Jan 15, 2026

Procurement Finance 2025: Strategic guide to ROI & alignment

Finance and procurement are two of the closest functions in business -- one manages the spend, the other tracks the spend. This article goes into the strategic and tactical details around how those team communicate through metrics.

Synopsis

Procurement isn't just about finding savings anymore. When it’s connected to finance, it becomes a profit engine. Once integrated, procurement-based finance uses real-time data and shared goals to align every buying decision with your company’s financial success.

Why procurement needs to think like finance

You’ve probably heard the old story: procurement cuts costs, finance reconciles invoices. That’s a slow, manual process that leaves money on the table.

What’s the problem with the old way?

The old mode creates a major gap. When purchasing makes a decision and finance only sees the impact months later, you're always playing catch-up. This lag means budget surprises, missed opportunities for better payment terms, and no immediate connection between a purchasing choice and the company's bottom line.

Procurement + finance alignment changes everything. It connects every purchasing decision directly to the company's financial goals. Every smart sourcing move contributes immediately to widening margins and long-term profitability. You start seeing the immediate impact of your decisions, not just reading about them on a report later.

Why does this alignment drive serious growth?

Alignment matters for one simple reason: Control.

When procurement and finance work from the same data, you catch budget overruns before a contract is signed. Procurement knows the budget before negotiating, not after. Finance sees supplier price changes right now, not weeks later when an invoice shows up.

Integrated teams report fewer surprise expenses. They also expand their working capital through optimized payment terms and early-payment discounts. That's real, measurable value, not just theoretical cost-cutting.

How does this affect supplier relationships?

It makes them stronger.

When invoices flow through shared, automated systems, suppliers get paid on time, every time. This speed and reliability build trust. Trust lets procurement secure favorable pricing and better capacity allocations. Manufacturers that unify procurement and accounts-payable approvals often cut the invoice-to-pay cycle from days to mere hours. That speed converts directly into better terms for you, especially when market prices spike.

How to shift to strategic procurement finance

Making this shift isn’t just about buying new software; it's about setting clear rules and shared workflows.

How can unified data drive smarter decisions?

You need to integrate your ERP, sourcing platforms, and supplier data into a single system.

Shared visibility improves forecasting, simplifies audits, and highlights new opportunities for savings. Real-time data lets procurement target categories with high margins, manage cash flow effectively, and maintain supplier performance—all while keeping finance in the loop.

What are the right metrics to share with finance?

Stop using different scorecards. AI-native procurement finance begins with setting joint goals that link savings to broader financial targets. Pair cycle-time reductions with the cash-flow impact, and align supplier performance to working-capital targets. A shared dashboard removes the guesswork over which numbers truly matter.

Procurement KPIs | Finance KPIs |

PO cycle time | Cash flow impact |

Cost savings | Working capital |

Spend under management | Budget vs actual spend |

Supplier on-time delivery rate | Forecast accuracy |

Maverick spend | Total savings realized |

Supplier defect rate | Return on Investment (ROI) |

Contract compliance rate | Variance to plan |

Lead time | Profit margin |

Should we ditch static budgets for rolling forecasts?

Yes, you should. Rolling forecasts incorporate category-level insights and adjust budgets instantly as commodity prices or market conditions shift.

Procurement teams that integrate their data into financial planning can spot variances early and adjust long before it hits the Profit & Loss statement. LightSource’s API integration pushes real-time supplier cost data directly into your finance dashboards. This lets you reallocate funds toward high-ROI projects or freeze non-essential categories without messing up working capital.

How can automation help with speed and control?

Automation is how you get both.

Automation eliminates bottlenecks in the approval process. You can tier requests based on value: low-cost, contract-compliant buys move through instantly, while complex, strategic purchases trigger deeper reviews. Automating this logic cuts manual touchpoints and highlights the exceptions to the right approver immediately. This preserves control without slowing down sourcing cycles.

Key takeaway

Stop operating in silos. The fastest way to unlock procurement ROI is to use unified, real-time data to connect every sourcing decision to finance's top priorities: cash flow and margin growth.

Smarter sourcing: Optimizing for value

Optimization is about making data-driven decisions that create long-term value, not just short-term cuts.

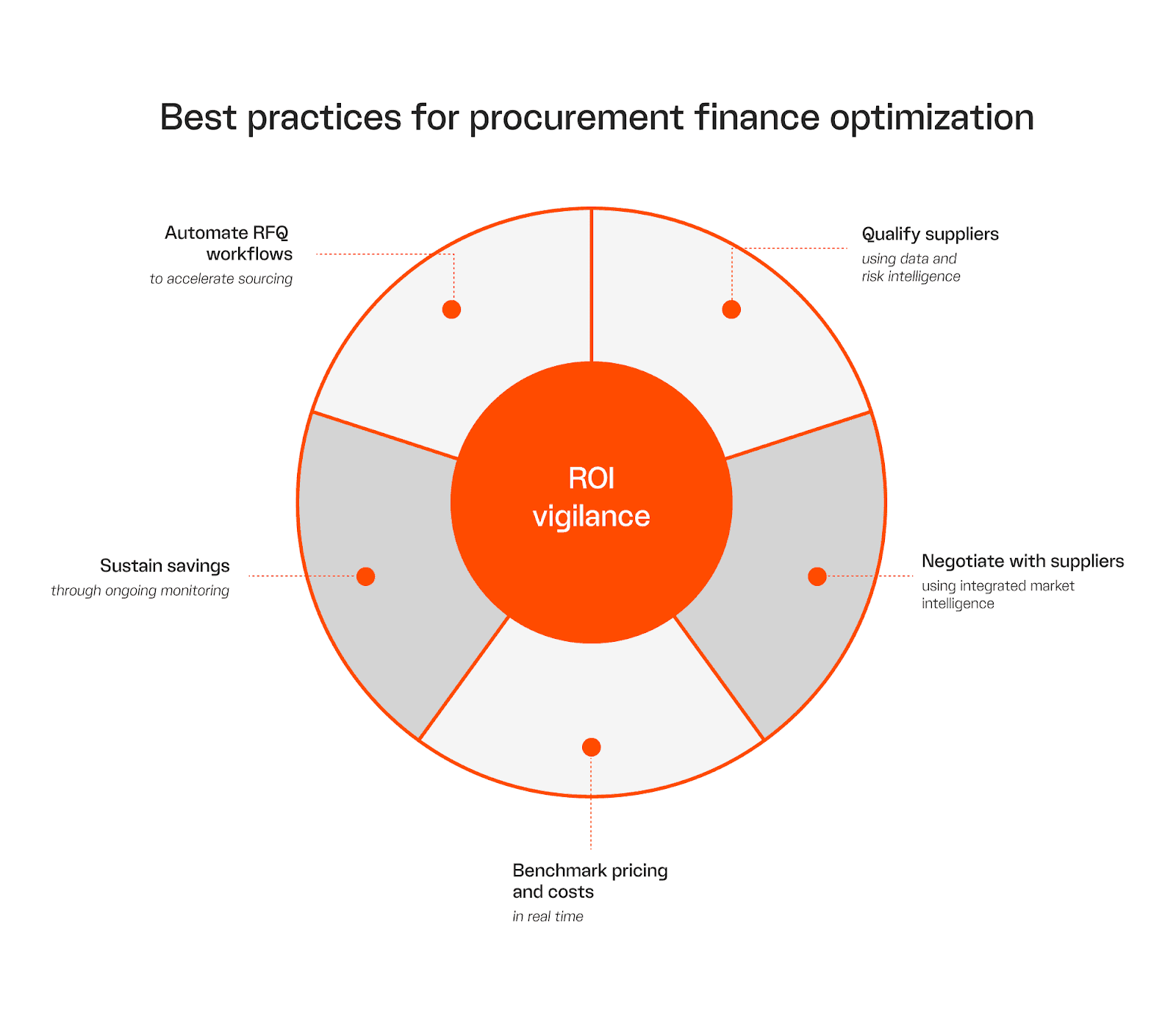

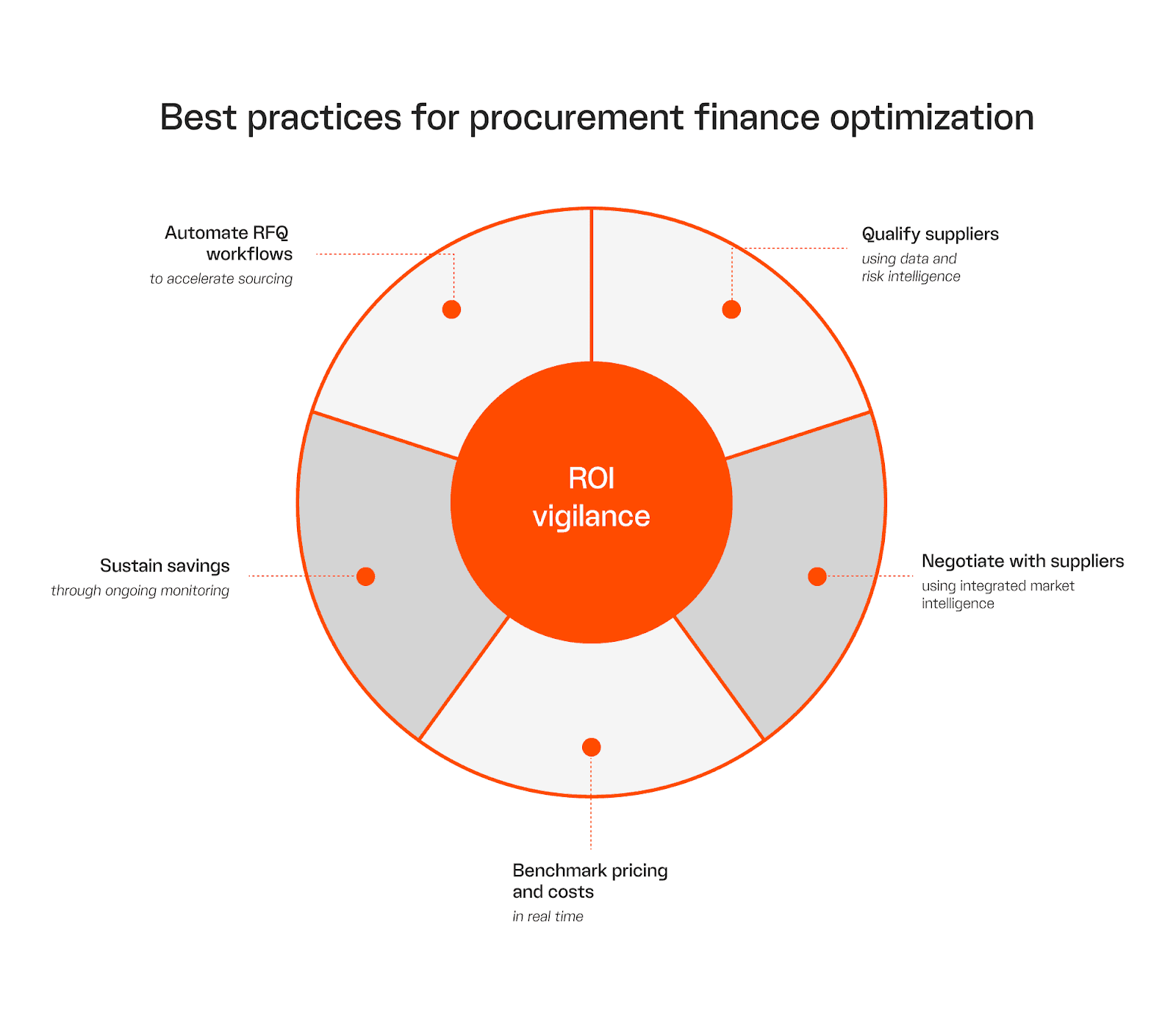

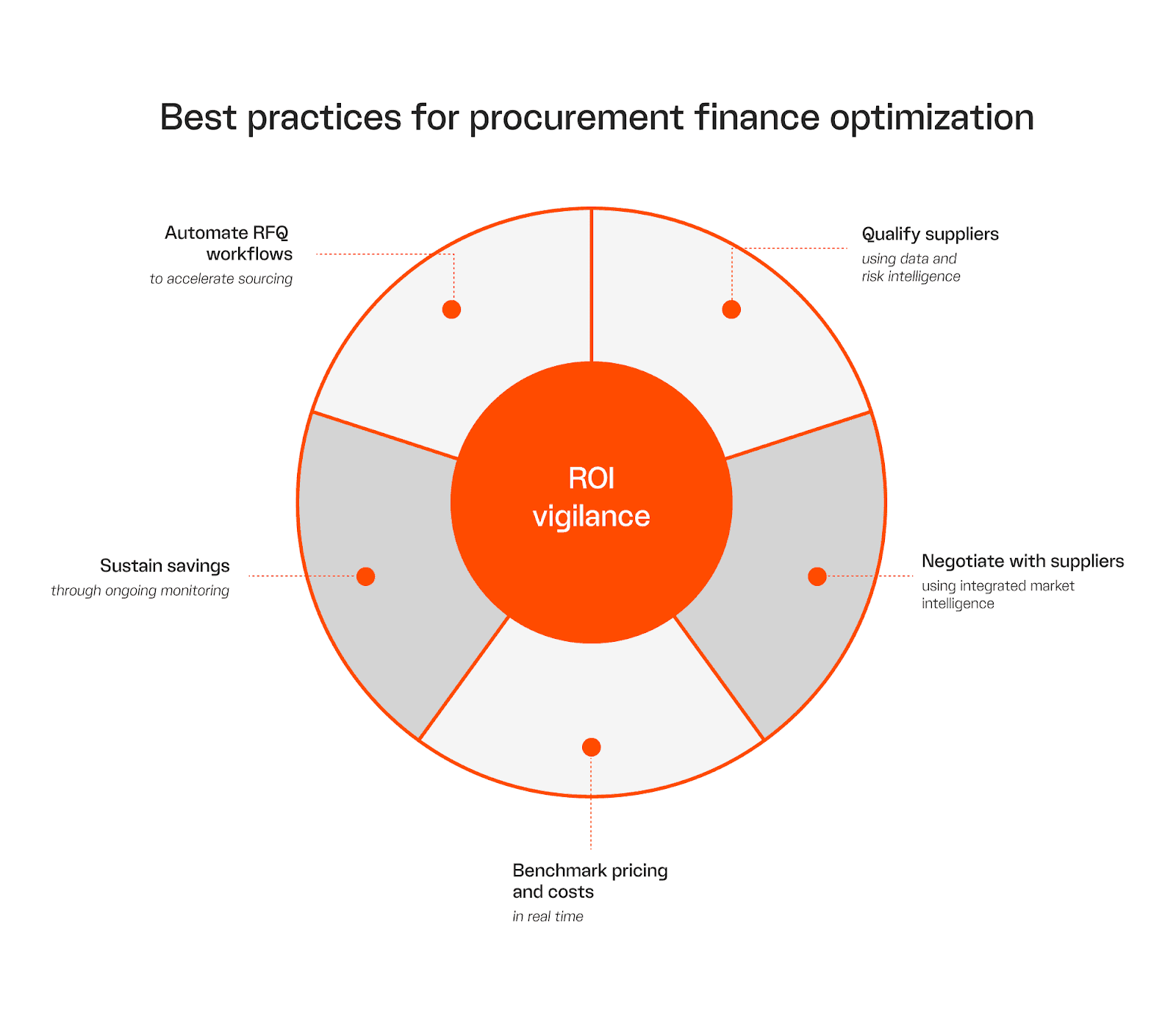

How do we make RFQ workflows faster and better?

Start with RFQ automation.

Comparing quotes across hundreds of line items manually can take weeks. Automating RFQs—routing them to pre-qualified suppliers and standardizing responses for side-by-side comparison—saves massive time and reduces human error. This approach lets your team focus on high-value negotiation instead of low-value data entry.

What's the right way to qualify suppliers?

You should rely on data and risk intelligence, not just relationships.

Evaluate suppliers based on delivery performance, financial stability, and compliance triggers. Using these insights helps procurement avoid costly production delays and hidden risks. Faster sourcing plus qualified suppliers means you get the best prices and minimize operational disruptions.

What makes a negotiation successful?

Successful negotiation hinges on preparation.

Procurement teams need access to market benchmarks, supplier histories, and cost drivers before the meeting. Integrated market intelligence helps you identify every potential savings opportunity and strengthens your bargaining power. This helps you secure better pricing and the most favorable terms.

Can we benchmark costs in real-time?

Absolutely. Real-time benchmarking lets you adjust sourcing strategy instantly.

LightSource updates item data points like commodity prices, freight rates, and peer pricing automatically, highlighting any discrepancies. Instead of waiting for quarterly reviews, you can renegotiate prices as soon as the data shows a delta. This secures better deals and reduces risk immediately.

Speaking the CFO's language

Procurement needs to translate its work into financial KPIs that the board can track.

Which financial metrics should procurement focus on?

Focus on the five key metrics that resonate most with finance teams:

Cost savings: Hard reductions in cost, like price cuts on raw materials.

Cost avoidance: Reducing unnecessary spend, like locking in prices before a supplier hike.

Procurement ROI: Total value delivered versus the cost of the procurement function.

Total Cost of Ownership (TCO): The lifetime cost from acquisition to disposal.

Purchase Price Variance (PPV): The difference between the expected and actual price.

These metrics clearly communicate procurement's contribution to profitability and bottom-line growth.

What operational data protects our results?

You need to track operational KPIs that maintain the consistency of your savings:

Spend Under Management (SUM): How much of the total spend flows through negotiated contracts.

Maverick spend: Off-contract buying that erodes value.

Contract compliance rate: How much procurement actually buys according to the agreed terms.

Automating the tracking of these ensures procurement stays aligned with financial goals.

How do we bridge the gap between our systems?

Siloed data is the enemy of efficiency.

LightSource acts as the critical bridge between procurement and the finance ERP system. It sits between these platforms and translates procurement data into finance-ready insights. This ensures real-time visibility into spend, risk, and supplier performance flows seamlessly into existing financial workflows. No more endless back-and-forth between teams—procurement gets the supplier intelligence they need while finance receives clean, actionable data in their familiar ERP environment.

What does an AI-native platform actually do for procurement finance?

It changes the game.

LightSource, the AI-native procurement solution, automates data classification, powers predictive risk models, and streamlines sourcing workflows. This immediately reduces sourcing cycle times, improves spend visibility, and delivers actionable insights. With this architecture, procurement can standardize supplier quotes, automate RFQ workflows, and make faster, data-driven decisions that align with financial objectives—transforming your function from a cost center into a strategic partner that drives measurable margin growth.

Ready to see how AI-native procurement transforms your financial outcomes?

Frequently asked questions about procurement finance

What is procurement finance?

Procurement finance directly connects every sourcing decision to the company's financial goals, ensuring that every procurement action contributes to margin improvement, cost control, and long-term profitability. It integrates real-time spend data, cost-saving metrics, and supplier performance into a cohesive system that aligns procurement with broader financial objectives.

How does procurement finance drive ROI?

By aligning procurement strategies with financial goals, procurement teams can negotiate better terms, optimize payment schedules, and prevent overspending before it happens. Real-time data and predictive models enable faster, data-driven decisions that improve contract terms and capture savings opportunities, resulting in a quantifiable return on investment.

What role do shared KPIs play in procurement finance?

Shared KPIs between procurement and finance ensure both teams are aligned toward common financial goals. By tracking key metrics like cost savings, cash flow impact, and supplier performance together, both functions can quickly identify opportunities for improvement and reduce operational inefficiencies.

How can AI improve procurement finance?

AI improves procurement finance by automating complex data analysis, providing real-time spend insights, and predicting supplier risks before they impact margins. LightSource’s AI-powered platform streamlines RFQ workflows, assesses supplier performance, and optimizes sourcing decisions, enabling faster, more informed procurement actions that align with financial goals.

What are the first steps to aligning procurement with finance?

Start by establishing shared KPIs that align procurement goals with broader financial targets and then move to data integration. The final critical step is automating workflows to eliminate process bottlenecks. Building cross-functional alignment ensures both procurement and finance work from the same data to drive strategic decisions.

Synopsis

Procurement isn't just about finding savings anymore. When it’s connected to finance, it becomes a profit engine. Once integrated, procurement-based finance uses real-time data and shared goals to align every buying decision with your company’s financial success.

Why procurement needs to think like finance

You’ve probably heard the old story: procurement cuts costs, finance reconciles invoices. That’s a slow, manual process that leaves money on the table.

What’s the problem with the old way?

The old mode creates a major gap. When purchasing makes a decision and finance only sees the impact months later, you're always playing catch-up. This lag means budget surprises, missed opportunities for better payment terms, and no immediate connection between a purchasing choice and the company's bottom line.

Procurement + finance alignment changes everything. It connects every purchasing decision directly to the company's financial goals. Every smart sourcing move contributes immediately to widening margins and long-term profitability. You start seeing the immediate impact of your decisions, not just reading about them on a report later.

Why does this alignment drive serious growth?

Alignment matters for one simple reason: Control.

When procurement and finance work from the same data, you catch budget overruns before a contract is signed. Procurement knows the budget before negotiating, not after. Finance sees supplier price changes right now, not weeks later when an invoice shows up.

Integrated teams report fewer surprise expenses. They also expand their working capital through optimized payment terms and early-payment discounts. That's real, measurable value, not just theoretical cost-cutting.

How does this affect supplier relationships?

It makes them stronger.

When invoices flow through shared, automated systems, suppliers get paid on time, every time. This speed and reliability build trust. Trust lets procurement secure favorable pricing and better capacity allocations. Manufacturers that unify procurement and accounts-payable approvals often cut the invoice-to-pay cycle from days to mere hours. That speed converts directly into better terms for you, especially when market prices spike.

How to shift to strategic procurement finance

Making this shift isn’t just about buying new software; it's about setting clear rules and shared workflows.

How can unified data drive smarter decisions?

You need to integrate your ERP, sourcing platforms, and supplier data into a single system.

Shared visibility improves forecasting, simplifies audits, and highlights new opportunities for savings. Real-time data lets procurement target categories with high margins, manage cash flow effectively, and maintain supplier performance—all while keeping finance in the loop.

What are the right metrics to share with finance?

Stop using different scorecards. AI-native procurement finance begins with setting joint goals that link savings to broader financial targets. Pair cycle-time reductions with the cash-flow impact, and align supplier performance to working-capital targets. A shared dashboard removes the guesswork over which numbers truly matter.

Procurement KPIs | Finance KPIs |

PO cycle time | Cash flow impact |

Cost savings | Working capital |

Spend under management | Budget vs actual spend |

Supplier on-time delivery rate | Forecast accuracy |

Maverick spend | Total savings realized |

Supplier defect rate | Return on Investment (ROI) |

Contract compliance rate | Variance to plan |

Lead time | Profit margin |

Should we ditch static budgets for rolling forecasts?

Yes, you should. Rolling forecasts incorporate category-level insights and adjust budgets instantly as commodity prices or market conditions shift.

Procurement teams that integrate their data into financial planning can spot variances early and adjust long before it hits the Profit & Loss statement. LightSource’s API integration pushes real-time supplier cost data directly into your finance dashboards. This lets you reallocate funds toward high-ROI projects or freeze non-essential categories without messing up working capital.

How can automation help with speed and control?

Automation is how you get both.

Automation eliminates bottlenecks in the approval process. You can tier requests based on value: low-cost, contract-compliant buys move through instantly, while complex, strategic purchases trigger deeper reviews. Automating this logic cuts manual touchpoints and highlights the exceptions to the right approver immediately. This preserves control without slowing down sourcing cycles.

Key takeaway

Stop operating in silos. The fastest way to unlock procurement ROI is to use unified, real-time data to connect every sourcing decision to finance's top priorities: cash flow and margin growth.

Smarter sourcing: Optimizing for value

Optimization is about making data-driven decisions that create long-term value, not just short-term cuts.

How do we make RFQ workflows faster and better?

Start with RFQ automation.

Comparing quotes across hundreds of line items manually can take weeks. Automating RFQs—routing them to pre-qualified suppliers and standardizing responses for side-by-side comparison—saves massive time and reduces human error. This approach lets your team focus on high-value negotiation instead of low-value data entry.

What's the right way to qualify suppliers?

You should rely on data and risk intelligence, not just relationships.

Evaluate suppliers based on delivery performance, financial stability, and compliance triggers. Using these insights helps procurement avoid costly production delays and hidden risks. Faster sourcing plus qualified suppliers means you get the best prices and minimize operational disruptions.

What makes a negotiation successful?

Successful negotiation hinges on preparation.

Procurement teams need access to market benchmarks, supplier histories, and cost drivers before the meeting. Integrated market intelligence helps you identify every potential savings opportunity and strengthens your bargaining power. This helps you secure better pricing and the most favorable terms.

Can we benchmark costs in real-time?

Absolutely. Real-time benchmarking lets you adjust sourcing strategy instantly.

LightSource updates item data points like commodity prices, freight rates, and peer pricing automatically, highlighting any discrepancies. Instead of waiting for quarterly reviews, you can renegotiate prices as soon as the data shows a delta. This secures better deals and reduces risk immediately.

Speaking the CFO's language

Procurement needs to translate its work into financial KPIs that the board can track.

Which financial metrics should procurement focus on?

Focus on the five key metrics that resonate most with finance teams:

Cost savings: Hard reductions in cost, like price cuts on raw materials.

Cost avoidance: Reducing unnecessary spend, like locking in prices before a supplier hike.

Procurement ROI: Total value delivered versus the cost of the procurement function.

Total Cost of Ownership (TCO): The lifetime cost from acquisition to disposal.

Purchase Price Variance (PPV): The difference between the expected and actual price.

These metrics clearly communicate procurement's contribution to profitability and bottom-line growth.

What operational data protects our results?

You need to track operational KPIs that maintain the consistency of your savings:

Spend Under Management (SUM): How much of the total spend flows through negotiated contracts.

Maverick spend: Off-contract buying that erodes value.

Contract compliance rate: How much procurement actually buys according to the agreed terms.

Automating the tracking of these ensures procurement stays aligned with financial goals.

How do we bridge the gap between our systems?

Siloed data is the enemy of efficiency.

LightSource acts as the critical bridge between procurement and the finance ERP system. It sits between these platforms and translates procurement data into finance-ready insights. This ensures real-time visibility into spend, risk, and supplier performance flows seamlessly into existing financial workflows. No more endless back-and-forth between teams—procurement gets the supplier intelligence they need while finance receives clean, actionable data in their familiar ERP environment.

What does an AI-native platform actually do for procurement finance?

It changes the game.

LightSource, the AI-native procurement solution, automates data classification, powers predictive risk models, and streamlines sourcing workflows. This immediately reduces sourcing cycle times, improves spend visibility, and delivers actionable insights. With this architecture, procurement can standardize supplier quotes, automate RFQ workflows, and make faster, data-driven decisions that align with financial objectives—transforming your function from a cost center into a strategic partner that drives measurable margin growth.

Ready to see how AI-native procurement transforms your financial outcomes?

Frequently asked questions about procurement finance

What is procurement finance?

Procurement finance directly connects every sourcing decision to the company's financial goals, ensuring that every procurement action contributes to margin improvement, cost control, and long-term profitability. It integrates real-time spend data, cost-saving metrics, and supplier performance into a cohesive system that aligns procurement with broader financial objectives.

How does procurement finance drive ROI?

By aligning procurement strategies with financial goals, procurement teams can negotiate better terms, optimize payment schedules, and prevent overspending before it happens. Real-time data and predictive models enable faster, data-driven decisions that improve contract terms and capture savings opportunities, resulting in a quantifiable return on investment.

What role do shared KPIs play in procurement finance?

Shared KPIs between procurement and finance ensure both teams are aligned toward common financial goals. By tracking key metrics like cost savings, cash flow impact, and supplier performance together, both functions can quickly identify opportunities for improvement and reduce operational inefficiencies.

How can AI improve procurement finance?

AI improves procurement finance by automating complex data analysis, providing real-time spend insights, and predicting supplier risks before they impact margins. LightSource’s AI-powered platform streamlines RFQ workflows, assesses supplier performance, and optimizes sourcing decisions, enabling faster, more informed procurement actions that align with financial goals.

What are the first steps to aligning procurement with finance?

Start by establishing shared KPIs that align procurement goals with broader financial targets and then move to data integration. The final critical step is automating workflows to eliminate process bottlenecks. Building cross-functional alignment ensures both procurement and finance work from the same data to drive strategic decisions.

Synopsis

Procurement isn't just about finding savings anymore. When it’s connected to finance, it becomes a profit engine. Once integrated, procurement-based finance uses real-time data and shared goals to align every buying decision with your company’s financial success.

Why procurement needs to think like finance

You’ve probably heard the old story: procurement cuts costs, finance reconciles invoices. That’s a slow, manual process that leaves money on the table.

What’s the problem with the old way?

The old mode creates a major gap. When purchasing makes a decision and finance only sees the impact months later, you're always playing catch-up. This lag means budget surprises, missed opportunities for better payment terms, and no immediate connection between a purchasing choice and the company's bottom line.

Procurement + finance alignment changes everything. It connects every purchasing decision directly to the company's financial goals. Every smart sourcing move contributes immediately to widening margins and long-term profitability. You start seeing the immediate impact of your decisions, not just reading about them on a report later.

Why does this alignment drive serious growth?

Alignment matters for one simple reason: Control.

When procurement and finance work from the same data, you catch budget overruns before a contract is signed. Procurement knows the budget before negotiating, not after. Finance sees supplier price changes right now, not weeks later when an invoice shows up.

Integrated teams report fewer surprise expenses. They also expand their working capital through optimized payment terms and early-payment discounts. That's real, measurable value, not just theoretical cost-cutting.

How does this affect supplier relationships?

It makes them stronger.

When invoices flow through shared, automated systems, suppliers get paid on time, every time. This speed and reliability build trust. Trust lets procurement secure favorable pricing and better capacity allocations. Manufacturers that unify procurement and accounts-payable approvals often cut the invoice-to-pay cycle from days to mere hours. That speed converts directly into better terms for you, especially when market prices spike.

How to shift to strategic procurement finance

Making this shift isn’t just about buying new software; it's about setting clear rules and shared workflows.

How can unified data drive smarter decisions?

You need to integrate your ERP, sourcing platforms, and supplier data into a single system.

Shared visibility improves forecasting, simplifies audits, and highlights new opportunities for savings. Real-time data lets procurement target categories with high margins, manage cash flow effectively, and maintain supplier performance—all while keeping finance in the loop.

What are the right metrics to share with finance?

Stop using different scorecards. AI-native procurement finance begins with setting joint goals that link savings to broader financial targets. Pair cycle-time reductions with the cash-flow impact, and align supplier performance to working-capital targets. A shared dashboard removes the guesswork over which numbers truly matter.

Procurement KPIs | Finance KPIs |

PO cycle time | Cash flow impact |

Cost savings | Working capital |

Spend under management | Budget vs actual spend |

Supplier on-time delivery rate | Forecast accuracy |

Maverick spend | Total savings realized |

Supplier defect rate | Return on Investment (ROI) |

Contract compliance rate | Variance to plan |

Lead time | Profit margin |

Should we ditch static budgets for rolling forecasts?

Yes, you should. Rolling forecasts incorporate category-level insights and adjust budgets instantly as commodity prices or market conditions shift.

Procurement teams that integrate their data into financial planning can spot variances early and adjust long before it hits the Profit & Loss statement. LightSource’s API integration pushes real-time supplier cost data directly into your finance dashboards. This lets you reallocate funds toward high-ROI projects or freeze non-essential categories without messing up working capital.

How can automation help with speed and control?

Automation is how you get both.

Automation eliminates bottlenecks in the approval process. You can tier requests based on value: low-cost, contract-compliant buys move through instantly, while complex, strategic purchases trigger deeper reviews. Automating this logic cuts manual touchpoints and highlights the exceptions to the right approver immediately. This preserves control without slowing down sourcing cycles.

Key takeaway

Stop operating in silos. The fastest way to unlock procurement ROI is to use unified, real-time data to connect every sourcing decision to finance's top priorities: cash flow and margin growth.

Smarter sourcing: Optimizing for value

Optimization is about making data-driven decisions that create long-term value, not just short-term cuts.

How do we make RFQ workflows faster and better?

Start with RFQ automation.

Comparing quotes across hundreds of line items manually can take weeks. Automating RFQs—routing them to pre-qualified suppliers and standardizing responses for side-by-side comparison—saves massive time and reduces human error. This approach lets your team focus on high-value negotiation instead of low-value data entry.

What's the right way to qualify suppliers?

You should rely on data and risk intelligence, not just relationships.

Evaluate suppliers based on delivery performance, financial stability, and compliance triggers. Using these insights helps procurement avoid costly production delays and hidden risks. Faster sourcing plus qualified suppliers means you get the best prices and minimize operational disruptions.

What makes a negotiation successful?

Successful negotiation hinges on preparation.

Procurement teams need access to market benchmarks, supplier histories, and cost drivers before the meeting. Integrated market intelligence helps you identify every potential savings opportunity and strengthens your bargaining power. This helps you secure better pricing and the most favorable terms.

Can we benchmark costs in real-time?

Absolutely. Real-time benchmarking lets you adjust sourcing strategy instantly.

LightSource updates item data points like commodity prices, freight rates, and peer pricing automatically, highlighting any discrepancies. Instead of waiting for quarterly reviews, you can renegotiate prices as soon as the data shows a delta. This secures better deals and reduces risk immediately.

Speaking the CFO's language

Procurement needs to translate its work into financial KPIs that the board can track.

Which financial metrics should procurement focus on?

Focus on the five key metrics that resonate most with finance teams:

Cost savings: Hard reductions in cost, like price cuts on raw materials.

Cost avoidance: Reducing unnecessary spend, like locking in prices before a supplier hike.

Procurement ROI: Total value delivered versus the cost of the procurement function.

Total Cost of Ownership (TCO): The lifetime cost from acquisition to disposal.

Purchase Price Variance (PPV): The difference between the expected and actual price.

These metrics clearly communicate procurement's contribution to profitability and bottom-line growth.

What operational data protects our results?

You need to track operational KPIs that maintain the consistency of your savings:

Spend Under Management (SUM): How much of the total spend flows through negotiated contracts.

Maverick spend: Off-contract buying that erodes value.

Contract compliance rate: How much procurement actually buys according to the agreed terms.

Automating the tracking of these ensures procurement stays aligned with financial goals.

How do we bridge the gap between our systems?

Siloed data is the enemy of efficiency.

LightSource acts as the critical bridge between procurement and the finance ERP system. It sits between these platforms and translates procurement data into finance-ready insights. This ensures real-time visibility into spend, risk, and supplier performance flows seamlessly into existing financial workflows. No more endless back-and-forth between teams—procurement gets the supplier intelligence they need while finance receives clean, actionable data in their familiar ERP environment.

What does an AI-native platform actually do for procurement finance?

It changes the game.

LightSource, the AI-native procurement solution, automates data classification, powers predictive risk models, and streamlines sourcing workflows. This immediately reduces sourcing cycle times, improves spend visibility, and delivers actionable insights. With this architecture, procurement can standardize supplier quotes, automate RFQ workflows, and make faster, data-driven decisions that align with financial objectives—transforming your function from a cost center into a strategic partner that drives measurable margin growth.

Ready to see how AI-native procurement transforms your financial outcomes?

Frequently asked questions about procurement finance

What is procurement finance?

Procurement finance directly connects every sourcing decision to the company's financial goals, ensuring that every procurement action contributes to margin improvement, cost control, and long-term profitability. It integrates real-time spend data, cost-saving metrics, and supplier performance into a cohesive system that aligns procurement with broader financial objectives.

How does procurement finance drive ROI?

By aligning procurement strategies with financial goals, procurement teams can negotiate better terms, optimize payment schedules, and prevent overspending before it happens. Real-time data and predictive models enable faster, data-driven decisions that improve contract terms and capture savings opportunities, resulting in a quantifiable return on investment.

What role do shared KPIs play in procurement finance?

Shared KPIs between procurement and finance ensure both teams are aligned toward common financial goals. By tracking key metrics like cost savings, cash flow impact, and supplier performance together, both functions can quickly identify opportunities for improvement and reduce operational inefficiencies.

How can AI improve procurement finance?

AI improves procurement finance by automating complex data analysis, providing real-time spend insights, and predicting supplier risks before they impact margins. LightSource’s AI-powered platform streamlines RFQ workflows, assesses supplier performance, and optimizes sourcing decisions, enabling faster, more informed procurement actions that align with financial goals.

What are the first steps to aligning procurement with finance?

Start by establishing shared KPIs that align procurement goals with broader financial targets and then move to data integration. The final critical step is automating workflows to eliminate process bottlenecks. Building cross-functional alignment ensures both procurement and finance work from the same data to drive strategic decisions.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Ready to change the way you source?

Try out LightSource and you’ll never go back to Excel and email.

Trusted by:

Trusted by:

Trusted by:

*GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and COOL VENDORS is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.