightSource captures supplier performance automatically during every RFQ interaction, builds performance profiles at the Bill of Materials line-item level, and flags deteriorating metrics before they cascade into delivery failures.

Our platform shortens sourcing cycles while building comprehensive supplier performance histories without manual data entry. It helps strategic sourcing managers make award decisions backed by historical delivery data, identify chronic underperformers before contract renewals, and spot performance trends that signal emerging supply chain risks.

Ready to see how it works? Book a personalized demo.

Frequently asked questions about supplier performance management

What is supplier performance management?

Supplier performance management is the systematic process of measuring, analyzing, and improving how suppliers deliver on quality, cost, delivery, and responsiveness commitments. SPM turns supplier relationships from reactive firefighting into data-driven partnerships where both sides work from the same performance scorecards.

What metrics matter most for tracking supplier performance?

Track five essential metrics: On-Time Delivery (reliability), defect rates (quality), cost variance (financial accuracy), lead time (responsiveness), and order accuracy (operational precision). Combine these into a weighted Supplier Performance Index score that lets you benchmark suppliers at a glance and make fast award decisions.

How do I calculate a supplier performance score?

Weight each metric by business impact, measure actual performance against targets, and multiply: On-Time Delivery (30%) plus Quality (30%) plus Cost (20%) plus Responsiveness (10%) plus Innovation (10%) equals your composite SPI score. Suppliers scoring 90+ are strategic partners, 70-89 need monitoring, below 70 need performance improvement plans or replacement.

How does SPM improve supplier relationships?

Performance data shifts conversations from blame to problem-solving when both sides review the same scorecards quarterly. Underperformers get clear improvement targets while top performers earn public recognition, longer contracts, and increased volume.

What technology accelerates SPM effectiveness?

AI-native platforms automate data collection, predict performance issues before they impact production, and embed supplier intelligence directly into sourcing decisions. Demand systems that pull delivery data from your ERP, quality metrics from inspection systems, and external risk signals into unified real-time dashboards with automated alerts.

How should an SPM program evolve over time?

Start with manual scorecards and quarterly reviews, move to standardized digital scorecards with monthly updates, then graduate to predictive analytics that segment suppliers by risk. The final stage implements AI-powered systems that connect historical performance data to contract negotiations and award decisions.

Can SPM prevent supply chain disruptions?

SPM doesn't prevent disruptions but buys critical reaction time by flagging early warning signs like climbing lead times or financial stress weeks before suppliers fail. Manual quarterly reviews give you 90 days of blind spots; real-time monitoring cuts that to days or hours.

Why choose LightSource for supplier performance management?

LightSource embeds performance tracking directly into sourcing workflows, automatically capturing responsiveness, quote accuracy, and delivery commitments at the Bill of Materials line-item level during every RFQ interaction. Performance data lives where award decisions happen, not buried in separate SPM modules that require manual updates.

TL;DR: Supplier performance management (SPM) = tracking supplier cost, quality, and delivery metrics to drive continuous improvement.

SPM forces procurement teams to track quality, compliance, and cost-effectiveness in real-time. That way, they discover problems way before the quarterly review.

That way, they can catch problems while they're fixable and identify strategic partners who drive competitive advantage.

Supplier performance management (SPM) tracks supplier performance across four areas: cost, quality, delivery, and compliance. You share the data with suppliers and collaborate with them, ideally, before problems escalate.

Procurement teams run SPM programs, but three groups use the data daily:

Supply chain managers track delivery performance to prevent stockouts

Quality engineers monitor defect rates to catch problems before products ship

Finance teams verify that invoiced prices match contracted rates

When all three work from the same supplier scorecards, you catch issues early.

SPM matters because it turns supplier problems from expensive surprises into fixable issues. Companies using SPM eliminate late-delivery crises that shut down production lines, catch quality issues before they reach customers, and build backup supplier relationships.

Why supplier performance management matters

SPM catches problems before they cost you money. Here's how:

Cost reduction through performance visibility. You can't optimize what you don't measure. SPM shows you which suppliers charge more for the same parts. You see the data, consolidate orders with your lowest-cost suppliers, and cut procurement spend.

Quality control before products reach customers. Customer complaints about defective products damage your reputation and cost money to fix. SPM tracks defect rates from each supplier and helps you catch quality problems in real time.

Supply chain resilience against disruption. SPM monitors your suppliers continuously for warning signs such as late deliveries, financial stress, and capacity issues. When problems emerge, you have time to line up backup suppliers.

Data-driven negotiation leverage. SPM gives you documented proof of supplier performance. When a supplier consistently delivers late or over budget, you have the numbers to negotiate better prices or switch to more reliable alternatives.

Compliance and risk management. SPM automatically tracks supplier certifications, audit results, financial health, and regulatory requirements. You get alerts before certifications expire or compliance issues arise, preventing violations that could shut down your operations.

3 types of supplier performance metrics

SPM metrics fall into three categories:

1. Operational metrics

Operational metrics measure day-to-day supplier execution. Five important operational metrics include:

On-time delivery (OTD): This tracks the percentage of orders delivered by the promised date. Target 95%+. Calculate it as (on-time deliveries / total deliveries) × 100. If you receive 100 shipments and 92 arrive on time, your OTD is 92%.

On-time in-full (OTIF): This measures orders delivered on time AND with the complete quantity. You might have 95% OTD but only 85% OTIF if suppliers consistently short-ship. OTIF shows you the real picture of supplier reliability. Use the same formula as OTD, but only count deliveries that arrive on time with full quantities.

Lead time accuracy: This measures how consistently suppliers meet quoted lead times. A supplier promises a four-week lead time but consistently delivers in 6 weeks? That's a planning problem. You can't schedule production when suppliers miss their commitments by 50%.

Defect rate: This calculates defective units per thousand delivered (DPMO). World-class suppliers target <500 DPMO. Calculate it as (defective units / total units) × 1,000. A supplier delivering 1,000 parts with 5 defects has a 5 DPMO rate.

Order Accuracy: This tracks how often suppliers ship exactly what you ordered. Wrong parts, wrong quantities, and wrong specifications all count as order errors. One wrong part can halt your production line while you wait for the correct component.

Track these five operational metrics together to spot patterns early—when OTD drops but OTIF stays stable, suppliers are shipping partial orders on time while missing volumes.

2. Financial and compliance metrics

Financial metrics quantify supplier cost impact and regulatory adherence. Here are five relevant ones for any business:

Price variance measures supplier pricing against contracted rates or market benchmarks. Calculate the difference between what you agreed to pay and what you're actually invoiced. A 5% variance seems small until you multiply it across $10M in annual spend. That's $500K leaking from your budget.

Total cost of ownership (TCO) goes beyond unit price. Add shipping costs, quality inspection time, returns processing, and administrative overhead for handling supplier issues. A supplier with the lowest unit price might cost you the most if they deliver defective products that require rework, replacement parts, and production downtime.

Invoice accuracy measures how often invoices match purchase orders and delivery receipts without discrepancies. Every invoice error means someone on your team wastes time chasing down the supplier, reconciling numbers, and fixing the payment. Target 95%+ accuracy. Below that, you're paying staff to fix supplier mistakes instead of doing strategic work.

Compliance rate tracks adherence to contractual terms, certifications, and regulatory requirements. This includes ISO certifications, conflict minerals declarations, sustainability standards, and safety requirements. A single compliance failure can shut down your production line if regulators step in or customers audit your supply chain.

Financial stability monitors suppliers' credit ratings, payment terms, and financial health. Check quarterly reports, payment history, and debt levels. A supplier declaring bankruptcy mid-contract creates immediate supply chain chaos. You'll scramble to find replacements, potentially halt production, and likely pay premium prices for emergency sourcing.

These five metrics catch the financial and regulatory issues that operational metrics miss. For example, a supplier with perfect OTD can still drain your budget through invoice errors or create compliance risk through expired certifications.

3. Composite metrics (SPI)

The Supplier Performance Index (SPI) combines multiple composite metrics into a single score for easy benchmarking.

Here’s a simple SPI formula:

SPI = (Quality Score × Weight) + (Delivery Score × Weight) + (Cost Score × Weight) + (Service Score × Weight)

Set your weights based on what matters most to your business. For example, manufacturing companies typically use:

Quality: 30%

Delivery: 30%

Cost: 25%

Service/Responsiveness: 15%

Adjust these weights for your industry. If you're shipping fresh food with a two-day shelf life, increase delivery weight to 40% and reduce cost to 20%.

Calculate SPI in three steps:

Convert each metric to a 0-100 scale

Multiply by its weight

Add the results

For instance, a supplier delivers 95% quality, 92% on-time delivery, 85% cost competitiveness, and 88% service responsiveness. Here’s how to calculate SPI:

Quality: 95 × 0.30 = 28.5

Delivery: 92 × 0.30 = 27.6

Cost: 85 × 0.25 = 21.25

Service: 88 × 0.15 = 13.2

Based on that, the supplier’s SPI is 90.55.

Use SPI scores to make decisions:

90+: Strategic partners. Increase their business, extend contract terms, involve them in new product development.

70-89: Solid performers. Maintain current relationship, monitor for improvement or decline.

Below 70: Underperformers. Put them on performance improvement plans or start qualifying replacements.

Update SPI scores monthly or quarterly to review how scores increase or decrease over time. A supplier scoring 92 in Q1 who drops to 78 in Q2 needs immediate attention before they damage your operations.

Measuring and tracking supplier performance

Effective supplier performance measurement runs on automated data feeds and real-time dashboards. Manual tracking can't keep up.

Automate data collection from your systems

Delivery confirmations flow from your ERP, defect counts from quality management systems, and pricing terms from contract platforms. Connect these systems so performance data feeds automatically into supplier scorecards instead of requiring manual updates. This eliminates the reconciliation work that consumes procurement analysts' time and ensures you're working with current data.

Add external risk signals to internal data

Internal systems track operational performance but miss external risks that disrupt supply chains. A supplier can deliver on time for months while their credit rating deteriorates or lawsuits pile up. Add third-party data feeds that monitor supplier financial health, news alerts, and geopolitical conditions to receive warning signs on time.

Build real-time scorecards for instant visibility

Centralized dashboards show supplier performance across all metrics with daily updates instead of monthly reports. Category managers see on-time delivery rates, defect percentages, and cost variance in real time. Automatic alerts flag performance changes the moment they happen. You'll know immediately when a supplier's on-time rate drops 10%, when defects exceed your threshold, or when invoices don't match POs. This gives you time to intervene on time.

Tailor reports to each stakeholder's needs

Executives need high-level SPI scores and risk heat maps showing which suppliers require attention. Engineers need detailed defect breakdowns by part number to diagnose quality issues. Finance needs cost variance reports to track budget adherence. Create monthly one-page scorecards for each group with only the metrics they use to make decisions to prevent data overload.

Turn measurement into action

Performance data only matters if you act on it. Run quarterly business reviews with suppliers using performance data as the agenda. When metrics decline, schedule root-cause analysis sessions to identify fixes together. When suppliers consistently exceed targets, reward them with increased volume or contract extensions. Transparent scorecards shift conversations from blame to problem-solving because both sides work from the same numbers.

How to improve supplier performance

Supplier performance improves when you identify problems early and give suppliers clear reasons to fix them.

Run regular performance reviews with top suppliers

Schedule monthly or quarterly reviews with your tier-one suppliers. Walk through on-time delivery, defect rates, and cost variance together. You'll spot issues while they're still fixable, and both sides see the same trends instead of arguing over one-off incidents.

Fix root causes, not symptoms

When problems appear, dig deeper. Document the issue, pilot a solution, measure the results, then either lock in what works or try something else. This approach prevents you from patching the same problem repeatedly while the underlying cause continues creating issues.

Invest in supplier capability building

Sometimes suppliers want to improve but lack the tools or expertise. When a supplier can't hit your quality targets, help them get there. Share your SOPs or co-fund training programs. You'll see fewer disruptions and faster lead times when suppliers feel supported instead of just audited.

Reward high performance publicly

Give your best suppliers more business, longer contracts, or bonus payments when they exceed targets. Public recognition reinforces what you value. Add penalty clauses for persistent underperformance, but start with incentives before moving to enforcement.

Build consistent communication channels

Set up weekly check-ins and shared dashboards so suppliers can flag problems early. When a supplier alerts you to capacity constraints or material shortages weeks in advance, you adjust forecasts proactively instead of scrambling for emergency alternatives.

Use centralized platforms to aggregate risk signals

Track supplier financial health, geographic exposure, and compliance status in one system. This lets you rank suppliers by risk level and focus oversight where it matters most. Automatic alerts notify you when delivery performance drops or certifications near expiration, giving you time to intervene before problems shut down production.

Transform SPM with AI

Effective supplier performance management requires more than quarterly scorecards and annual reviews. Integrating performance tracking into RFx processes, building automated scorecards with real-time data, and establishing collaborative improvement programs turn SPM from administrative overhead into strategic supplier intelligence that drives cost savings and supply chain resilience.

These strategies help procurement teams spot performance degradation, focus improvement efforts on suppliers who matter most, and build supply chains where accountability drives continuous improvement. The result is procurement operations that reward top performers, fix underperformers quickly, and eliminate suppliers who can't meet standards.

AI-native platforms accelerate this transformation by automating data capture, predicting performance issues before they impact operations, and embedding supplier intelligence directly into sourcing decisions. LightSource captures supplier performance automatically during every RFQ interaction, builds performance profiles at the Bill of Materials line-item level, and flags deteriorating metrics before they cascade into delivery failures.

Our platform shortens sourcing cycles while building comprehensive supplier performance histories without manual data entry. It helps strategic sourcing managers make award decisions backed by historical delivery data, identify chronic underperformers before contract renewals, and spot performance trends that signal emerging supply chain risks.

Ready to see how it works? Book a personalized demo.

Frequently asked questions about supplier performance management

What is supplier performance management?

Supplier performance management is the systematic process of measuring, analyzing, and improving how suppliers deliver on quality, cost, delivery, and responsiveness commitments. SPM turns supplier relationships from reactive firefighting into data-driven partnerships where both sides work from the same performance scorecards.

What metrics matter most for tracking supplier performance?

Track five essential metrics: On-Time Delivery (reliability), defect rates (quality), cost variance (financial accuracy), lead time (responsiveness), and order accuracy (operational precision). Combine these into a weighted Supplier Performance Index score that lets you benchmark suppliers at a glance and make fast award decisions.

How do I calculate a supplier performance score?

Weight each metric by business impact, measure actual performance against targets, and multiply: On-Time Delivery (30%) plus Quality (30%) plus Cost (20%) plus Responsiveness (10%) plus Innovation (10%) equals your composite SPI score. Suppliers scoring 90+ are strategic partners, 70-89 need monitoring, below 70 need performance improvement plans or replacement.

How does SPM improve supplier relationships?

Performance data shifts conversations from blame to problem-solving when both sides review the same scorecards quarterly. Underperformers get clear improvement targets while top performers earn public recognition, longer contracts, and increased volume.

What technology accelerates SPM effectiveness?

AI-native platforms automate data collection, predict performance issues before they impact production, and embed supplier intelligence directly into sourcing decisions. Demand systems that pull delivery data from your ERP, quality metrics from inspection systems, and external risk signals into unified real-time dashboards with automated alerts.

How should an SPM program evolve over time?

Start with manual scorecards and quarterly reviews, move to standardized digital scorecards with monthly updates, then graduate to predictive analytics that segment suppliers by risk. The final stage implements AI-powered systems that connect historical performance data to contract negotiations and award decisions.

Can SPM prevent supply chain disruptions?

SPM doesn't prevent disruptions but buys critical reaction time by flagging early warning signs like climbing lead times or financial stress weeks before suppliers fail. Manual quarterly reviews give you 90 days of blind spots; real-time monitoring cuts that to days or hours.

Why choose LightSource for supplier performance management?

LightSource embeds performance tracking directly into sourcing workflows, automatically capturing responsiveness, quote accuracy, and delivery commitments at the Bill of Materials line-item level during every RFQ interaction. Performance data lives where award decisions happen, not buried in separate SPM modules that require manual updates.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Trusted by:

Trusted by:

Trusted by:

*GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and COOL VENDORS is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.