Jan 23, 2026

What is Budgeting in Procurement?

Master procurement budgeting to prove ROI and drive strategic value. Actionable frameworks, AI-driven forecasting, and best practices for CPOs.

TL;DR: Budgeting decides if you're driving value or just processing orders. Leading CPOs use structured budget processes and AI-driven forecasting to deliver measurable business impact.

This budgeting guide provides CPOs with actionable frameworks that they can use to:

Prove ROI to leadership by connecting budget investments to quantifiable business outcomes, using industry benchmarks to establish defensible targets tied to peer performance

Optimize budget resource allocation through zero-based budgeting principles, AI-enhanced forecasting, and cross-functional governance mechanisms that prevent value leakage

Elevate procurement's strategic value by implementing expanded budget measurement frameworks that demonstrate impact on margins, revenue growth, and sustainability initiatives

The organizations winning this budgeting transformation have shifted from reactive planning cycles to strategic value creation, supported by unified decision intelligence that turns weeks of manual budget analysis into real-time strategic insights.

Procurement budgeting is the strategic financial planning process that allocates resources, forecasts spend, and establishes governance frameworks to maximize value creation across your supply chain.

Procurement budgets differ from regular budgets in three ways: suppliers can fail, commodity prices swing wildly, and you're constantly deciding whether to make or buy components. Standard financial planning doesn't account for this.

Budget planning separates CPOs who justify costs from CPOs who prove value.

According to the Project Management Institute, effective budget planning establishes baselines that enable CPOs to demonstrate value through quantifiable business outcomes like cost avoidance, working capital improvements, and supply chain risk mitigation. Outcomes that would otherwise remain invisible to executive leadership.

Key objectives of budgeting

Strategic procurement budget planning must deliver on three core objectives:

Proving measurable ROI to executive leadership

Optimizing resource allocation across competing priorities

Elevating procurement's strategic value beyond traditional cost control.

Proving and quantifying ROI

Your board needs quantified business outcomes, not procurement metrics. Effective budget management connects procurement investments directly to enterprise-level value creation, providing leadership with concrete evidence of procurement's contribution to organizational goals.

Industry budget benchmarks provide the context you need to defend your targets. When the CFO questions your 5% savings goal, peer data from your sector proves whether you're ambitious or unrealistic.

The most successful procurement organizations translate technical achievements into budget outcomes that resonate with CFOs and board members. This shift fundamentally repositions procurement budgets from operational overhead to strategic investments with measurable returns.

Optimizing resource allocation

Budget resource optimization balances competing priorities across cost, risk, innovation, and sustainability. Leading procurement organizations establish budget governance frameworks that align spend with strategic objectives, ensuring every dollar delivers maximum value at acceptable risk levels.

Zero-Based Budgeting provides the methodological foundation for budget optimization. Rather than incremental adjustments to prior year budgets, ZBB requires every expense be justified from zero each budget cycle. This forces prioritization of high-impact investments and creates accountability through business case requirements for all budget spending.

Machine learning amplifies budget optimization capabilities. MIT research demonstrates that ML-enabled spend categorization achieves 94% accuracy, identifying supplier contract renegotiation opportunities and increasing budget accuracy through enhanced spend visibility that prevents value leakage during budget execution.

Elevating strategic value beyond cost control

Strategic budget management elevates procurement from a cost center to an enterprise value driver through innovation acceleration, risk management, and sustainability leadership. This expanded budget framework requires new measurement approaches that capture procurement's full strategic contribution.

Leading organizations implement three distinct budget value elevation strategies:

Innovation catalyst: Allocating budget for supplier-enabled innovation, co-development initiatives, and early supplier involvement that accelerates time-to-market and creates competitive differentiation

Risk intelligence: Building financial resilience through budget scenario modeling, supplier financial health monitoring, and supply chain stress testing that protects enterprise value against disruptions

Sustainability driver: Embedding carbon reduction targets, ethical sourcing requirements, and circular economy principles into budget frameworks that address increasing stakeholder demands

The procurement function's evolution from cost center to strategic partner hinges on budget frameworks that measure and communicate this expanded value contribution across the supply chain.

11 essential budgeting terms for CPOs

Effective budget planning demands precision in both concept and communication. CPOs need a shared vocabulary when discussing budget frameworks with board members, CFOs, and financial teams. These eleven foundational budget terms provide the lexicon for demonstrating procurement's strategic value and financial impact across the enterprise.

Master these budget concepts to transform procurement discussions from tactical cost conversations to strategic value dialogues:

1. Spend under management

Spend under management is the portion of total organizational spend actively managed by procurement budget to optimize costs, supplier relationships, and compliance.

This budget metric indicates procurement's scope of influence over sourcing decisions and typically correlates with the maturity of procurement operations. Leading organizations work toward optimizing spend under management to enable comprehensive cost control and value creation

2. Total cost of ownership (TCO)

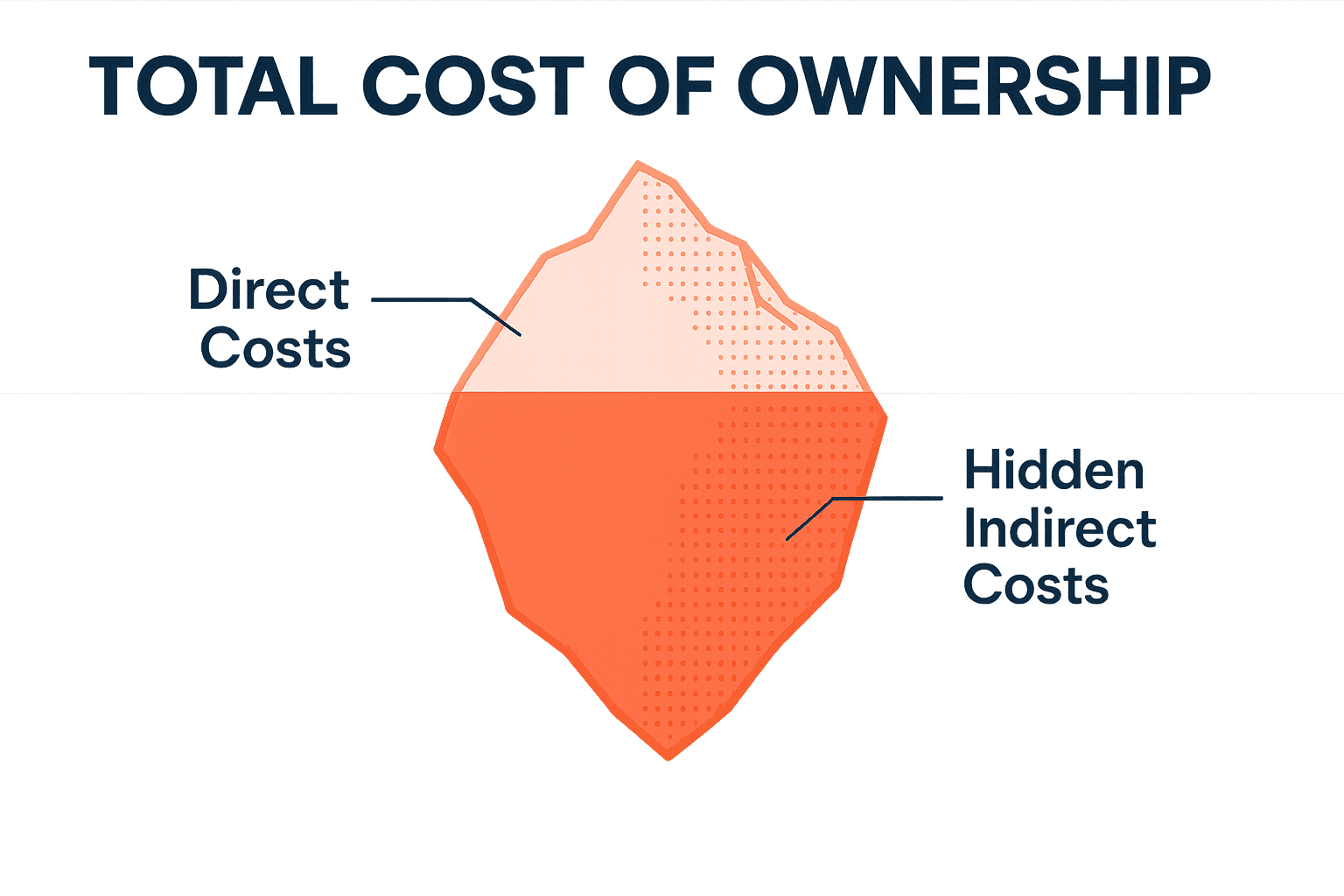

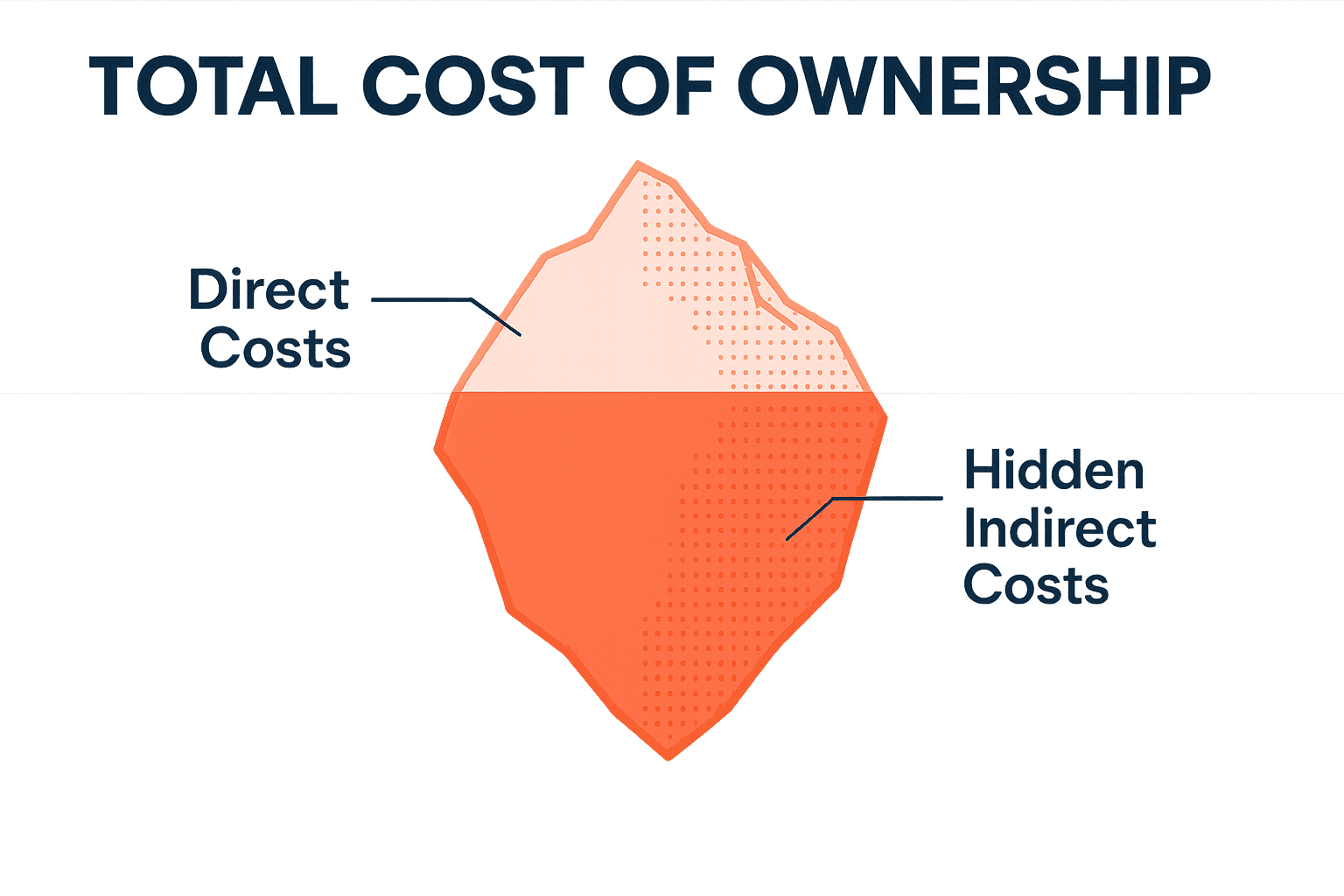

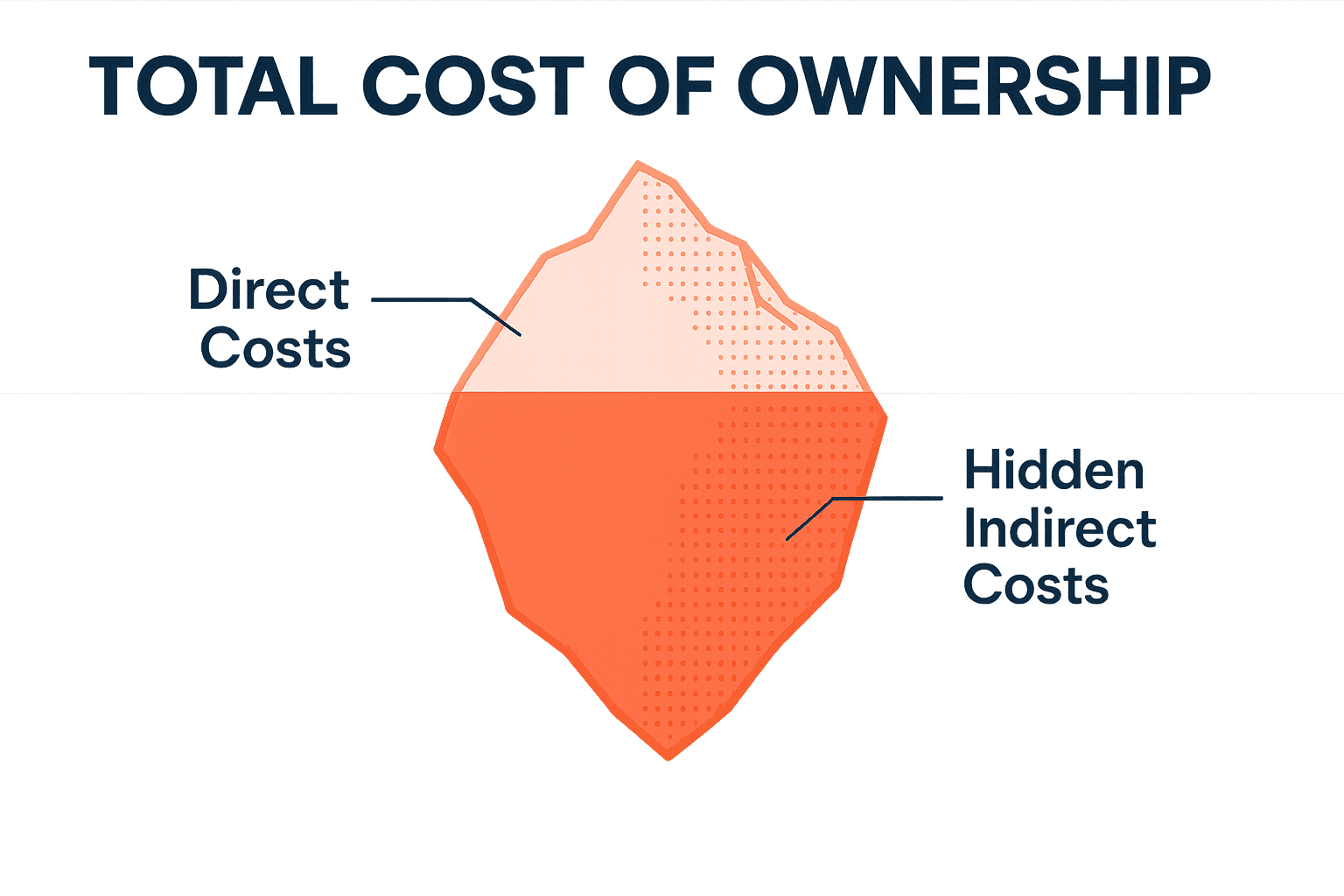

The total cost of ownership (TCO) is a comprehensive examination of all costs associated with acquiring, operating, maintaining, and disposing of a product or service throughout its lifecycle.

TCO budget planning encompasses direct costs (purchase price, shipping, installation) and indirect costs (order processing, inspection, training, maintenance, disposal). This holistic budget view prevents procurement decisions that minimize purchase price while creating hidden downstream costs.

3. Capital expenditure (CapEx) and operating expenditure (OpEx)

CapEx represents budget funds for acquiring or upgrading physical assets like property, buildings, or equipment that provide long-term value.

OpEx covers ongoing budget costs for running products, businesses, or systems.

Procurement budget strategies vary significantly between these categories, with CapEx requiring a comprehensive ROI analysis and OpEx focusing on continuous cost optimization.

4. Category management

Category management is a Strategic procurement approach that organizes budget resources around specific spend categories to optimize purchasing decisions, improve supplier relationships, and achieve better overall value. Category budget strategies consider market dynamics, supplier landscapes, and business requirements to align sourcing tactics with broader organizational objectives.

5. Inventory turnover

Inventory turnover is a financial budget metric measuring how frequently inventory is sold and replaced over a specified period, calculated as Cost of Goods Sold divided by Average Inventory Value.

High turnover indicates efficient budget management, while low turnover signals potential cash flow constraints, obsolescence risks, and excess carrying costs that procurement budget strategies can address.

6. Procurement ROI

Procurement ROI is the financial return generated by procurement budget activities relative to procurement operating costs, expressed as:

(Procurement Value Generated - Procurement Operating Costs) ÷ Procurement Operating Costs × 100

This budget metric demonstrates procurement's value contribution beyond traditional cost savings by quantifying impact on revenue, risk mitigation, and operational efficiency.

7. Cost savings

Cost savings is the reduction in budget expenditure achieved through procurement strategies, including negotiation, supplier consolidation, and process improvements. Distinguishes between hard savings (measurable price reductions) and soft savings (value through efficiency gains, risk mitigation, quality improvements). Effective procurement organizations implement rigorous budget savings validation processes aligned with finance to ensure savings flow to the bottom line.

8. Supplier performance

Supplier performance is the comprehensive assessment of suppliers' ability to meet contractual obligations across quality, delivery, cost, and service dimensions. LightSource's advanced supplier performance analytics provide real-time, data-driven insights into supplier health across complex multi-tier supply chains, enabling proactive budget risk mitigation and strategic decision-making. The platform's early warning system identifies potential budget issues before they impact production, transforming reactive supplier management into strategic relationship optimization.

9. Payment terms

Payment terms are conditions agreed between buyer and supplier regarding timing and method of payment for goods or services, directly impacting budget working capital management. Strategic payment term optimization balances buyer's desire to extend terms with supplier relationship considerations, leveraging scale for favorable budget terms while maintaining supplier financial health.

10. Working capital

Working capital is the cash you have available to operate - your current assets minus current liabilities. Procurement budget decisions on payment terms and inventory levels directly impact working capital optimization, with strategic procurement budgeting contributing significantly to enterprise cash flow through inventory reduction, extended payment terms, and dynamic discounting programs.

11. Strategic sourcing automation

Strategic sourcing automation is the application of digital tools and platforms to accelerate and optimize strategic budgeting processes across supplier identification, evaluation, negotiation, and contract management.

LightSource's AI-native platform automates the entire source-to-contract lifecycle, delivering 70-100% workload automation and enabling procurement teams to manage budget communications, track costs, and maintain supplier relationships within unified project workspaces.

The platform transforms weeks of manual budget analysis into real-time decision intelligence through automated bid analysis and spend visibility capabilities.

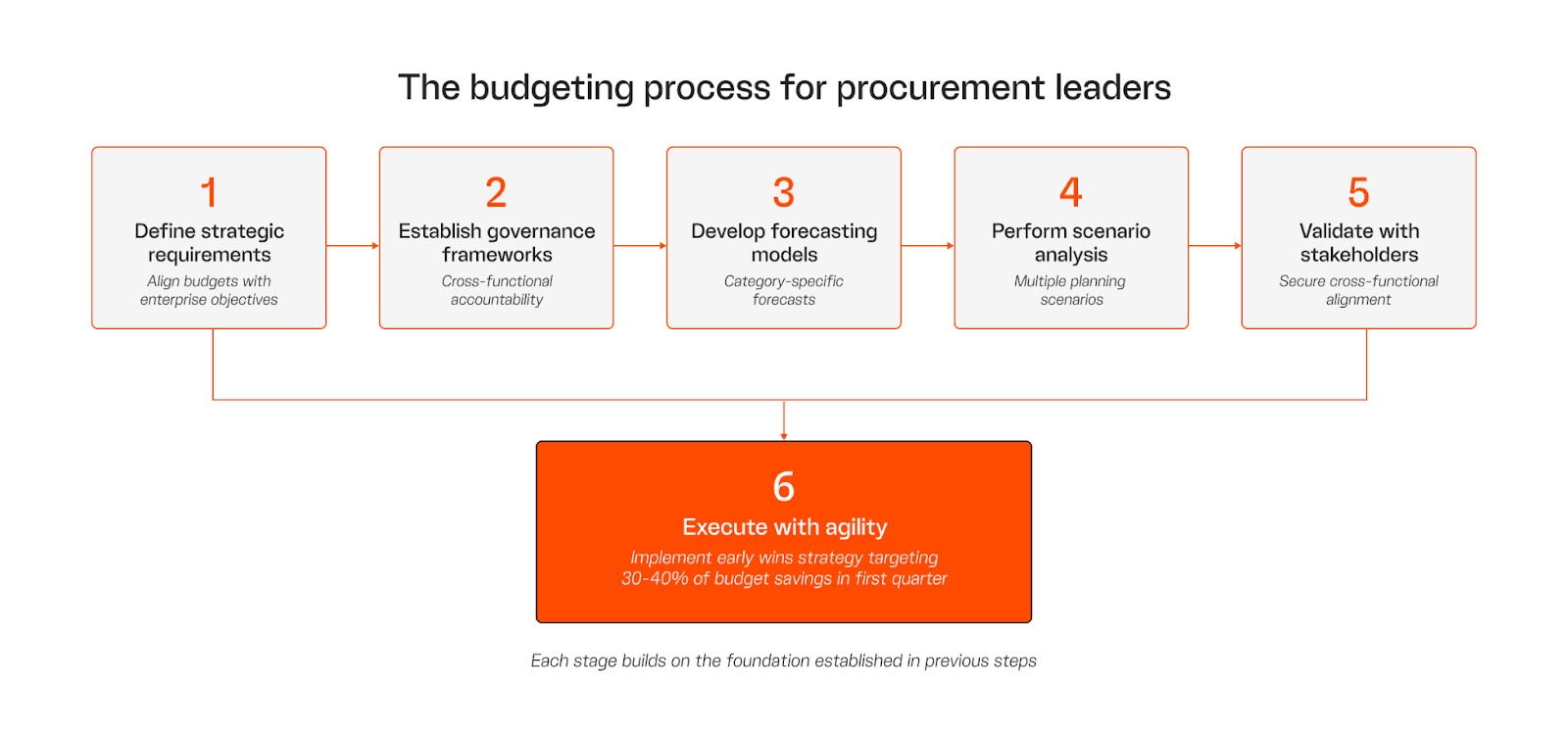

The budgeting process for procurement leaders

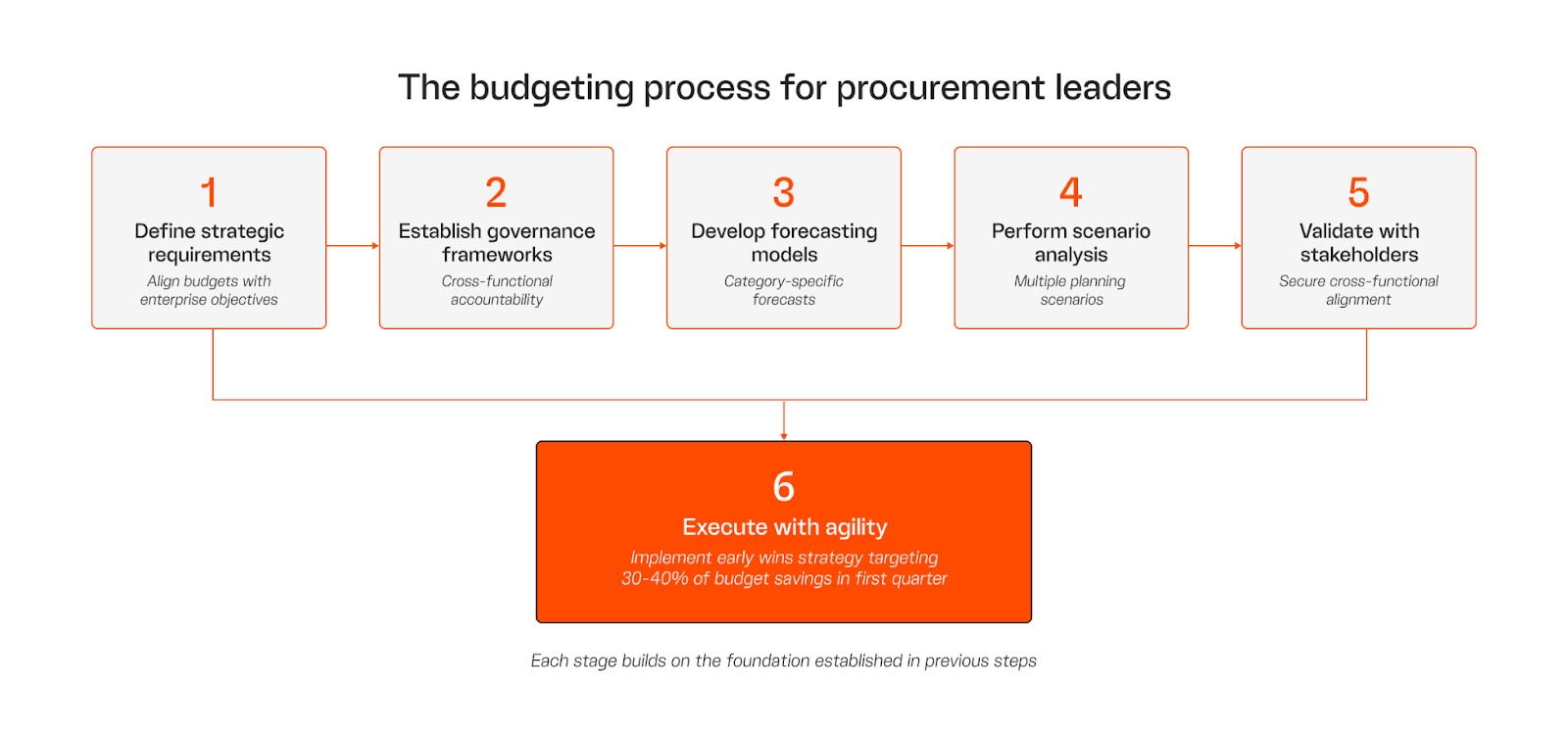

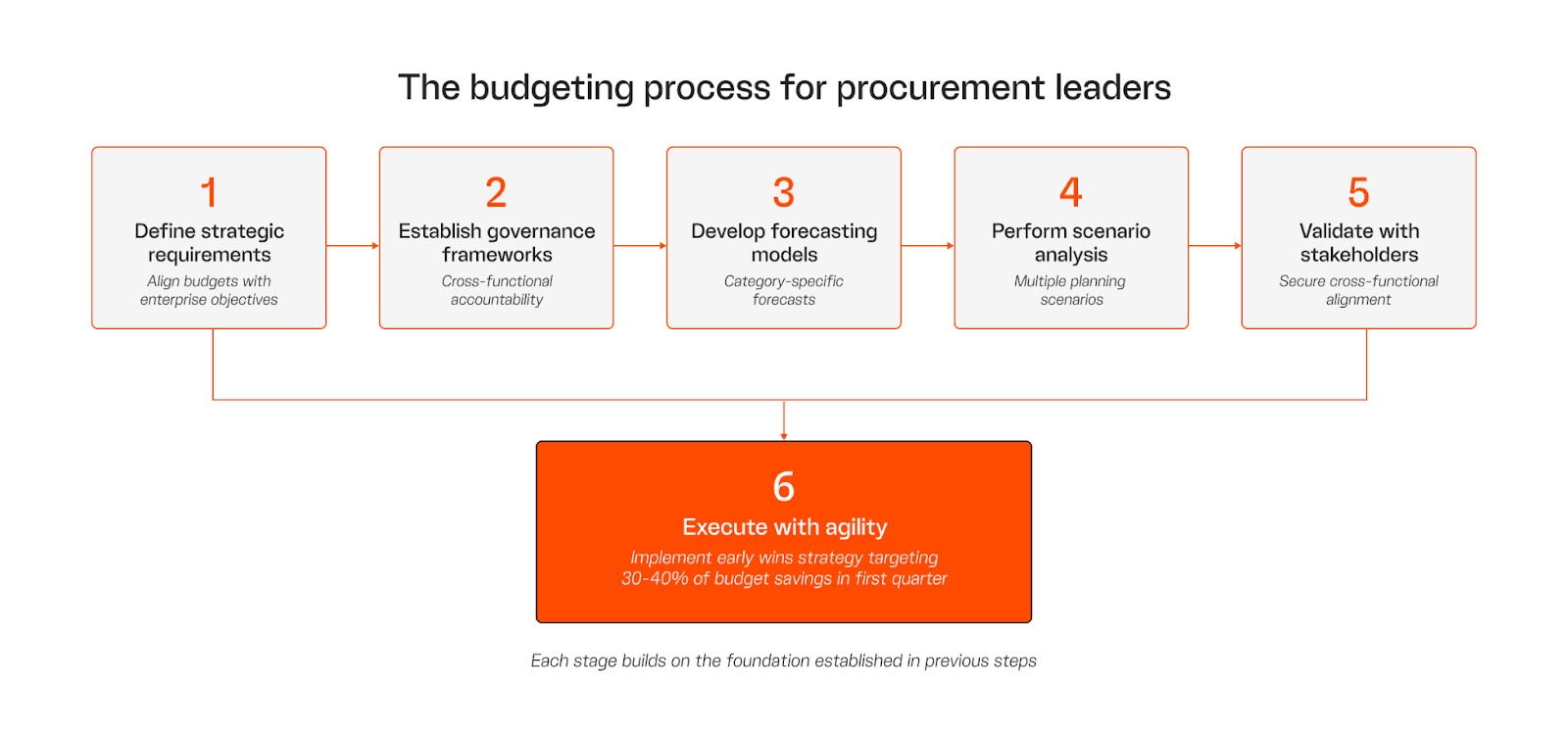

Successful procurement budget planning starts with requirement definition, not historical spend analysis. Leading organizations integrate budget development with corporate strategic planning cycles to ensure procurement investments directly support business objectives.

The following six steps create a comprehensive budget roadmap from initial requirements through execution, with each stage building on the foundation established in previous steps:

Define strategic requirements: Align procurement budgets with enterprise objectives before allocating resources. Identify how budget plans will contribute to margin improvement, revenue growth, and strategic initiatives.

Establish governance frameworks: Implement cross-functional accountability mechanisms that prevent budget value leakage and ensure shared ownership of savings targets.

Develop forecasting models: Create category-specific budget forecasts incorporating supplier negotiations, commodity trends, and capacity constraints.

Perform scenario analysis: Build multiple budget planning scenarios with differentiated inflation and demand assumptions to address market volatility.

Validate with stakeholders: Secure cross-functional alignment on budget assumptions, methodologies, and targets before finalizing budgets.

Execute with agility: Implement an early wins strategy targeting 30-40% of budget savings in the first quarter to build momentum and credibility.

Approaches to budget development

The budget process architecture requires three distinct approaches working in concert:

Top-down guidance establishes strategic budget parameters: total procurement spend targets, savings goals, risk tolerance, and alignment with corporate financial planning. This ensures budget investments directly support enterprise objectives while providing clear boundaries for resource allocation.

Bottom-up forecasting incorporates category management intelligence into budget plans based on supplier negotiations, commodity trends, and capacity constraints. Category managers provide detailed budget projections grounded in market research and supplier relationship intelligence.

Scenario modeling addresses volatility through multiple budget planning scenarios—typically three to five distinct models, including conservative, base case, and aggressive growth assumptions with differentiated inflation and demand projections. These budget scenarios integrate real-time market intelligence and AI/ML algorithms for predictive analytics.

Stakeholder alignment and strategic KPIs

Stakeholder alignment represents the critical budget governance layer. Industry CPO interviews reveal procurement budget planning has evolved into a strategic partnership function, requiring quarterly business reviews with finance, operations, and business unit leaders. Joint accountability mechanisms ensure shared ownership of budget savings targets rather than procurement working in isolation.

Strategic budget KPIs must balance financial, operational, and strategic dimensions:

Financial metrics: Money you save (target: 3.1% of managed spend according to the Institute for Supply Management, though this varies significantly across industries and manufacturers and serves as a reference point), how much it costs to run your procurement team, and how efficiently you manage company cash

Operational metrics: Budget compliance, supplier on-time delivery, and procurement cycle time

Strategic metrics: Innovation value from supplier partnerships, budget risk mitigation impact, and sustainability achievement

LightSource centralizes this budget complexity into unified decision intelligence. The platform's predictive analytics forecast budgets accurately while identifying cost drivers and potential price fluctuations. The platform's advanced cost analysis tools help you track product costs across all components, compare prices over time, and determine fair market prices.

The most successful procurement organizations implement budget early warning systems with variance triggers that enable rapid course correction when actual results deviate from budgeted targets. This agility ensures budgets remain effective management tools rather than static documents that quickly become obsolete in volatile markets.

Best practices for strategic budgeting

By aligning procurement budgets directly with enterprise objectives and leveraging AI-native technology to automate complex budget processes, these organizations achieve breakthrough financial performance while elevating procurement's strategic influence.

Aligning procurement budgets with enterprise objectives

Aligning budget plans with enterprise objectives requires repositioning procurement as an enterprise value creator rather than a cost center. Industry budget frameworks identify three critical dimensions: supplier ecosystem development through strategic supplier partnerships, cross-functional budget integration with joint governance structures for sales, R&D, and finance, and margin contribution demonstrating direct impact on top-line revenue and bottom-line profitability. These dimensions require procurement to embed new "currencies" beyond budget cost savings: improving net margin by outperforming markets, ensuring volume and growth, and leading value-chain emissions reduction.

This budget repositioning demands expanded measurement frameworks. MIT Sloan research establishes that budget value measurement must balance tactical and strategic indicators while incorporating predictive analytics. Enterprise budget contribution metrics for C-suite reporting should include net margin improvement versus market benchmarks, revenue enablement through supplier innovation, working capital optimization, and risk-adjusted return on procurement budget investments.

Leveraging technology for strategic budgeting

Leading procurement organizations achieve this budget transformation by implementing unified platforms that deliver real-time decision intelligence across the entire budget lifecycle.

LightSource demonstrates this budget value creation framework at enterprise scale. The platform's predictive analytics and unified decision intelligence capabilities centralize budget complexity, enabling CPOs to forecast budgets accurately while identifying cost drivers and potential price fluctuations. Key technological budget advantages include:

End-to-end automation: LightSource automates the entire strategic budget lifecycle, from AI-recommended category-specific templates for RFX setup to Auto-Analyst features that automatically identify optimal budget scenarios

Unified project workspaces: Procurement teams manage budget communications, track costs, and maintain supplier relationships within a single platform, eliminating data silos and manual reconciliation

Predictive analytics: The platform forecasts budget patterns, transforming static annual budgets into dynamic forecasts responsive to real-time market conditions

Real customer outcomes validate these budget capabilities across multiple industries. Manufacturers using LightSource have achieved substantial reductions in Bill of Materials costs by integrating the platform into their budgeting process. Global enterprises report cutting sourcing timelines significantly, transforming multi-week processes into days through LightSource's budget-to-execution workflow. LightSource's unified data model ensures budget targets translate directly into execution outcomes, delivering significant workload automation while turning weeks of manual budget analysis into real-time strategic insights.

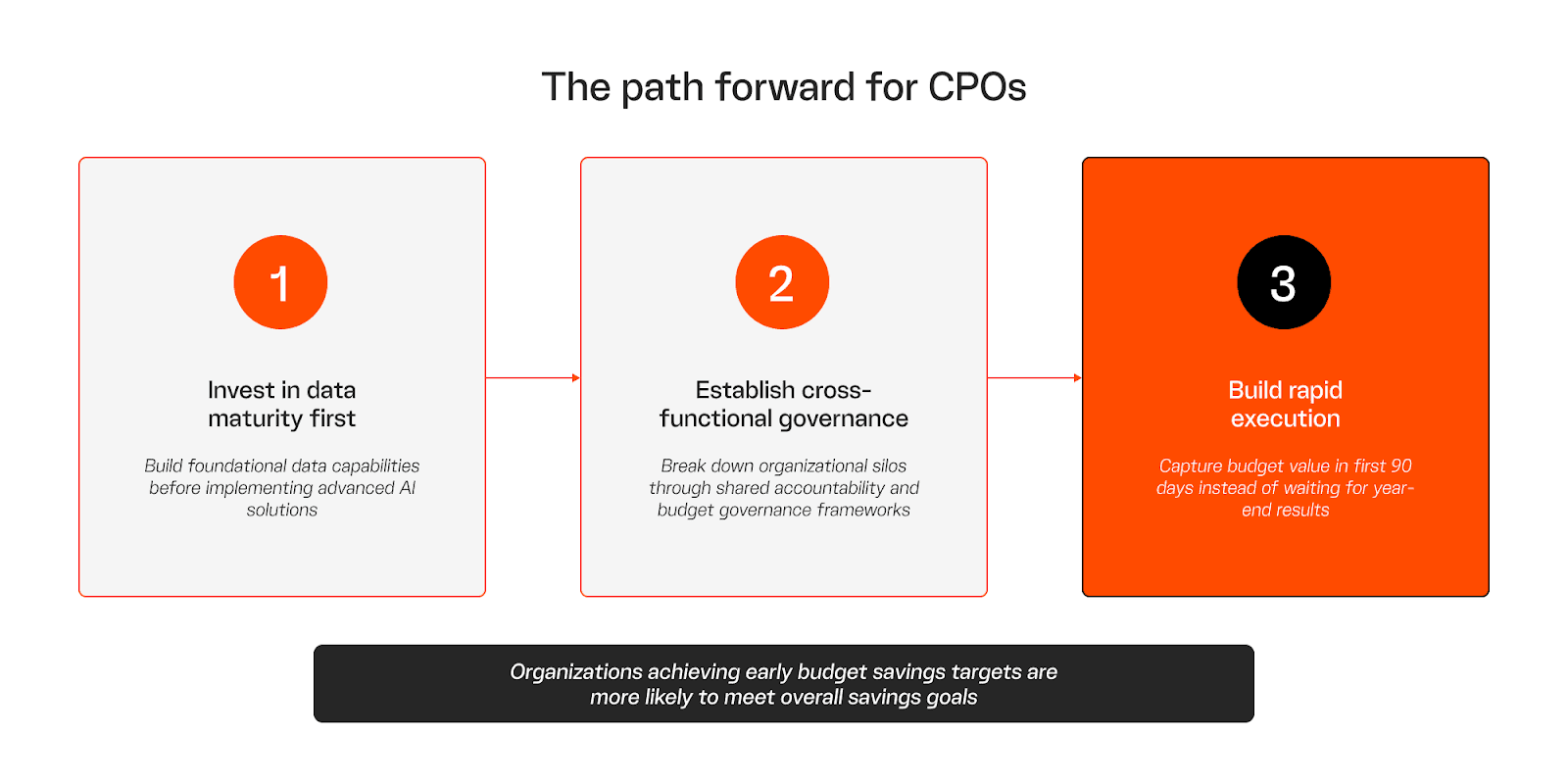

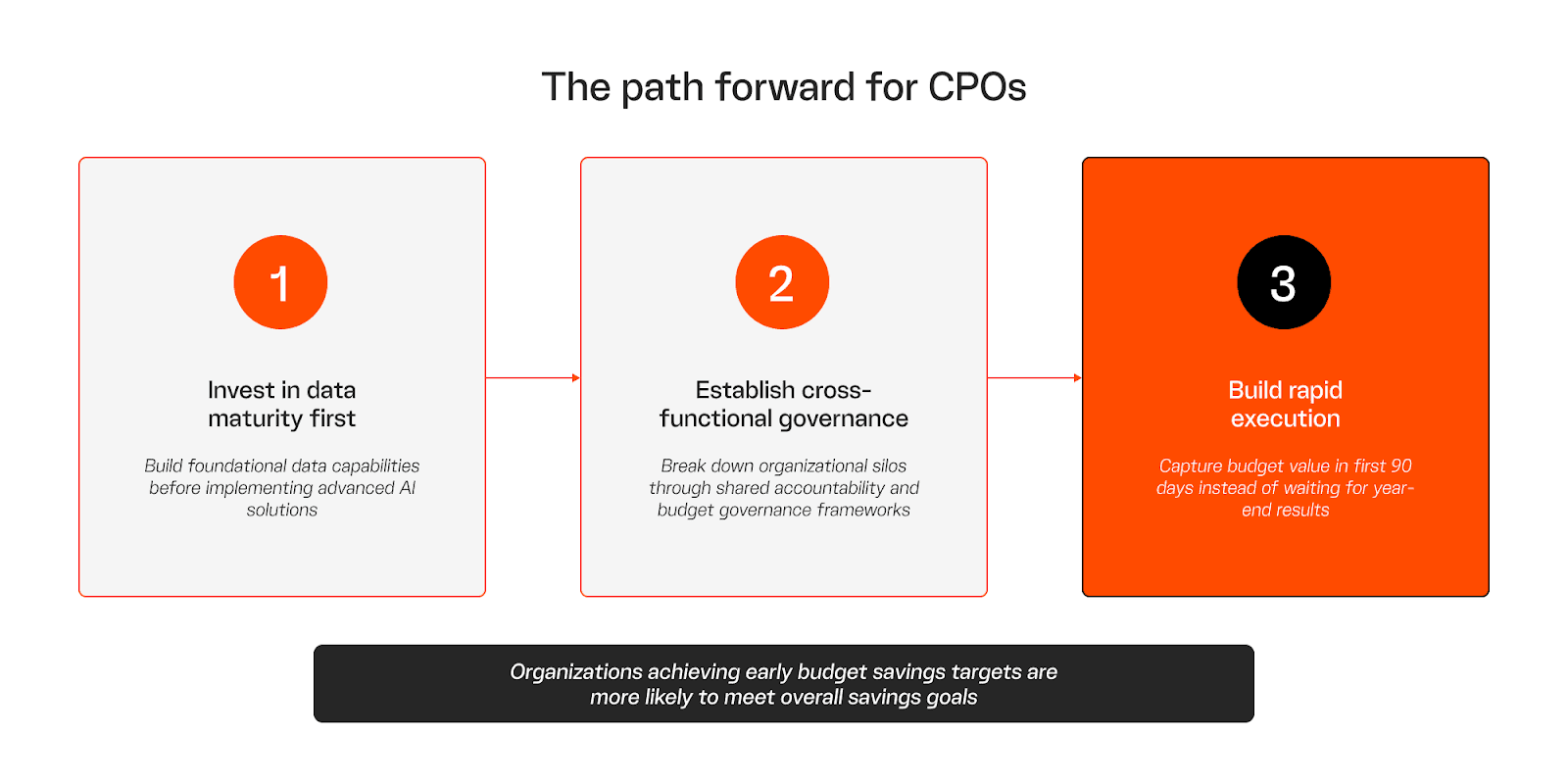

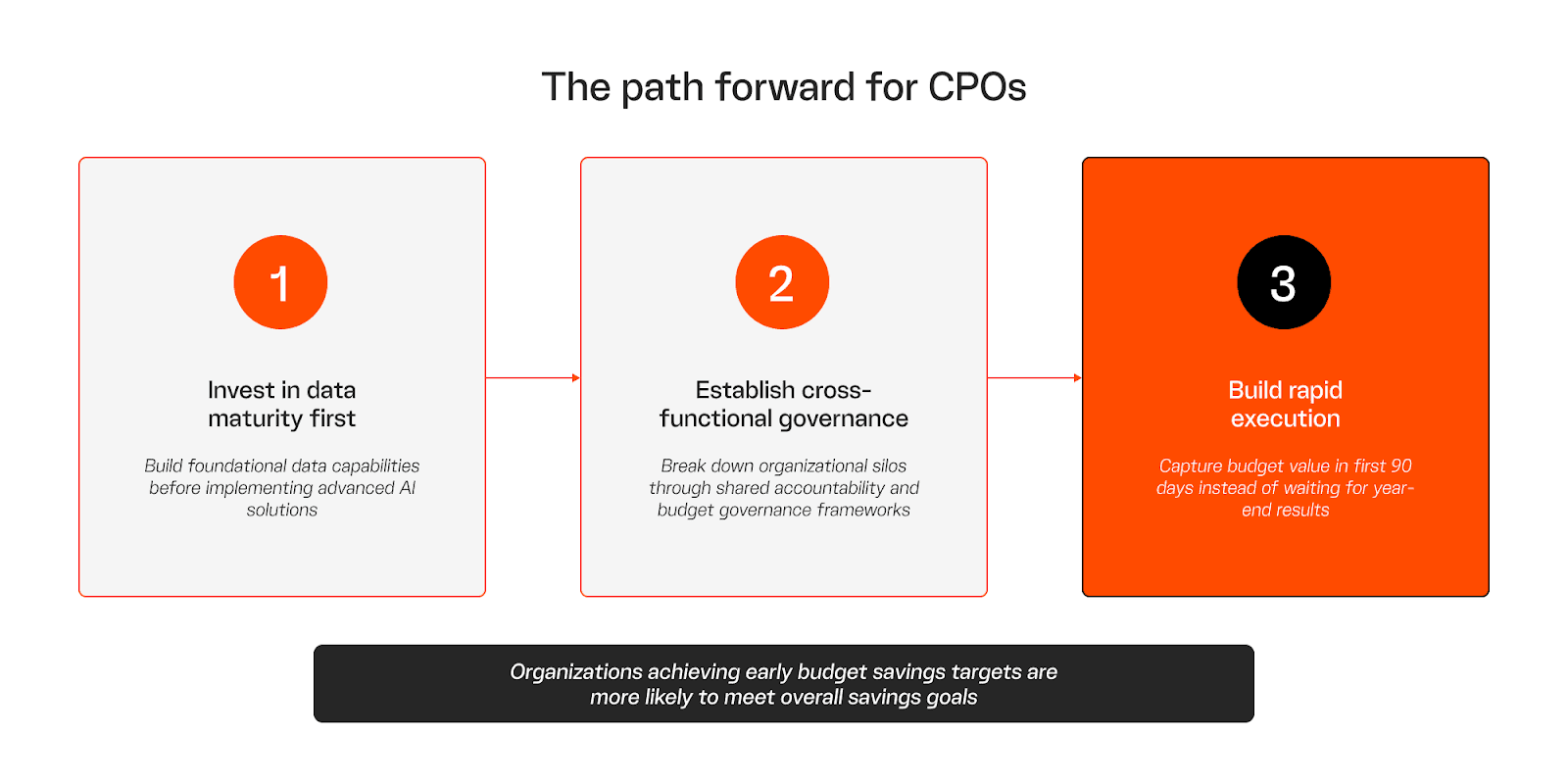

For CPOs navigating this budget transformation, the path forward is clear. Invest in data maturity before advanced AI capabilities. Establish cross-functional budget governance to overcome organizational silos. Build rapid execution capabilities that capture budget value in the first 90 days rather than waiting for year-end results, with organizations achieving early budget savings targets being more likely to meet overall savings goals.

Master procurement budgeting to prove value

Procurement budgeting differs from financial planning: you're managing supplier failures, commodity price swings, and make-or-buy decisions that standard budgets ignore. CPOs who master budget planning shift conversations from cost defense to value capture through spend forecasting, variance tracking, and cross-functional alignment. Without structured budgeting processes, procurement teams spend quarters justifying expenses instead of proving savings.

AI-native platforms give CPOs and their teams real-time budget visibility and predictive spend intelligence. LightSource connects procurement budgets directly to sourcing decisions through centralized workspaces where supplier quotes, BOM costs, and contract awards update budgets automatically. The platform eliminates manual spend tracking through AI-powered quote standardization and creates unified views where procurement, finance, and engineering collaborate on cost decisions in real-time.

Ready to see how budgeting works? Book a demo.

Frequently Asked Questions About Budgeting

1. What is procurement budgeting, and why is it essential for aligning spend with organizational strategy?

Procurement budgeting is the strategic financial planning process that allocates resources, forecasts spend, and establishes governance frameworks to maximize value creation across your supply chain. Unlike general financial planning, it requires specialized methodologies, including supplier risk assessment, commodity volatility modeling, and make-or-buy analyses that directly impact your organization's bottom line. Leading organizations integrate budget development with corporate strategic planning cycles to ensure procurement investments deliver measurable business impact through AI-enhanced forecasting and predictive spend analysis.

2. How can procurement leaders create effective budgets that balance direct, indirect, and contingency costs for complex projects or annual planning cycles?

Successful budget planning requires three distinct approaches working together: top-down guidance that establishes strategic parameters, bottom-up forecasting that incorporates category intelligence, and scenario modeling that addresses volatility through multiple planning scenarios. Direct materials represent the majority of total procurement spend and demand specialized forecasting incorporating supplier negotiations and commodity trends, while indirect spend requires different control mechanisms. The most effective CPOs build multiple distinct budget scenarios with differentiated inflation and demand assumptions, enabling rapid pivots when market conditions shift.

3. What best practices should procurement teams follow to optimize resource allocation, control costs, and adapt quickly to changing market conditions?

The breakthrough: align procurement budgets directly with enterprise objectives by repositioning procurement as a value creator, not a cost center. Leading organizations achieve this through cross-functional governance structures with joint accountability for savings targets, implement early warning systems with variance triggers for rapid course correction, and target early-quarter savings to build momentum. Best-in-class procurement teams leverage AI-native platforms to transform static annual budgets into dynamic forecasts. LightSource customers achieve substantial workload automation while turning weeks of manual analysis into real-time strategic insights.

4. How can procurement organizations prepare for and manage unpredictable or irregular expenses, such as market volatility, supply chain disruptions, or regulatory changes?

Build contingency reserves to absorb unexpected costs while maintaining risk buffers that scale with category volatility and supplier concentration. Implement advanced scenario planning with AI-powered forecasting to model multiple futures, including conservative, base case, and aggressive growth assumptions that enable rapid reallocation when disruptions hit. The technical reality: organizations using real-time supplier performance analytics and predictive spend forecasting identify potential budget issues before they impact production, transforming reactive management into strategic risk mitigation.

5. In what ways should procurement budgets be monitored and adjusted throughout the year to ensure compliance, financial stability, and continuous value delivery across supplier relationships and categories?

Strategic budget monitoring requires balancing three dimensions: financial metrics (cost savings and procurement efficiency), operational metrics (budget compliance and cycle time), and strategic metrics (supplier innovation value and risk mitigation). Leading CPOs implement quarterly business reviews with finance, operations, and business unit leaders to ensure joint accountability rather than procurement working in isolation. LightSource's predictive analytics centralize this complexity into unified decision intelligence, forecasting budgets accurately while identifying cost drivers and enabling rapid course correction when actuals deviate from targets.

TL;DR: Budgeting decides if you're driving value or just processing orders. Leading CPOs use structured budget processes and AI-driven forecasting to deliver measurable business impact.

This budgeting guide provides CPOs with actionable frameworks that they can use to:

Prove ROI to leadership by connecting budget investments to quantifiable business outcomes, using industry benchmarks to establish defensible targets tied to peer performance

Optimize budget resource allocation through zero-based budgeting principles, AI-enhanced forecasting, and cross-functional governance mechanisms that prevent value leakage

Elevate procurement's strategic value by implementing expanded budget measurement frameworks that demonstrate impact on margins, revenue growth, and sustainability initiatives

The organizations winning this budgeting transformation have shifted from reactive planning cycles to strategic value creation, supported by unified decision intelligence that turns weeks of manual budget analysis into real-time strategic insights.

Procurement budgeting is the strategic financial planning process that allocates resources, forecasts spend, and establishes governance frameworks to maximize value creation across your supply chain.

Procurement budgets differ from regular budgets in three ways: suppliers can fail, commodity prices swing wildly, and you're constantly deciding whether to make or buy components. Standard financial planning doesn't account for this.

Budget planning separates CPOs who justify costs from CPOs who prove value.

According to the Project Management Institute, effective budget planning establishes baselines that enable CPOs to demonstrate value through quantifiable business outcomes like cost avoidance, working capital improvements, and supply chain risk mitigation. Outcomes that would otherwise remain invisible to executive leadership.

Key objectives of budgeting

Strategic procurement budget planning must deliver on three core objectives:

Proving measurable ROI to executive leadership

Optimizing resource allocation across competing priorities

Elevating procurement's strategic value beyond traditional cost control.

Proving and quantifying ROI

Your board needs quantified business outcomes, not procurement metrics. Effective budget management connects procurement investments directly to enterprise-level value creation, providing leadership with concrete evidence of procurement's contribution to organizational goals.

Industry budget benchmarks provide the context you need to defend your targets. When the CFO questions your 5% savings goal, peer data from your sector proves whether you're ambitious or unrealistic.

The most successful procurement organizations translate technical achievements into budget outcomes that resonate with CFOs and board members. This shift fundamentally repositions procurement budgets from operational overhead to strategic investments with measurable returns.

Optimizing resource allocation

Budget resource optimization balances competing priorities across cost, risk, innovation, and sustainability. Leading procurement organizations establish budget governance frameworks that align spend with strategic objectives, ensuring every dollar delivers maximum value at acceptable risk levels.

Zero-Based Budgeting provides the methodological foundation for budget optimization. Rather than incremental adjustments to prior year budgets, ZBB requires every expense be justified from zero each budget cycle. This forces prioritization of high-impact investments and creates accountability through business case requirements for all budget spending.

Machine learning amplifies budget optimization capabilities. MIT research demonstrates that ML-enabled spend categorization achieves 94% accuracy, identifying supplier contract renegotiation opportunities and increasing budget accuracy through enhanced spend visibility that prevents value leakage during budget execution.

Elevating strategic value beyond cost control

Strategic budget management elevates procurement from a cost center to an enterprise value driver through innovation acceleration, risk management, and sustainability leadership. This expanded budget framework requires new measurement approaches that capture procurement's full strategic contribution.

Leading organizations implement three distinct budget value elevation strategies:

Innovation catalyst: Allocating budget for supplier-enabled innovation, co-development initiatives, and early supplier involvement that accelerates time-to-market and creates competitive differentiation

Risk intelligence: Building financial resilience through budget scenario modeling, supplier financial health monitoring, and supply chain stress testing that protects enterprise value against disruptions

Sustainability driver: Embedding carbon reduction targets, ethical sourcing requirements, and circular economy principles into budget frameworks that address increasing stakeholder demands

The procurement function's evolution from cost center to strategic partner hinges on budget frameworks that measure and communicate this expanded value contribution across the supply chain.

11 essential budgeting terms for CPOs

Effective budget planning demands precision in both concept and communication. CPOs need a shared vocabulary when discussing budget frameworks with board members, CFOs, and financial teams. These eleven foundational budget terms provide the lexicon for demonstrating procurement's strategic value and financial impact across the enterprise.

Master these budget concepts to transform procurement discussions from tactical cost conversations to strategic value dialogues:

1. Spend under management

Spend under management is the portion of total organizational spend actively managed by procurement budget to optimize costs, supplier relationships, and compliance.

This budget metric indicates procurement's scope of influence over sourcing decisions and typically correlates with the maturity of procurement operations. Leading organizations work toward optimizing spend under management to enable comprehensive cost control and value creation

2. Total cost of ownership (TCO)

The total cost of ownership (TCO) is a comprehensive examination of all costs associated with acquiring, operating, maintaining, and disposing of a product or service throughout its lifecycle.

TCO budget planning encompasses direct costs (purchase price, shipping, installation) and indirect costs (order processing, inspection, training, maintenance, disposal). This holistic budget view prevents procurement decisions that minimize purchase price while creating hidden downstream costs.

3. Capital expenditure (CapEx) and operating expenditure (OpEx)

CapEx represents budget funds for acquiring or upgrading physical assets like property, buildings, or equipment that provide long-term value.

OpEx covers ongoing budget costs for running products, businesses, or systems.

Procurement budget strategies vary significantly between these categories, with CapEx requiring a comprehensive ROI analysis and OpEx focusing on continuous cost optimization.

4. Category management

Category management is a Strategic procurement approach that organizes budget resources around specific spend categories to optimize purchasing decisions, improve supplier relationships, and achieve better overall value. Category budget strategies consider market dynamics, supplier landscapes, and business requirements to align sourcing tactics with broader organizational objectives.

5. Inventory turnover

Inventory turnover is a financial budget metric measuring how frequently inventory is sold and replaced over a specified period, calculated as Cost of Goods Sold divided by Average Inventory Value.

High turnover indicates efficient budget management, while low turnover signals potential cash flow constraints, obsolescence risks, and excess carrying costs that procurement budget strategies can address.

6. Procurement ROI

Procurement ROI is the financial return generated by procurement budget activities relative to procurement operating costs, expressed as:

(Procurement Value Generated - Procurement Operating Costs) ÷ Procurement Operating Costs × 100

This budget metric demonstrates procurement's value contribution beyond traditional cost savings by quantifying impact on revenue, risk mitigation, and operational efficiency.

7. Cost savings

Cost savings is the reduction in budget expenditure achieved through procurement strategies, including negotiation, supplier consolidation, and process improvements. Distinguishes between hard savings (measurable price reductions) and soft savings (value through efficiency gains, risk mitigation, quality improvements). Effective procurement organizations implement rigorous budget savings validation processes aligned with finance to ensure savings flow to the bottom line.

8. Supplier performance

Supplier performance is the comprehensive assessment of suppliers' ability to meet contractual obligations across quality, delivery, cost, and service dimensions. LightSource's advanced supplier performance analytics provide real-time, data-driven insights into supplier health across complex multi-tier supply chains, enabling proactive budget risk mitigation and strategic decision-making. The platform's early warning system identifies potential budget issues before they impact production, transforming reactive supplier management into strategic relationship optimization.

9. Payment terms

Payment terms are conditions agreed between buyer and supplier regarding timing and method of payment for goods or services, directly impacting budget working capital management. Strategic payment term optimization balances buyer's desire to extend terms with supplier relationship considerations, leveraging scale for favorable budget terms while maintaining supplier financial health.

10. Working capital

Working capital is the cash you have available to operate - your current assets minus current liabilities. Procurement budget decisions on payment terms and inventory levels directly impact working capital optimization, with strategic procurement budgeting contributing significantly to enterprise cash flow through inventory reduction, extended payment terms, and dynamic discounting programs.

11. Strategic sourcing automation

Strategic sourcing automation is the application of digital tools and platforms to accelerate and optimize strategic budgeting processes across supplier identification, evaluation, negotiation, and contract management.

LightSource's AI-native platform automates the entire source-to-contract lifecycle, delivering 70-100% workload automation and enabling procurement teams to manage budget communications, track costs, and maintain supplier relationships within unified project workspaces.

The platform transforms weeks of manual budget analysis into real-time decision intelligence through automated bid analysis and spend visibility capabilities.

The budgeting process for procurement leaders

Successful procurement budget planning starts with requirement definition, not historical spend analysis. Leading organizations integrate budget development with corporate strategic planning cycles to ensure procurement investments directly support business objectives.

The following six steps create a comprehensive budget roadmap from initial requirements through execution, with each stage building on the foundation established in previous steps:

Define strategic requirements: Align procurement budgets with enterprise objectives before allocating resources. Identify how budget plans will contribute to margin improvement, revenue growth, and strategic initiatives.

Establish governance frameworks: Implement cross-functional accountability mechanisms that prevent budget value leakage and ensure shared ownership of savings targets.

Develop forecasting models: Create category-specific budget forecasts incorporating supplier negotiations, commodity trends, and capacity constraints.

Perform scenario analysis: Build multiple budget planning scenarios with differentiated inflation and demand assumptions to address market volatility.

Validate with stakeholders: Secure cross-functional alignment on budget assumptions, methodologies, and targets before finalizing budgets.

Execute with agility: Implement an early wins strategy targeting 30-40% of budget savings in the first quarter to build momentum and credibility.

Approaches to budget development

The budget process architecture requires three distinct approaches working in concert:

Top-down guidance establishes strategic budget parameters: total procurement spend targets, savings goals, risk tolerance, and alignment with corporate financial planning. This ensures budget investments directly support enterprise objectives while providing clear boundaries for resource allocation.

Bottom-up forecasting incorporates category management intelligence into budget plans based on supplier negotiations, commodity trends, and capacity constraints. Category managers provide detailed budget projections grounded in market research and supplier relationship intelligence.

Scenario modeling addresses volatility through multiple budget planning scenarios—typically three to five distinct models, including conservative, base case, and aggressive growth assumptions with differentiated inflation and demand projections. These budget scenarios integrate real-time market intelligence and AI/ML algorithms for predictive analytics.

Stakeholder alignment and strategic KPIs

Stakeholder alignment represents the critical budget governance layer. Industry CPO interviews reveal procurement budget planning has evolved into a strategic partnership function, requiring quarterly business reviews with finance, operations, and business unit leaders. Joint accountability mechanisms ensure shared ownership of budget savings targets rather than procurement working in isolation.

Strategic budget KPIs must balance financial, operational, and strategic dimensions:

Financial metrics: Money you save (target: 3.1% of managed spend according to the Institute for Supply Management, though this varies significantly across industries and manufacturers and serves as a reference point), how much it costs to run your procurement team, and how efficiently you manage company cash

Operational metrics: Budget compliance, supplier on-time delivery, and procurement cycle time

Strategic metrics: Innovation value from supplier partnerships, budget risk mitigation impact, and sustainability achievement

LightSource centralizes this budget complexity into unified decision intelligence. The platform's predictive analytics forecast budgets accurately while identifying cost drivers and potential price fluctuations. The platform's advanced cost analysis tools help you track product costs across all components, compare prices over time, and determine fair market prices.

The most successful procurement organizations implement budget early warning systems with variance triggers that enable rapid course correction when actual results deviate from budgeted targets. This agility ensures budgets remain effective management tools rather than static documents that quickly become obsolete in volatile markets.

Best practices for strategic budgeting

By aligning procurement budgets directly with enterprise objectives and leveraging AI-native technology to automate complex budget processes, these organizations achieve breakthrough financial performance while elevating procurement's strategic influence.

Aligning procurement budgets with enterprise objectives

Aligning budget plans with enterprise objectives requires repositioning procurement as an enterprise value creator rather than a cost center. Industry budget frameworks identify three critical dimensions: supplier ecosystem development through strategic supplier partnerships, cross-functional budget integration with joint governance structures for sales, R&D, and finance, and margin contribution demonstrating direct impact on top-line revenue and bottom-line profitability. These dimensions require procurement to embed new "currencies" beyond budget cost savings: improving net margin by outperforming markets, ensuring volume and growth, and leading value-chain emissions reduction.

This budget repositioning demands expanded measurement frameworks. MIT Sloan research establishes that budget value measurement must balance tactical and strategic indicators while incorporating predictive analytics. Enterprise budget contribution metrics for C-suite reporting should include net margin improvement versus market benchmarks, revenue enablement through supplier innovation, working capital optimization, and risk-adjusted return on procurement budget investments.

Leveraging technology for strategic budgeting

Leading procurement organizations achieve this budget transformation by implementing unified platforms that deliver real-time decision intelligence across the entire budget lifecycle.

LightSource demonstrates this budget value creation framework at enterprise scale. The platform's predictive analytics and unified decision intelligence capabilities centralize budget complexity, enabling CPOs to forecast budgets accurately while identifying cost drivers and potential price fluctuations. Key technological budget advantages include:

End-to-end automation: LightSource automates the entire strategic budget lifecycle, from AI-recommended category-specific templates for RFX setup to Auto-Analyst features that automatically identify optimal budget scenarios

Unified project workspaces: Procurement teams manage budget communications, track costs, and maintain supplier relationships within a single platform, eliminating data silos and manual reconciliation

Predictive analytics: The platform forecasts budget patterns, transforming static annual budgets into dynamic forecasts responsive to real-time market conditions

Real customer outcomes validate these budget capabilities across multiple industries. Manufacturers using LightSource have achieved substantial reductions in Bill of Materials costs by integrating the platform into their budgeting process. Global enterprises report cutting sourcing timelines significantly, transforming multi-week processes into days through LightSource's budget-to-execution workflow. LightSource's unified data model ensures budget targets translate directly into execution outcomes, delivering significant workload automation while turning weeks of manual budget analysis into real-time strategic insights.

For CPOs navigating this budget transformation, the path forward is clear. Invest in data maturity before advanced AI capabilities. Establish cross-functional budget governance to overcome organizational silos. Build rapid execution capabilities that capture budget value in the first 90 days rather than waiting for year-end results, with organizations achieving early budget savings targets being more likely to meet overall savings goals.

Master procurement budgeting to prove value

Procurement budgeting differs from financial planning: you're managing supplier failures, commodity price swings, and make-or-buy decisions that standard budgets ignore. CPOs who master budget planning shift conversations from cost defense to value capture through spend forecasting, variance tracking, and cross-functional alignment. Without structured budgeting processes, procurement teams spend quarters justifying expenses instead of proving savings.

AI-native platforms give CPOs and their teams real-time budget visibility and predictive spend intelligence. LightSource connects procurement budgets directly to sourcing decisions through centralized workspaces where supplier quotes, BOM costs, and contract awards update budgets automatically. The platform eliminates manual spend tracking through AI-powered quote standardization and creates unified views where procurement, finance, and engineering collaborate on cost decisions in real-time.

Ready to see how budgeting works? Book a demo.

Frequently Asked Questions About Budgeting

1. What is procurement budgeting, and why is it essential for aligning spend with organizational strategy?

Procurement budgeting is the strategic financial planning process that allocates resources, forecasts spend, and establishes governance frameworks to maximize value creation across your supply chain. Unlike general financial planning, it requires specialized methodologies, including supplier risk assessment, commodity volatility modeling, and make-or-buy analyses that directly impact your organization's bottom line. Leading organizations integrate budget development with corporate strategic planning cycles to ensure procurement investments deliver measurable business impact through AI-enhanced forecasting and predictive spend analysis.

2. How can procurement leaders create effective budgets that balance direct, indirect, and contingency costs for complex projects or annual planning cycles?

Successful budget planning requires three distinct approaches working together: top-down guidance that establishes strategic parameters, bottom-up forecasting that incorporates category intelligence, and scenario modeling that addresses volatility through multiple planning scenarios. Direct materials represent the majority of total procurement spend and demand specialized forecasting incorporating supplier negotiations and commodity trends, while indirect spend requires different control mechanisms. The most effective CPOs build multiple distinct budget scenarios with differentiated inflation and demand assumptions, enabling rapid pivots when market conditions shift.

3. What best practices should procurement teams follow to optimize resource allocation, control costs, and adapt quickly to changing market conditions?

The breakthrough: align procurement budgets directly with enterprise objectives by repositioning procurement as a value creator, not a cost center. Leading organizations achieve this through cross-functional governance structures with joint accountability for savings targets, implement early warning systems with variance triggers for rapid course correction, and target early-quarter savings to build momentum. Best-in-class procurement teams leverage AI-native platforms to transform static annual budgets into dynamic forecasts. LightSource customers achieve substantial workload automation while turning weeks of manual analysis into real-time strategic insights.

4. How can procurement organizations prepare for and manage unpredictable or irregular expenses, such as market volatility, supply chain disruptions, or regulatory changes?

Build contingency reserves to absorb unexpected costs while maintaining risk buffers that scale with category volatility and supplier concentration. Implement advanced scenario planning with AI-powered forecasting to model multiple futures, including conservative, base case, and aggressive growth assumptions that enable rapid reallocation when disruptions hit. The technical reality: organizations using real-time supplier performance analytics and predictive spend forecasting identify potential budget issues before they impact production, transforming reactive management into strategic risk mitigation.

5. In what ways should procurement budgets be monitored and adjusted throughout the year to ensure compliance, financial stability, and continuous value delivery across supplier relationships and categories?

Strategic budget monitoring requires balancing three dimensions: financial metrics (cost savings and procurement efficiency), operational metrics (budget compliance and cycle time), and strategic metrics (supplier innovation value and risk mitigation). Leading CPOs implement quarterly business reviews with finance, operations, and business unit leaders to ensure joint accountability rather than procurement working in isolation. LightSource's predictive analytics centralize this complexity into unified decision intelligence, forecasting budgets accurately while identifying cost drivers and enabling rapid course correction when actuals deviate from targets.

TL;DR: Budgeting decides if you're driving value or just processing orders. Leading CPOs use structured budget processes and AI-driven forecasting to deliver measurable business impact.

This budgeting guide provides CPOs with actionable frameworks that they can use to:

Prove ROI to leadership by connecting budget investments to quantifiable business outcomes, using industry benchmarks to establish defensible targets tied to peer performance

Optimize budget resource allocation through zero-based budgeting principles, AI-enhanced forecasting, and cross-functional governance mechanisms that prevent value leakage

Elevate procurement's strategic value by implementing expanded budget measurement frameworks that demonstrate impact on margins, revenue growth, and sustainability initiatives

The organizations winning this budgeting transformation have shifted from reactive planning cycles to strategic value creation, supported by unified decision intelligence that turns weeks of manual budget analysis into real-time strategic insights.

Procurement budgeting is the strategic financial planning process that allocates resources, forecasts spend, and establishes governance frameworks to maximize value creation across your supply chain.

Procurement budgets differ from regular budgets in three ways: suppliers can fail, commodity prices swing wildly, and you're constantly deciding whether to make or buy components. Standard financial planning doesn't account for this.

Budget planning separates CPOs who justify costs from CPOs who prove value.

According to the Project Management Institute, effective budget planning establishes baselines that enable CPOs to demonstrate value through quantifiable business outcomes like cost avoidance, working capital improvements, and supply chain risk mitigation. Outcomes that would otherwise remain invisible to executive leadership.

Key objectives of budgeting

Strategic procurement budget planning must deliver on three core objectives:

Proving measurable ROI to executive leadership

Optimizing resource allocation across competing priorities

Elevating procurement's strategic value beyond traditional cost control.

Proving and quantifying ROI

Your board needs quantified business outcomes, not procurement metrics. Effective budget management connects procurement investments directly to enterprise-level value creation, providing leadership with concrete evidence of procurement's contribution to organizational goals.

Industry budget benchmarks provide the context you need to defend your targets. When the CFO questions your 5% savings goal, peer data from your sector proves whether you're ambitious or unrealistic.

The most successful procurement organizations translate technical achievements into budget outcomes that resonate with CFOs and board members. This shift fundamentally repositions procurement budgets from operational overhead to strategic investments with measurable returns.

Optimizing resource allocation

Budget resource optimization balances competing priorities across cost, risk, innovation, and sustainability. Leading procurement organizations establish budget governance frameworks that align spend with strategic objectives, ensuring every dollar delivers maximum value at acceptable risk levels.

Zero-Based Budgeting provides the methodological foundation for budget optimization. Rather than incremental adjustments to prior year budgets, ZBB requires every expense be justified from zero each budget cycle. This forces prioritization of high-impact investments and creates accountability through business case requirements for all budget spending.

Machine learning amplifies budget optimization capabilities. MIT research demonstrates that ML-enabled spend categorization achieves 94% accuracy, identifying supplier contract renegotiation opportunities and increasing budget accuracy through enhanced spend visibility that prevents value leakage during budget execution.

Elevating strategic value beyond cost control

Strategic budget management elevates procurement from a cost center to an enterprise value driver through innovation acceleration, risk management, and sustainability leadership. This expanded budget framework requires new measurement approaches that capture procurement's full strategic contribution.

Leading organizations implement three distinct budget value elevation strategies:

Innovation catalyst: Allocating budget for supplier-enabled innovation, co-development initiatives, and early supplier involvement that accelerates time-to-market and creates competitive differentiation

Risk intelligence: Building financial resilience through budget scenario modeling, supplier financial health monitoring, and supply chain stress testing that protects enterprise value against disruptions

Sustainability driver: Embedding carbon reduction targets, ethical sourcing requirements, and circular economy principles into budget frameworks that address increasing stakeholder demands

The procurement function's evolution from cost center to strategic partner hinges on budget frameworks that measure and communicate this expanded value contribution across the supply chain.

11 essential budgeting terms for CPOs

Effective budget planning demands precision in both concept and communication. CPOs need a shared vocabulary when discussing budget frameworks with board members, CFOs, and financial teams. These eleven foundational budget terms provide the lexicon for demonstrating procurement's strategic value and financial impact across the enterprise.

Master these budget concepts to transform procurement discussions from tactical cost conversations to strategic value dialogues:

1. Spend under management

Spend under management is the portion of total organizational spend actively managed by procurement budget to optimize costs, supplier relationships, and compliance.

This budget metric indicates procurement's scope of influence over sourcing decisions and typically correlates with the maturity of procurement operations. Leading organizations work toward optimizing spend under management to enable comprehensive cost control and value creation

2. Total cost of ownership (TCO)

The total cost of ownership (TCO) is a comprehensive examination of all costs associated with acquiring, operating, maintaining, and disposing of a product or service throughout its lifecycle.

TCO budget planning encompasses direct costs (purchase price, shipping, installation) and indirect costs (order processing, inspection, training, maintenance, disposal). This holistic budget view prevents procurement decisions that minimize purchase price while creating hidden downstream costs.

3. Capital expenditure (CapEx) and operating expenditure (OpEx)

CapEx represents budget funds for acquiring or upgrading physical assets like property, buildings, or equipment that provide long-term value.

OpEx covers ongoing budget costs for running products, businesses, or systems.

Procurement budget strategies vary significantly between these categories, with CapEx requiring a comprehensive ROI analysis and OpEx focusing on continuous cost optimization.

4. Category management

Category management is a Strategic procurement approach that organizes budget resources around specific spend categories to optimize purchasing decisions, improve supplier relationships, and achieve better overall value. Category budget strategies consider market dynamics, supplier landscapes, and business requirements to align sourcing tactics with broader organizational objectives.

5. Inventory turnover

Inventory turnover is a financial budget metric measuring how frequently inventory is sold and replaced over a specified period, calculated as Cost of Goods Sold divided by Average Inventory Value.

High turnover indicates efficient budget management, while low turnover signals potential cash flow constraints, obsolescence risks, and excess carrying costs that procurement budget strategies can address.

6. Procurement ROI

Procurement ROI is the financial return generated by procurement budget activities relative to procurement operating costs, expressed as:

(Procurement Value Generated - Procurement Operating Costs) ÷ Procurement Operating Costs × 100

This budget metric demonstrates procurement's value contribution beyond traditional cost savings by quantifying impact on revenue, risk mitigation, and operational efficiency.

7. Cost savings

Cost savings is the reduction in budget expenditure achieved through procurement strategies, including negotiation, supplier consolidation, and process improvements. Distinguishes between hard savings (measurable price reductions) and soft savings (value through efficiency gains, risk mitigation, quality improvements). Effective procurement organizations implement rigorous budget savings validation processes aligned with finance to ensure savings flow to the bottom line.

8. Supplier performance

Supplier performance is the comprehensive assessment of suppliers' ability to meet contractual obligations across quality, delivery, cost, and service dimensions. LightSource's advanced supplier performance analytics provide real-time, data-driven insights into supplier health across complex multi-tier supply chains, enabling proactive budget risk mitigation and strategic decision-making. The platform's early warning system identifies potential budget issues before they impact production, transforming reactive supplier management into strategic relationship optimization.

9. Payment terms

Payment terms are conditions agreed between buyer and supplier regarding timing and method of payment for goods or services, directly impacting budget working capital management. Strategic payment term optimization balances buyer's desire to extend terms with supplier relationship considerations, leveraging scale for favorable budget terms while maintaining supplier financial health.

10. Working capital

Working capital is the cash you have available to operate - your current assets minus current liabilities. Procurement budget decisions on payment terms and inventory levels directly impact working capital optimization, with strategic procurement budgeting contributing significantly to enterprise cash flow through inventory reduction, extended payment terms, and dynamic discounting programs.

11. Strategic sourcing automation

Strategic sourcing automation is the application of digital tools and platforms to accelerate and optimize strategic budgeting processes across supplier identification, evaluation, negotiation, and contract management.

LightSource's AI-native platform automates the entire source-to-contract lifecycle, delivering 70-100% workload automation and enabling procurement teams to manage budget communications, track costs, and maintain supplier relationships within unified project workspaces.

The platform transforms weeks of manual budget analysis into real-time decision intelligence through automated bid analysis and spend visibility capabilities.

The budgeting process for procurement leaders

Successful procurement budget planning starts with requirement definition, not historical spend analysis. Leading organizations integrate budget development with corporate strategic planning cycles to ensure procurement investments directly support business objectives.

The following six steps create a comprehensive budget roadmap from initial requirements through execution, with each stage building on the foundation established in previous steps:

Define strategic requirements: Align procurement budgets with enterprise objectives before allocating resources. Identify how budget plans will contribute to margin improvement, revenue growth, and strategic initiatives.

Establish governance frameworks: Implement cross-functional accountability mechanisms that prevent budget value leakage and ensure shared ownership of savings targets.

Develop forecasting models: Create category-specific budget forecasts incorporating supplier negotiations, commodity trends, and capacity constraints.

Perform scenario analysis: Build multiple budget planning scenarios with differentiated inflation and demand assumptions to address market volatility.

Validate with stakeholders: Secure cross-functional alignment on budget assumptions, methodologies, and targets before finalizing budgets.

Execute with agility: Implement an early wins strategy targeting 30-40% of budget savings in the first quarter to build momentum and credibility.

Approaches to budget development

The budget process architecture requires three distinct approaches working in concert:

Top-down guidance establishes strategic budget parameters: total procurement spend targets, savings goals, risk tolerance, and alignment with corporate financial planning. This ensures budget investments directly support enterprise objectives while providing clear boundaries for resource allocation.

Bottom-up forecasting incorporates category management intelligence into budget plans based on supplier negotiations, commodity trends, and capacity constraints. Category managers provide detailed budget projections grounded in market research and supplier relationship intelligence.

Scenario modeling addresses volatility through multiple budget planning scenarios—typically three to five distinct models, including conservative, base case, and aggressive growth assumptions with differentiated inflation and demand projections. These budget scenarios integrate real-time market intelligence and AI/ML algorithms for predictive analytics.

Stakeholder alignment and strategic KPIs

Stakeholder alignment represents the critical budget governance layer. Industry CPO interviews reveal procurement budget planning has evolved into a strategic partnership function, requiring quarterly business reviews with finance, operations, and business unit leaders. Joint accountability mechanisms ensure shared ownership of budget savings targets rather than procurement working in isolation.

Strategic budget KPIs must balance financial, operational, and strategic dimensions:

Financial metrics: Money you save (target: 3.1% of managed spend according to the Institute for Supply Management, though this varies significantly across industries and manufacturers and serves as a reference point), how much it costs to run your procurement team, and how efficiently you manage company cash

Operational metrics: Budget compliance, supplier on-time delivery, and procurement cycle time

Strategic metrics: Innovation value from supplier partnerships, budget risk mitigation impact, and sustainability achievement

LightSource centralizes this budget complexity into unified decision intelligence. The platform's predictive analytics forecast budgets accurately while identifying cost drivers and potential price fluctuations. The platform's advanced cost analysis tools help you track product costs across all components, compare prices over time, and determine fair market prices.

The most successful procurement organizations implement budget early warning systems with variance triggers that enable rapid course correction when actual results deviate from budgeted targets. This agility ensures budgets remain effective management tools rather than static documents that quickly become obsolete in volatile markets.

Best practices for strategic budgeting

By aligning procurement budgets directly with enterprise objectives and leveraging AI-native technology to automate complex budget processes, these organizations achieve breakthrough financial performance while elevating procurement's strategic influence.

Aligning procurement budgets with enterprise objectives

Aligning budget plans with enterprise objectives requires repositioning procurement as an enterprise value creator rather than a cost center. Industry budget frameworks identify three critical dimensions: supplier ecosystem development through strategic supplier partnerships, cross-functional budget integration with joint governance structures for sales, R&D, and finance, and margin contribution demonstrating direct impact on top-line revenue and bottom-line profitability. These dimensions require procurement to embed new "currencies" beyond budget cost savings: improving net margin by outperforming markets, ensuring volume and growth, and leading value-chain emissions reduction.

This budget repositioning demands expanded measurement frameworks. MIT Sloan research establishes that budget value measurement must balance tactical and strategic indicators while incorporating predictive analytics. Enterprise budget contribution metrics for C-suite reporting should include net margin improvement versus market benchmarks, revenue enablement through supplier innovation, working capital optimization, and risk-adjusted return on procurement budget investments.

Leveraging technology for strategic budgeting

Leading procurement organizations achieve this budget transformation by implementing unified platforms that deliver real-time decision intelligence across the entire budget lifecycle.

LightSource demonstrates this budget value creation framework at enterprise scale. The platform's predictive analytics and unified decision intelligence capabilities centralize budget complexity, enabling CPOs to forecast budgets accurately while identifying cost drivers and potential price fluctuations. Key technological budget advantages include:

End-to-end automation: LightSource automates the entire strategic budget lifecycle, from AI-recommended category-specific templates for RFX setup to Auto-Analyst features that automatically identify optimal budget scenarios

Unified project workspaces: Procurement teams manage budget communications, track costs, and maintain supplier relationships within a single platform, eliminating data silos and manual reconciliation

Predictive analytics: The platform forecasts budget patterns, transforming static annual budgets into dynamic forecasts responsive to real-time market conditions

Real customer outcomes validate these budget capabilities across multiple industries. Manufacturers using LightSource have achieved substantial reductions in Bill of Materials costs by integrating the platform into their budgeting process. Global enterprises report cutting sourcing timelines significantly, transforming multi-week processes into days through LightSource's budget-to-execution workflow. LightSource's unified data model ensures budget targets translate directly into execution outcomes, delivering significant workload automation while turning weeks of manual budget analysis into real-time strategic insights.

For CPOs navigating this budget transformation, the path forward is clear. Invest in data maturity before advanced AI capabilities. Establish cross-functional budget governance to overcome organizational silos. Build rapid execution capabilities that capture budget value in the first 90 days rather than waiting for year-end results, with organizations achieving early budget savings targets being more likely to meet overall savings goals.

Master procurement budgeting to prove value

Procurement budgeting differs from financial planning: you're managing supplier failures, commodity price swings, and make-or-buy decisions that standard budgets ignore. CPOs who master budget planning shift conversations from cost defense to value capture through spend forecasting, variance tracking, and cross-functional alignment. Without structured budgeting processes, procurement teams spend quarters justifying expenses instead of proving savings.

AI-native platforms give CPOs and their teams real-time budget visibility and predictive spend intelligence. LightSource connects procurement budgets directly to sourcing decisions through centralized workspaces where supplier quotes, BOM costs, and contract awards update budgets automatically. The platform eliminates manual spend tracking through AI-powered quote standardization and creates unified views where procurement, finance, and engineering collaborate on cost decisions in real-time.

Ready to see how budgeting works? Book a demo.

Frequently Asked Questions About Budgeting

1. What is procurement budgeting, and why is it essential for aligning spend with organizational strategy?

Procurement budgeting is the strategic financial planning process that allocates resources, forecasts spend, and establishes governance frameworks to maximize value creation across your supply chain. Unlike general financial planning, it requires specialized methodologies, including supplier risk assessment, commodity volatility modeling, and make-or-buy analyses that directly impact your organization's bottom line. Leading organizations integrate budget development with corporate strategic planning cycles to ensure procurement investments deliver measurable business impact through AI-enhanced forecasting and predictive spend analysis.

2. How can procurement leaders create effective budgets that balance direct, indirect, and contingency costs for complex projects or annual planning cycles?

Successful budget planning requires three distinct approaches working together: top-down guidance that establishes strategic parameters, bottom-up forecasting that incorporates category intelligence, and scenario modeling that addresses volatility through multiple planning scenarios. Direct materials represent the majority of total procurement spend and demand specialized forecasting incorporating supplier negotiations and commodity trends, while indirect spend requires different control mechanisms. The most effective CPOs build multiple distinct budget scenarios with differentiated inflation and demand assumptions, enabling rapid pivots when market conditions shift.

3. What best practices should procurement teams follow to optimize resource allocation, control costs, and adapt quickly to changing market conditions?

The breakthrough: align procurement budgets directly with enterprise objectives by repositioning procurement as a value creator, not a cost center. Leading organizations achieve this through cross-functional governance structures with joint accountability for savings targets, implement early warning systems with variance triggers for rapid course correction, and target early-quarter savings to build momentum. Best-in-class procurement teams leverage AI-native platforms to transform static annual budgets into dynamic forecasts. LightSource customers achieve substantial workload automation while turning weeks of manual analysis into real-time strategic insights.

4. How can procurement organizations prepare for and manage unpredictable or irregular expenses, such as market volatility, supply chain disruptions, or regulatory changes?

Build contingency reserves to absorb unexpected costs while maintaining risk buffers that scale with category volatility and supplier concentration. Implement advanced scenario planning with AI-powered forecasting to model multiple futures, including conservative, base case, and aggressive growth assumptions that enable rapid reallocation when disruptions hit. The technical reality: organizations using real-time supplier performance analytics and predictive spend forecasting identify potential budget issues before they impact production, transforming reactive management into strategic risk mitigation.

5. In what ways should procurement budgets be monitored and adjusted throughout the year to ensure compliance, financial stability, and continuous value delivery across supplier relationships and categories?

Strategic budget monitoring requires balancing three dimensions: financial metrics (cost savings and procurement efficiency), operational metrics (budget compliance and cycle time), and strategic metrics (supplier innovation value and risk mitigation). Leading CPOs implement quarterly business reviews with finance, operations, and business unit leaders to ensure joint accountability rather than procurement working in isolation. LightSource's predictive analytics centralize this complexity into unified decision intelligence, forecasting budgets accurately while identifying cost drivers and enabling rapid course correction when actuals deviate from targets.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Trusted by:

Trusted by:

Trusted by:

*GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and COOL VENDORS is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.